In the worlds of finance, trade, economies, currencies and energy there is a lot going on. We’ve a war in Ukraine that will likely generate the largest oil dislocation in modern history. The global Baby Boomer generation is retiring and taking their money with them, generating the largest financial dislocation in modern history. Presidents Trump and Biden are following the same script on trade issues, generating the largest trade dislocation in modern history. And the Federal Reserve is tightening monetary policy in an effort to tamp down inflation.

The implications of all these seismic shifts are many and massive. Here’s two of them:

Whenever countries are struck by economic shocks – like, say, now – investors look for safer places to stash their money. Less money into tech, more into consumer products. Less money into Brazil, more into Europe. The safest of all safes is the United States, and so the U.S. dollar is on a bit of a tear, rising by roughly 10 percent verses most of the world’s currencies since the beginning of the year.

A rising dollar has any number of outcomes, but the one making the biggest splash at the moment is its impact upon energy markets.

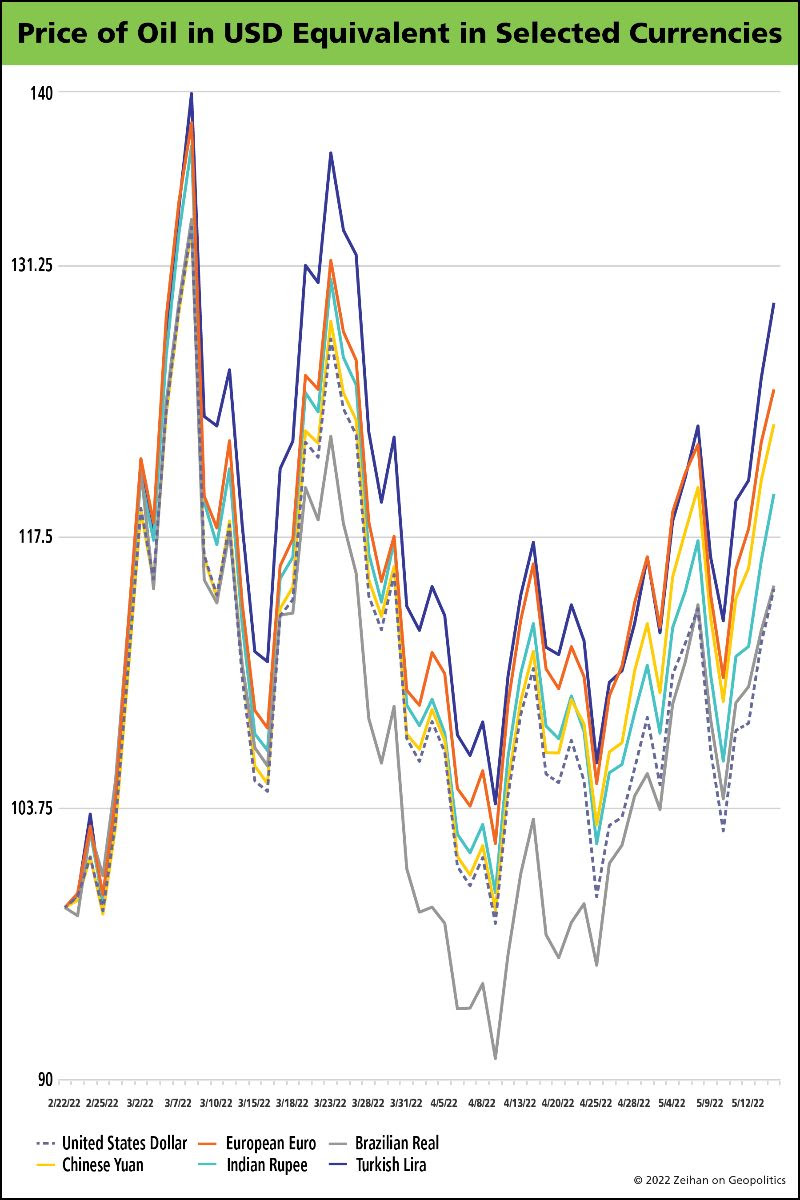

Oil prices were already rising due to a variety of factors ranging from insufficient investment in new projects over the past several years, to disruptions in trade patterns, to, of course, the Ukraine War. For the United States this is known and obvious. But all commodity trade is denominated in U.S. dollars. Oil is no exception. Combine oil’s price rise with a strengthening dollar and much of the world takes a double hit.

Brazil’s real has largely kept pace with the U.S. dollar, so this energy hit doesn’t land on Brazilians quite as hard. But Europe and Turkey? Those locales heavily depend upon Russian crude. Not only does that challenge their supply systems, it’s also contributed to the pair’s suffering from significant currency weakness. The end impact? In local currency terms, internationally sourced oil now costs 10-15% more in Europe and Turkey than it does in the United States.

Unfortunately, there is little reason to expect the world’s energy situation to improve within the next half decade, nor is there reason to expect the U.S. dollar to go anywhere but up for years to come. But that is a story for another day.

That day is … June 8. That’s when we’ll be hosting our next seminar, Inflation: Navigating the New Normal. You can sign up here.

Here at Zeihan On Geopolitics we select a single charity to sponsor. We have two criteria:

First, we look across the world and use our skill sets to identify where the needs are most acute. Second, we look for an institution with preexisting networks for both materials gathering and aid distribution. That way we know every cent of our donation is not simply going directly to where help is needed most, but our donations serve as a force multiplier for a system already in existence. Then we give what we can.

Today, our chosen charity is a group called Medshare, which provides emergency medical services to communities in need, with a very heavy emphasis on locations facing acute crises. Medshare operates right in the thick of it. Until future notice, every cent we earn from every book we sell in every format through every retailer is going to Medshare’s Ukraine fund.

And then there’s you.

Our newsletters and videologues are not only free, they will always be free. We also will never share your contact information with anyone. All we ask is that if you find one of our releases in any way useful, that you make a donation to Medshare. Over one third of Ukraine’s pre-war population has either been forced from their homes, kidnapped and shipped to Russia, or is trying to survive in occupied lands. This is our way to help who we can. Please, join us.