My fourth book, The End of the World Is Just the Beginning: Mapping the Collapse of Globalization is scheduled for release on June 14. In coming weeks we will be sharing graphics and excerpts, along with info on how to preorder.

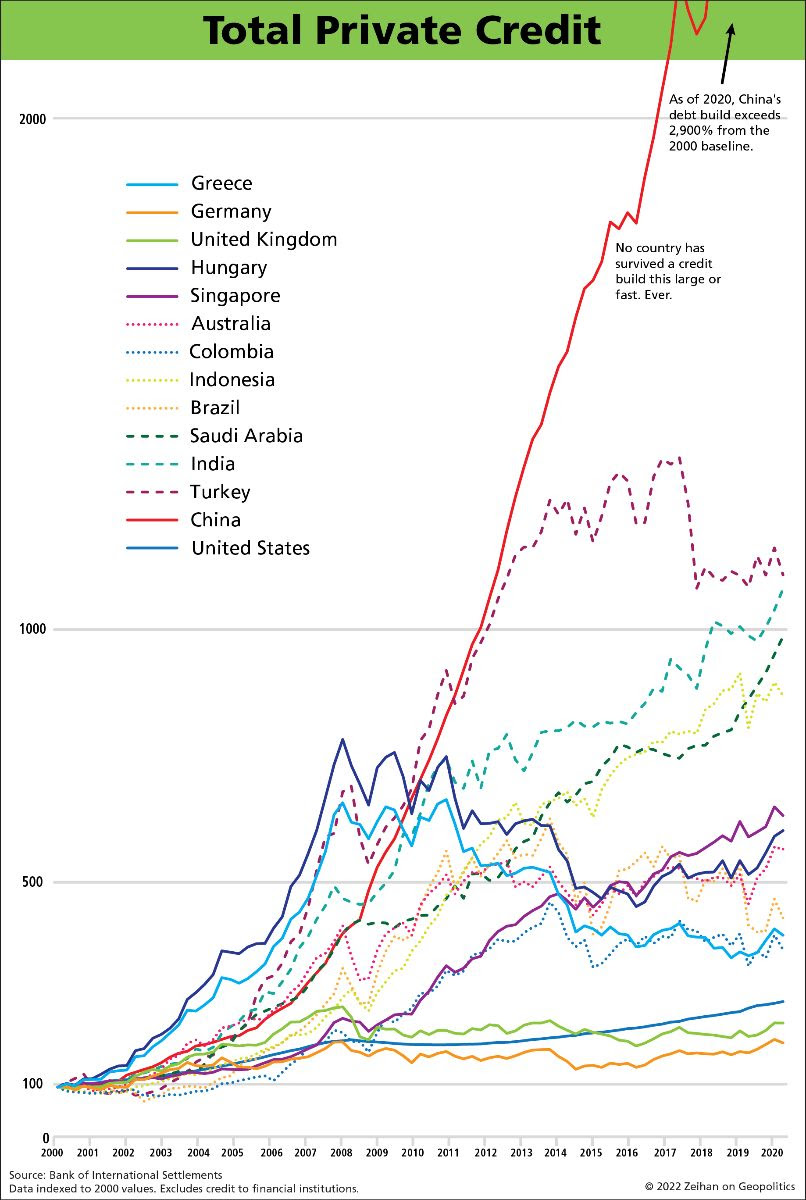

Add the extravagances and exaggerations of the fiat era to the excesses and eruptions of the demographic moment and we have experienced the largest credit surges in human history. In the United States we know the biggest chunk of those surges as the subprime era. From 2000, when the subprime industry was birthed, to 2007, when ended, total credit in the United States roughly doubled. The ensuing crash from such irrational exuberance knocked roughly 5 percent off of U.S. GDP in the two years before the economy found its footing.

Doubling of credit. Five percent economic drop. That’s a good baseline. Let’s take a quick look around:

The credit picture of Brazil is a reasonable echo of Greece: a sixfold increase, peaking in 2014. In that year investor sentiment and the Brazilian political system broke at the same time, triggering a political crisis and deep recession that at the time of this writing shows no sign of abating. Making matters worse, Brazil’s constitution and currency only date back to the 1990s. Not only is this modern Brazil’s first true political and economic crisis, but it is a full-blown constitutional crisis that hits at the very bedrock of everything that makes Brazil…Brazil. Assuming for the moment that the Brazilian political system regenerates in short order (and there is no sign of that) and that Brazil’s governing institutions suffer no additional damage (and that seems sheer fantasy), Brazil faces years of severe recession simply to recover from their credit overexpansion. Brazil isn’t looking down the maw of a lost decade, but instead at two. At least.

With the combination of a fairly diversified economy, government policies welcoming immigration, and a bevy of mineral reserves big enough to feed insatiable Chinese demand, Australia has avoided recession for a generation. Others noticed, and foreign money has funneled into the country to take advantage of the longest continuous period of economic growth in human history. That has turned the Great Down Under into the most over credited of the Western countries to not yet experience a credit collapse. Credit has increased sixfold since 2000. Housing and household debt are of course the expected bugaboos, but the credit inflows have pushed the Australian dollar up to uncomfortably unsustainable highs, eroding the competitiveness of every economic sector outside of mining. Any effort the government has taken to decrease demand with regulatory hammers has been overwhelmed by a tax code that not only encourages property ownership, but in fact encourages those already owning residential property to purchase more. This would be a problem anywhere, but in Australia it is particularly acute. Oz might seem like a place with a lot of land, but the Outback is beyond useless to residential real estate. The vast bulk of the Aussie population lives in fewer than ten largely disconnected metro regions, sharply limiting availability and driving up the cost of building new housing inventory. This will blow.

At the time of this paragraph’s addition on February 28, 2022, Russia is being melon-scooped out of global finance as punishment for the Ukraine War, the Russian Central Bank included. By the time this book publishes, the world will have a fascinating, horrific case study of true financial disintegration. Nor is Russia done. Beset with a population aging into decrepitude and a system that has given up educating the next generation, Russia’s credit collapse is but one of a phalanx of factors capable of ending the Russian state. The question isn’t will the Russians go out swinging—Russian’s invasion of Ukraine is testament to that—but instead, who else will they swing at? Over-credited countries beware. Credit collapses can be caused by any number of actions or inactions. They do not require a war. Or sanctions.

The absolute financial blowout that is China has generated the largest and most unsustainable credit boom in human history both in absolute and relative measures. The Chinese will exit the modern world just as they entered it: with a big splash. The only question is when. If I had the answer to that you wouldn’t be reading this book, because instead of struggling through edits I’d be idling away my days on the Peter Virgin Islands.

Here at Zeihan On Geopolitics we select a single charity to sponsor. We have two criteria:

First, we look across the world and use our skill sets to identify where the needs are most acute. Second, we look for an institution with preexisting networks for both materials gathering and aid distribution. That way we know every cent of our donation is not simply going directly to where help is needed most, but our donations serve as a force multiplier for a system already in existence. Then we give what we can.

Today, our chosen charity is a group called Medshare, which provides emergency medical services to communities in need, with a very heavy emphasis on locations facing acute crises. Medshare operates right in the thick of it. Until future notice, every cent we earn from every book we sell in every format through every retailer is going to Medshare’s Ukraine fund.

And then there’s you.

Our newsletters and videologues are not only free, they will always be free. We also will never share your contact information with anyone. All we ask is that if you find one of our releases in any way useful, that you make a donation to Medshare. Over one third of Ukraine’s pre-war population has either been forced from their homes, kidnapped and shipped to Russia, or is trying to survive in occupied lands. This is our way to help who we can. Please, join us.