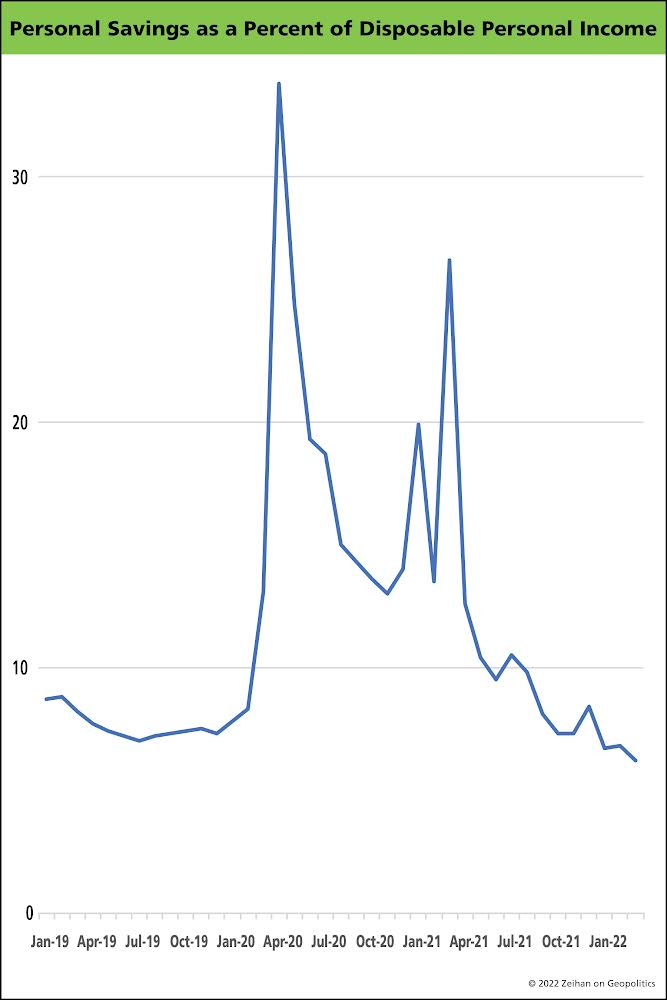

Between the Ukraine war, supply chain shortages, energy shocks, and government policy that probably spent too much money for too long a period of time, Americans are feeling the pinch of ever-higher inflation on an ever-broadening array of goods. The question is whether Americans can’t afford it.

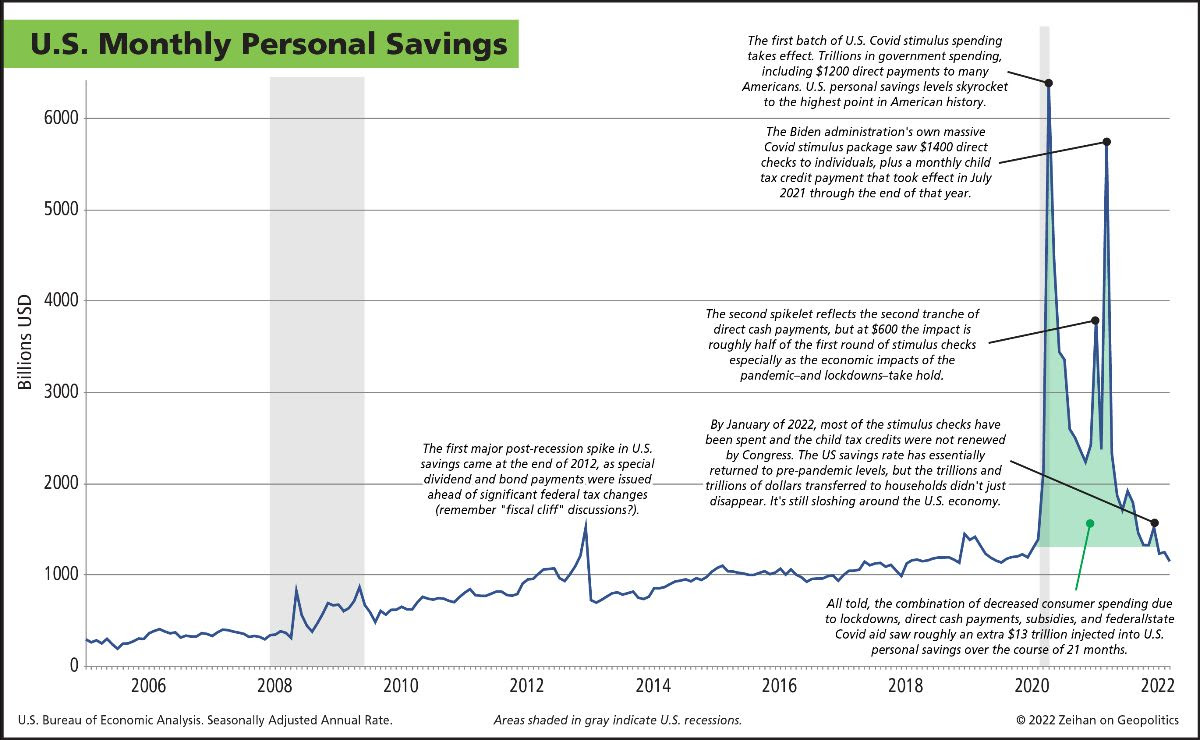

The chart below shows what percentage of their income Americans are socking away – that all-important “savings rate”. During COVID it hit record highs. But now? It has already plunged to pre-COVID lows.

It looks a bit spooky, right? Maybe even a little recessionary? After all, if Americans don’t have a savings buffer, any curveballs – and we seem to be living in world of nothing but curveballs – could cause immense damage.

But the chart needs context.

It’s one thing for Americans to no longer be saving, it’s quite another when you consider just how much they have already saved. Take a look at this second graphic (below) which stretches back to before the 2007-2009 financial crisis. Whereas the first graphic showed the savings rate (the percentage of income saved), this second one shows savings volume (the actual amount of cash).

Between the Trump and Biden Covid stimulus checks, Americans amassed an extra $13 trillion in savings.

So are Americans burning through their savings purchasing goods whose prices keep going up and up and up? Absolutely.

But $13 trillion is roughly how much all consumers in the United States spend in ten months. Even in an inflated environment, it will take most Americans two years to burn through the surplus.

It doesn’t quite make Americans price insensitive, but it certainly suggests that the current levels of consumption – and by extension current levels of demand-driven inflation – can be with us a lot longer than the headline “savings rate” would suggest.

How long? Well, that’s part of what we’ll be going through in our next seminar. We invite those of you who are interested to join us for our upcoming webinar, Inflation: Navigating the New Normal, on June 8th. More information at this link. Unable to attend the webinar live? No problem. All paid registrants and attendees will be able to access a recording of the presentation as well as a PDF of presentation materials.

Here at Zeihan On Geopolitics we select a single charity to sponsor. We have two criteria:

First, we look across the world and use our skill sets to identify where the needs are most acute. Second, we look for an institution with preexisting networks for both materials gathering and aid distribution. That way we know every cent of our donation is not simply going directly to where help is needed most, but our donations serve as a force multiplier for a system already in existence. Then we give what we can.

Today, our chosen charity is a group called Medshare, which provides emergency medical services to communities in need, with a very heavy emphasis on locations facing acute crises. Medshare operates right in the thick of it. Until future notice, every cent we earn from every book we sell in every format through every retailer is going to Medshare’s Ukraine fund.

And then there’s you.

Our newsletters and videologues are not only free, they will always be free. We also will never share your contact information with anyone. All we ask is that if you find one of our releases in any way useful, that you make a donation to Medshare. Over one third of Ukraine’s pre-war population has either been forced from their homes, kidnapped and shipped to Russia, or is trying to survive in occupied lands. This is our way to help who we can. Please, join us.