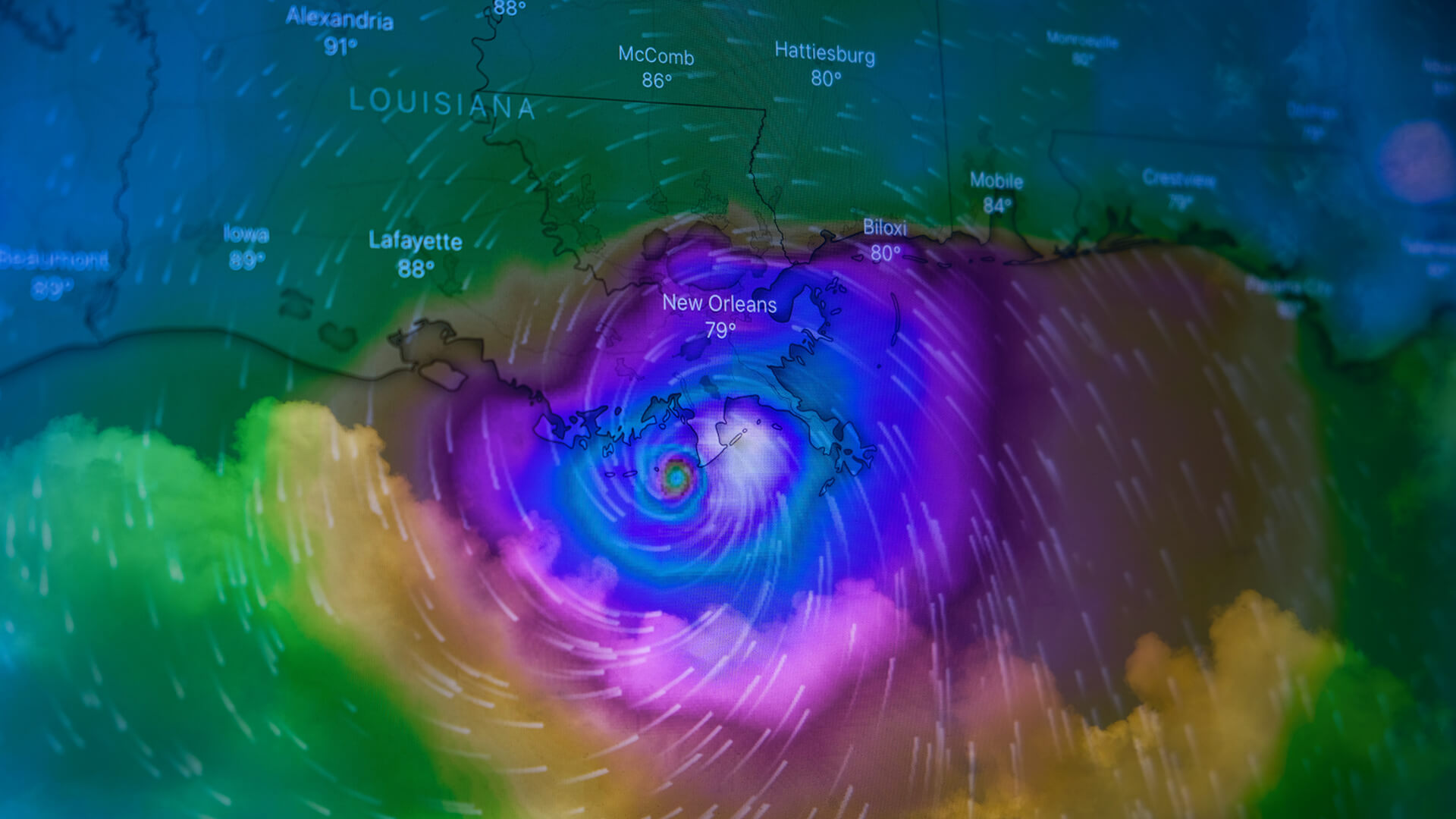

Hurricane Ida made landfall in southern Louisiana as a Category 4 storm on August 29. In its wake it left a trail of damage that Americans living on the Gulf and Atlantic coasts have found depressingly familiar. Total recovery costs will not be known for weeks, but $80 billion is being floated by some insurance firms as a likely figure.

For those not living along Ida’s path, there are still impacts. Ida was the first major tropical storm system to hit the Gulf of Mexico energy space dead-on in quite some time. Oil and natural gas production throughout the entire Gulf have gone offline. Natural gas prices have already bumped up by some 15% to roughly $4.60 per 1000 cubic feet, the highest in years.

I’m not worried. Not even a little. If anything, this is great!

Some backstory about how the American energy complex has evolved in the past decade or so:

Out in the Gulf of Mexico, hurricane-driven waves regularly top 50 feet high. Storms force production shutdowns and staff evacuations. The result? Entire swathes of the Gulf go from being among the world’s most productive oil and natural production zones, to a flat zero.

And not just for the duration of the storm.

The bigger and broader the storm, the greater the chance that some little thing, somewhere, breaks. Once the storm passes, staff return. They began a never-ending list of safety checks to make sure things can be turned back on without causing leaks, spills or explosions. Repairs are necessary both above the water on the platforms, and down below on the seabed where the tangle of pipes interfaces with the actual well casings. The worse the storm, the longer this takes. Sometimes it is over a year before full production is restored. And the whole time Americans keep using oil and natural gas, so we get supply and demand mismatches that manifest as higher prices for months at a time.

Back in my Stratfor days it was my job to track every such storm to evaluate such impacts. I hated it. So very very much. (BTW if you want to bookmark the gold standard for hurricane tracking, that’d be Weather Underground).

And then suddenly, it all stopped.

Around 2004 the Americans cracked the code on how to extract natural gas from shale rock formations. Instead of drilling down vertically and tapping deposits of the stuff, we’d drill laterally, inject a mix of water and sand into the formation and crack it apart from the inside. Trillions of tiny pockets of natural gas would then have access to the pipe, and natural pressure would force the gas up to the surface for collection. By 2009, this American shale gas output exceeded all other sources of natural gas in the United States. Every speck of shale gas is produced on shore. Shale doesn’t give a wit what happens with hurricanes.

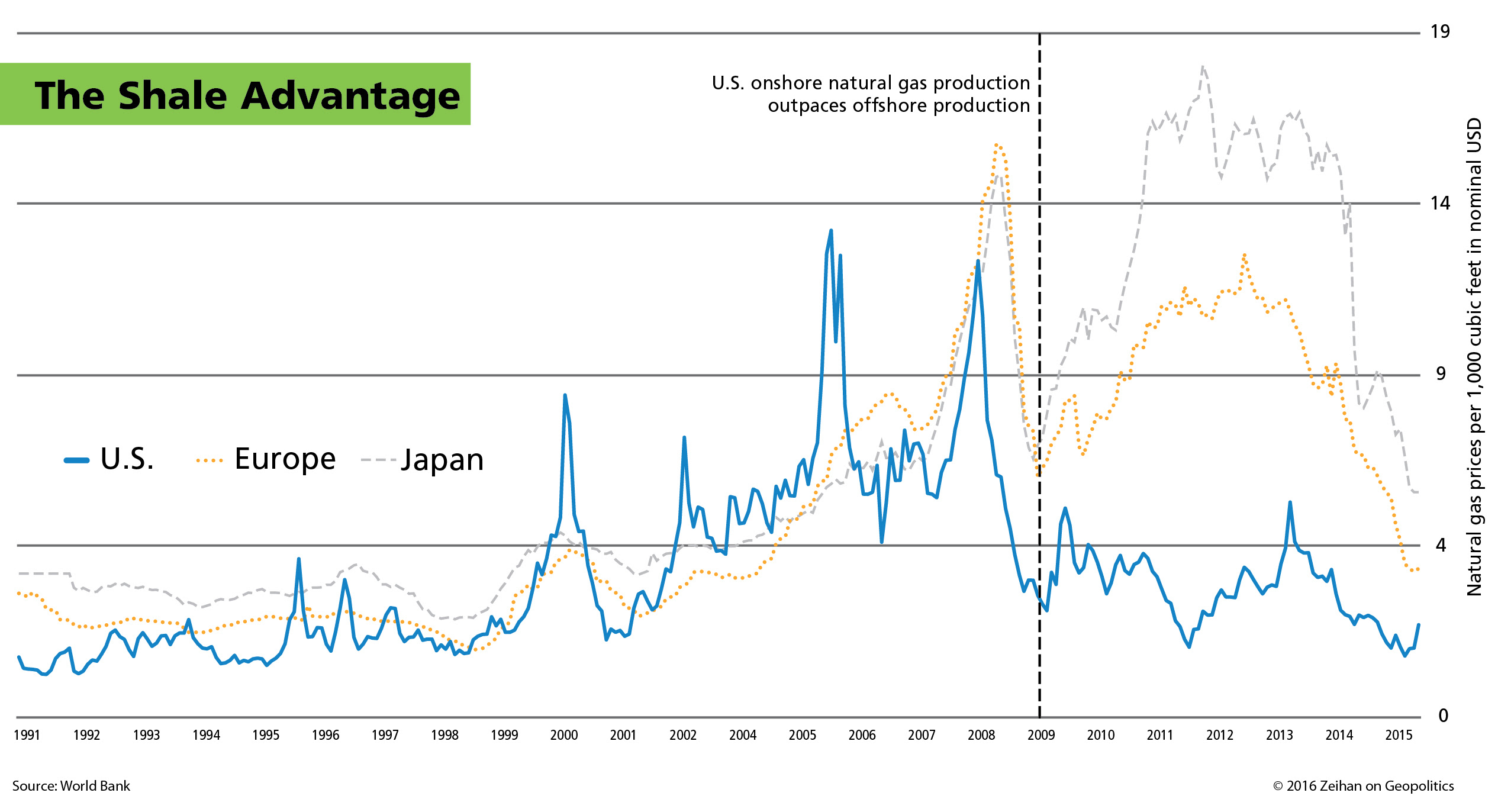

Take a look at this graphic from my previous book, The Absent Superpower. You can clearly see how pre-2009 U.S. natural gas prices fairly reasonably tracked prices in other markets. But in 2009, the United States diverged and never went back. The United States has been in chronic natural gas oversupply for years.

Hurricane Ida isn’t going to change that. Yes, prices are higher, but a few thoughts.

First, prices aren’t that much higher. In the pre-shale days we considered sub-$5 natural gas to be criminally cheap. The Europeans even went so far to sue the Russians for having prices in that range. (Russia at the time was the world’s largest natural gas exporter and so kept its domestic prices at rock bottom.) From time to time we even breached $10.

Second, American natural gas prices today are higher primarily not because of disruptions to supply, but instead because of structural changes to demand.

Prices in the U.S. have been so low for so long that our entire industrial space has been retooled to match. Natural gas is now the country’s primary electricity fuel, displacing coal throughout most of the country. When fed into combined-cycle power plants, natural gas use can be ramped up and down in minutes, making it the perfect complement to solar and wind power – fuel sources that are literally as erratic as the weather. We’ve also used natural gas components to replace oil throughout our petrochemical systems. We now use the stuff to make everything from lipstick to diapers to safety glass to insulation to pesticides to paint to gum to furniture to bowling balls. Higher demand means higher prices.

Third, there’s more to shale than just natural gas. Around 2008 the tech of shale started being applied en masse to oil, and in the years since America has figured out how to get not simply the vast majority of its natural gas from shale, but also the vast majority of its oil. Natural gas is often a byproduct of such shale oil plays. Oftentimes such byproduct drove natural gas prices below $3. Aside from the Gulf of Mexico and the giant Marcellus field in the Northeast, there just aren’t many places left in the United States where folks are drilling for natural gas on purpose. It simply isn’t cost effective.

Or it wasn’t until now.

While $5 natural gas is cheap by historical standards, its very high by shale-era standards. It has been roughly eight years since we’ve seen this sort of price environment where it makes sense to go after natural gas just for the gas. In those eight years, shale operators have learned a lot – they’ll now be applying new shale techs to the places where shale was first birthed, specifically in Texas’ Barnett, Arkansas’ Fayetteville, and the Texas-Louisiana-shared Haynesville.

I expect to see explosive growth in on-shore production, and I expect to see it soon. After all, unlike an off-shore Gulf of Mexico well that takes years to bring on-line, an on-shore shale well reaches full output in a mere six weeks.

This matters hugely. In the longer term, every speck of U.S. oil&gas production that moves into on-shore shale space is a speck that is more sustainable, at lower cost, cleaner and at lower risk than anything that’s international or offshore. (I broadly like solar and especially wind as well, but those are topics for another day.)

In the shorter term, the advantage isn’t simply that rising shale production suggests current prices are not long for this world. There’s a more immediate concern:

Between COVID-driven resourcings, industries moving out of China, increased integration with Mexico, and increasingly Trumpesque economic policies out of the Biden administration, the United States is in the midst of its biggest ever industrial build-out. That all takes a lot of natural gas, both to burn to generate electricity and as a feedstock to create physical products. Ida has provided the impetus to generate the necessary supply before a general shortage would have. We’ve all seen what similar shortages in labor markets have done to the economic recovery. It’s great to know we won’t need to worry about them in the world of energy.

If you enjoy our free newsletters, the team at Zeihan on Geopolitics asks you to consider donating to Feeding America.

The economic lockdowns in the wake of COVID-19 left many without jobs and additional tens of millions of people, including children, without reliable food. Feeding America works with food manufacturers and suppliers to provide meals for those in need and provides direct support to America’s food banks.

Food pantries are facing declining donations from grocery stores with stretched supply chains. At the same time, they are doing what they can to quickly scale their operations to meet demand. But they need donations – they need cash – to do so now.

Feeding America is a great way to help in difficult times.

The team at Zeihan on Geopolitics thanks you and hopes you continue to enjoy our work.