Gasoline costs. Housing costs. Food costs. Consumer goods costs. They are all going up. The inflation is real and it is only “transitory” if by “transitory” you are measuring time in years.

The real nut of the issue, however, is that few of the current price pressures have anything to do with government policy. Higher energy costs are the result of years of financial mismanagement. Higher housing costs are an outcome of large-scale internal migration decisions. Food costs largely boil down to transport issues. Consumer goods costs are an outcome of COVID-related demand whiplashes.

This might sound odd, but I don’t worry so much about these short-term inflationary pressures we’re currently experiencing. They are the outcomes of our current economic evolutions. That makes them uncomfortable, but ultimately, heh, transitory.

I’m far more concerned with the waves of inflationary pressures occurring just past the horizon:

The American economy is in the midst of the greatest rewiring in the history of the Republic, while the global system faces systemic breakdown. Those pressures are not simply inflationary, they will have a far greater impact upon prices than anything we’ve seen so far in 2021.

Here’s a more homegrown inflation source that will be — at least in part — an outcome of internal political and government decision-making.

Over the course of the past sixty years, we’ve become somewhat accustomed to the geopolitics of oil. Interrupt oil flows from the former Soviet or Persian Gulf regions, and we see energy inflation wash over us all. It forced us to pay attention to the ins-and-outs of politics in as calm, measured places as Gaza and Tehran and Riyadh and Caracas and Moscow and Kiev.

One of the (many) benefits of the American shale revolution is that America just doesn’t care very much about any of these places any longer. It’s a big piece of why energy prices are chronically lower in North America compared to the rest of the world, and why U.S. troop deployments abroad are now at their lowest levels in 120 years.

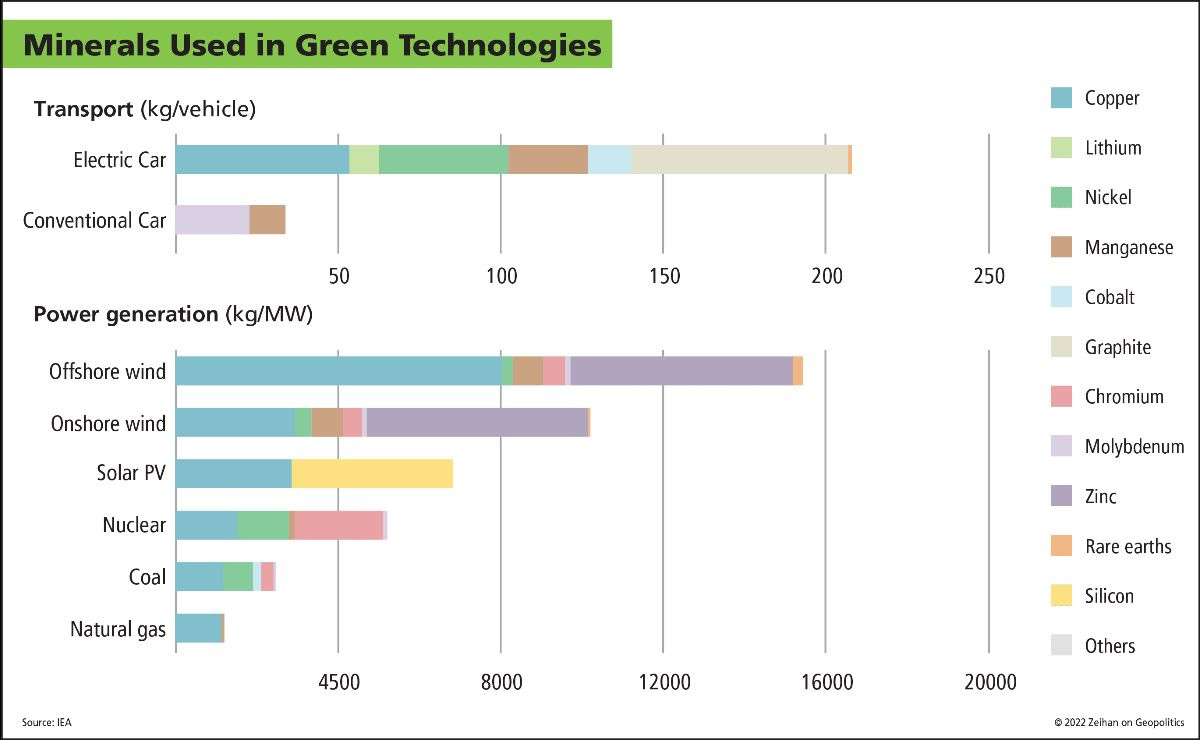

But the path to deglobalization isn’t a smooth one, wrapped up as it is in a variety of technological evolutions, some of which may force the United States to become more involved in managing the world. For as difficult as the geopolitics of oil has proven to be, it is nothing compared to the geopolitics of green energy. Yes, green electricity is generated at home, but the supply chain for constructing wind and solar facilities makes getting oil out of the Middle East look like a game of checkers.

For oil we needed to interface with Saudi Arabia and Iran and Venezuela and Russia, but greentech requires us to interface with Chile and Argentina and Bolivia and China and Australia and Congo and Gabon and Brazil and South Africa and Peru and Mexico and Kazakhstan and Turkey and India and Mozambique and oh yeah still Russia.

If the Green dream of 100% non-carbon energy is to take form, we will need to replace our one energy input supply chain with over a dozen more.

Interested in more? This Wednesday we are hosting the final installment of our exploration of economic trends in an era of globalization: Part III: The Face of Inflation. We’ll be diving into not simply the inflation of the now, but also bringing together the wildly disparate inflationary trends that will entangle the American and global economies for the next four years. Everything from manufactured products to industrial commodities to energy to money itself.

REGISTER FOR THE FACE OF INFLATION

Digital copies of the series’ previous installments can be purchased here:

Part I: Wither the Workforce

PURCHASE ACCESS TO WITHER THE WORKFORCE

Part II: Supply Chains No More