Hey everyone. Peter Zeihan here coming to you from flat on my back in bed because I threw out my back. This is the last what I heard from here. We have a dead update from the U.S. government, specifically the Department of Energy’s Energy Information Agency, which tracks energy production, usage and prices and everything and their data for a calendar year 2023 indicates that the average price for natural gas in the country was just over $2.50 per thousand cubic feet.

In fact, it bottomed out at just below $2.20 in May. And this is after a really volatile year in calendar year 2022, when because of the Ukraine oil cuts a slow, we’re because we’ll just we’ll just do that we’re because of Ukraine or there was high demand everywhere and everyone was trying to get away from Russian natural gas in that calendar year.

U.S. prices hit nearly $10, but that was nothing compared to what happened in the rest of the world. With prices for several months being above 50 and even approaching a hundred in a few areas, which still boggles my mind that we actually hit those numbers that way. 2023 was much calmer. And the reason for it is twofold. Number one, that the United States is not just a producer, an exporter of natural gas, but it does so using a series of technologies that are broadly not applicable in the rest of the world.

The shale technology and fracking. Because of this, the United States has a break even price in our pure shale natural gas fields, typically below five in some places below $3 per thousand cubic feet. And second, we get a lot of associated natural gas production that comes from our shale oil operations, which, you know, technically based on how you run the numbers, that could be free anyway.

It means the United States is the world’s largest producer of natural gas, kicking out about 120 billion cubic meters a year. And most of that is trapped in the system at home because moving natural gas from A to B is kind of difficult. There’s really only two routes. One is to have a pipeline network that sends it from production to consumption locations.

Usually those are within individual country because natural gas being a gas is hard to store. And the U.S. does have the world’s largest system for distribution by far. The second option is to chill it down to -300 odd degrees into a liquid form and then put it in onto a special sea tanker to send it across the ocean to someone who has a specific receiving facility, who can take the liquid and reclassify it without it blowing up.

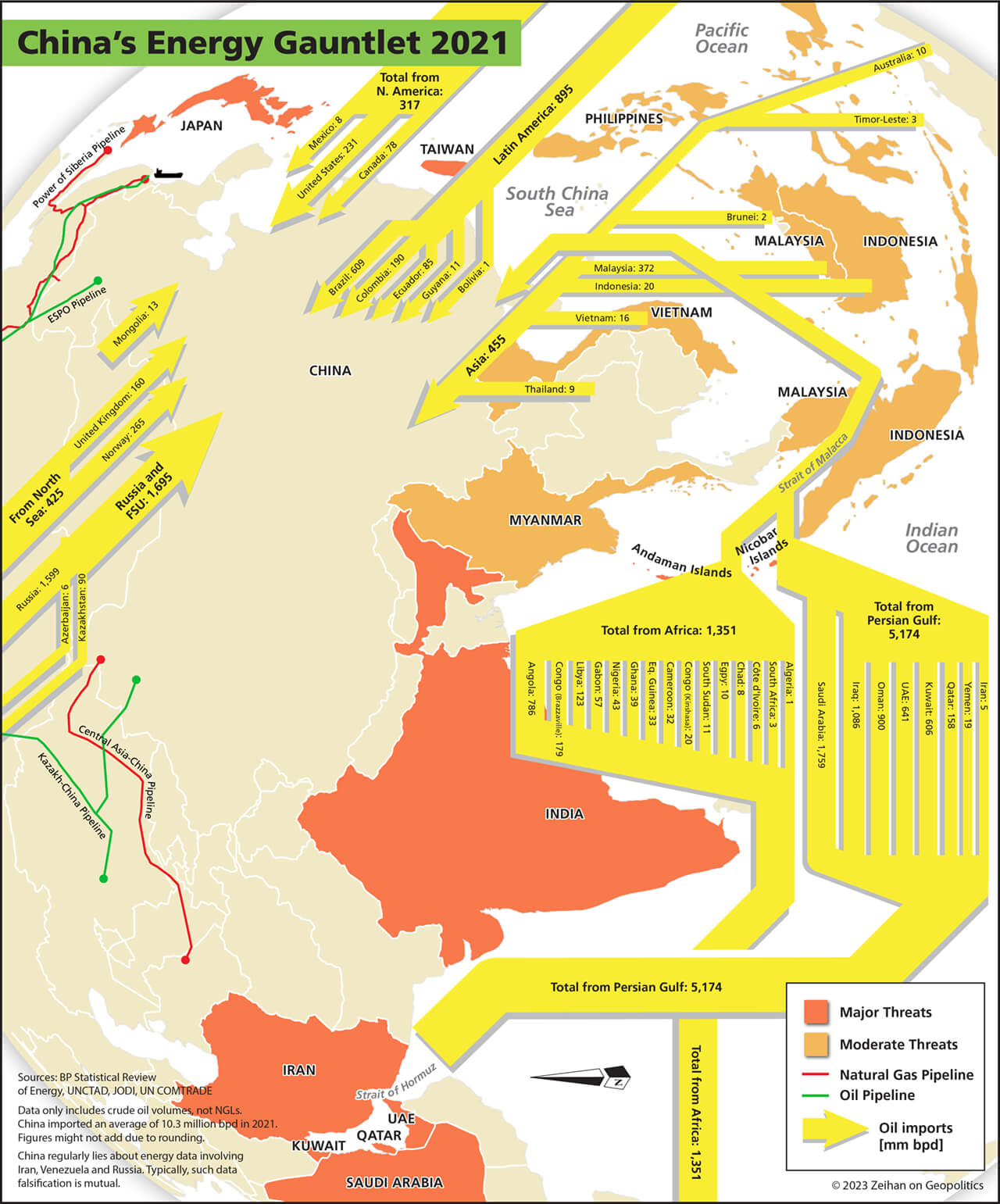

All of that is as expensive as it sounds. So what happened in 2022 in Europe was the Europeans used to be on a pipe system that brought in stuff from northwestern Siberia for the most part, and that gave them access to reliably, large and reliably cheap supplies. So when the Europeans decided to move on from the Russians, they had to go to some other piped suppliers that they have, specifically Algeria, Libya, and especially Norway.

But that wasn’t enough. So they had to go out and tap the world for liquefied natural gas, which is not available in large volumes in the way that piped gas from a neighbor can be. And so prices went up and up and up and up. And in the United States, we sent everything that we could and that allowed the Europeans a degree of energy security, but only at a very, very high price point.

What we’re seeing now is the slow motion so far, slow motion degradation of the Russian system, because the pipes are all oriented towards Europe and they are falling into disrepair because they’re not being used. And the Russians are using all their technical experts to maintain their war effort. They do have a couple of liquefied natural gas facilities, some in the Far East and the island of Sakhalin, north of Japan, and some on the IMO Peninsula in far northwest Russia.

But it is foreigners who provide the technical skills for those facilities to operate. And as those technical skills are increasingly withheld, these facilities will fall into disrepair. And well, let’s just see when you’ve got a refrigeration unit that is dealing with billions of cubic meters of flammable materials and something goes wrong, something goes wrong all at once. We haven’t had any industrial accidents at these facilities yet, but it’s only a matter of time, one year to year, five years.

I don’t know how long before those facilities go offline and then Russian natural gas will be gone. Getting it out by other means is nearly impossible. There are very few countries that can do LNG liquefaction. China is not on that list. Most of them are part of the Western alliance plus Japan that is backing Ukraine. And if you’re going to get a pipeline for the small peninsula to populated China, you’re talking about the world’s largest chunk of infrastructure with roughly 70% of the train it’s going to cross being virgin with no existing infrastructure at all.

So you’re talking tundra and tiger and permafrost and mountains. Building that pipeline would be $100 billion project. It would take a minimum of 15 years. And even if it was done, the cost of operating would be two, three, four times as much as the natural gas would be worth. So the Russians and the Chinese repeatedly say that this pipeline is going to happen.

They’ve been saying that for 20 years. And then you get down into the details and the traders again, the Russians are going to pay for the operation pipeline. And the Russians, like, you know, the Chinese are going to pay for the operation of the pipeline. And that’s why nothing has started. So the world has to get by without Russian natural gas.

And until a year and a half ago, they were the world’s largest exporter. That is going to have big price implications everywhere except in countries that produce natural gas for themselves. Read the United States. Now, that means in the United States, the 2 to $3 range we’re in right now is more or less normal. We’re not going to go above five for any more than very short periods of time, because what we’ve discovered is that the shale gas guys can bring on well, wells in a matter of weeks.

If you remember your shale history back between 2004 and 2011, roughly, it was all about the natural gas. And then in 2011, the 2013 oil really came into its own and natural gas faded, not because we were producing it, but because we were producing it as a byproduct of oil production. What we saw in calendar year 2023 when prices were going up is that the shale guys went back to the old natural gas fields and were able to produce using the tricks they’d learned in the shale oil fields the last ten years.

And that pushed down the cost of production and push up the volume of natural gas that was produced by massive volumes. And we basically got back to a balanced market. Now, the United States does have takeaway capacity to get some of that natural gas to international systems. We have roughly 10 billion cubic feet of pipeline capacity, mostly in Mexico and about another 10 billion cubic feet for LNG, which is mostly going to Europe now.

That’s in comparison to 120 billion cubic feet of overall production, which is a number we now know that we can increase in fairly quick succession when we need to. So again, prices should be lower for a longer. We might have those occasional spikes, but then the shale guys will just drill and bring the price right back down. Now, why does that matter to you?

Three big reasons. Number one, natural gas remains the number one fuel source for electricity generation in this country. About 40% of the total. So anything that requires electricity, which is almost everything, natural gas is the solution, at least in the mid-term. And since the United States needs to roughly double the size of its industrial plant. As the Chinese fade away, we basically need 50% more electricity, and natural gas is going to be a huge component of that.

Second, let’s say you don’t like fossil fuels at all. Let’s say that you’re a greenie and you like solar and wind. Well, you should still like natural gas because when the wind doesn’t blow or when the sun doesn’t shine, which happens, you know, every night, you need a partner, a fuel in order to keep the lights on. And natural gas combined cycle power generation facilities can spin up and spin down in less than 15 minutes.

So they are the best partner for GreenTech that we have. And while the Californians don’t like to say it out loud, about half of their energy that they generate within California itself comes from natural gas, specifically because of this pairing capacity batteries cost an order of magnitude more. They don’t last very long and they have some other problems with their construction That is ugly from any number of strategic and green points of view.

Natural gas is a known and as long as we’re going to be moving towards wind and solar for most of this country, even in increments, natural gas is the logical partner for all of it. And then the third thing is a little bit more esoteric, and that has to do with what happens in manufacturing. Once you decide you want to really get into everything in globalization, we have broken up the supply chains.

Energy comes from someplace, iron ore comes from someplace, steel comes from someplace else, plastics comes from someplace else. It’s brought together for assembly, different locations. As the world breaks apart and we have a more national or continental system, more and more of those intermediate steps need to be done at home or near home. And a lot of those intermediate steps use raw materials that are made from natural gas.

So natural gas makes naphtha, makes polyurethane makes plastics, naphtha makes fertilizers and pesticides, makes agricultural products. Natural gas is the base material for a lot of this stuff. And now the United States is the largest producer, supplier and exporter of all of those intermediate products. And what we’re seeing now is the U.S. moving up the production chain, moving in a greater value added production system for all of this so that we can still do the classic manufacturing and have the entire input system at home.

So to have natural gas at these price levels for a very long time is great and it’s going to be a very long time. We largely stopped looking for natural gas about ten, 15 years ago because we knew at that time we had over 30 years of supplies at current rates of production. And we proved in 2023 that it’s pretty easy to bring even more on line.

So this is going to be the norm for the United States while it goes through these massive re industrialization phases. And natural gas will both power fuel and provide the base materials to make all of the possible. And that is not going to be replicated any where else. No one else can produce natural gas at the price point that the United States can.

And no one else has. In natural gas production facilities relatively close to the population centers like the United States does. So this this is our new normal, and it’s going to provide the bulwark for American industry for at least the rest of this century.