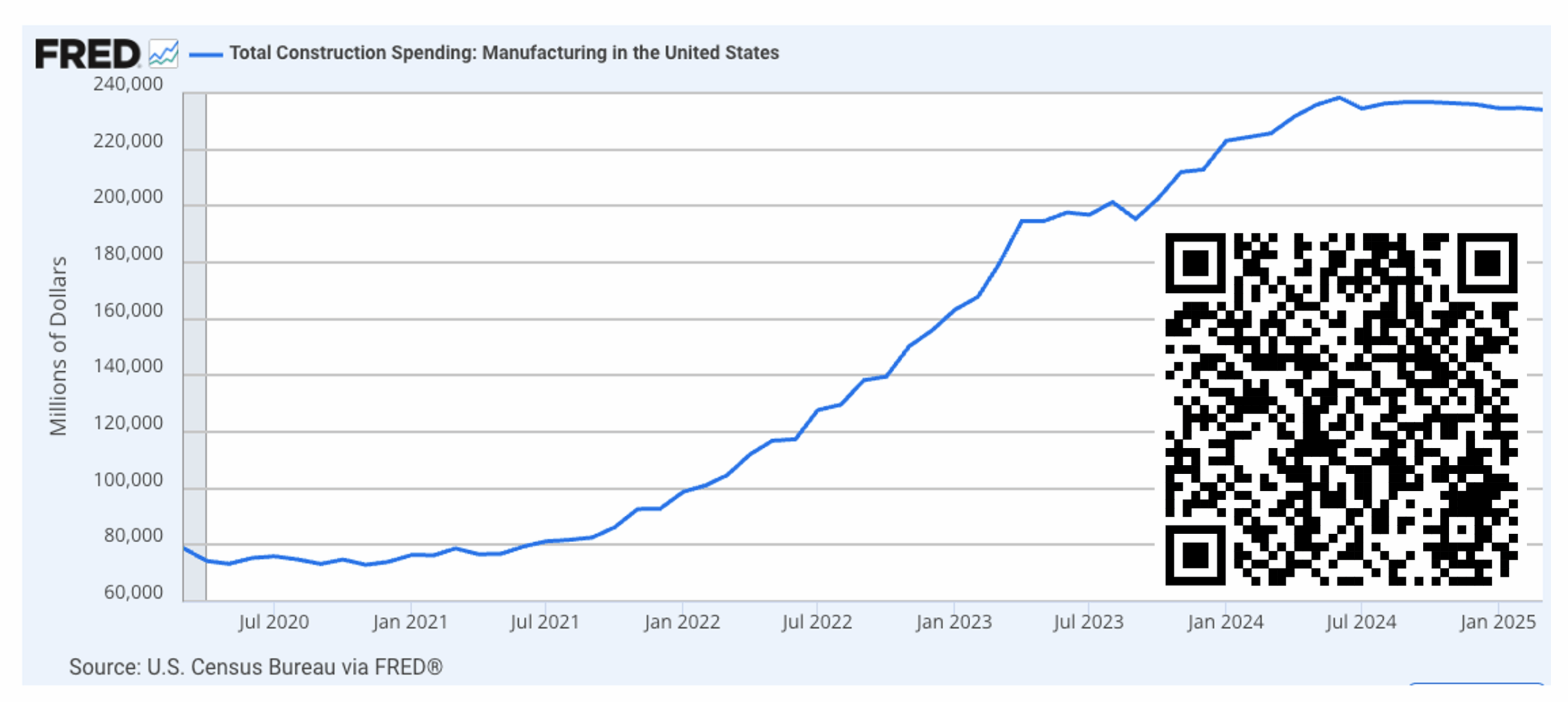

We’ve got another economic metric for y’all to keep an eye on. Today, we’re looking at total construction spending for US manufacturing capacity.

This metric helps us understand how quickly the US is preparing to rebuild its industrial base. Which, as we’ve discussed extensively, is going to be essential as the US faces deglobalization…and China going bye-bye.

But things are stalling. Trump has created a construction purgatory, and businesses are holding investments until they know the rules of the game. And as we prepare for the next chapter of the global order, a drop in construction spending could spell serious problems.

Transcript

Hey, all. Good morning. From the Front Range foothills above Denver. Today I’m going to talk about one of these other economic statistics that I’m following very closely in the current environment. And it is something that is collected by the Federal Reserve. It is called total construction spending for manufacturing capacity. Basically, it tracks how the United States is spending to expand its industrial plant.

Now, if you’ve been following me for any time whatsoever, you know that I am concerned that we are not getting ready for the Chinese collapse fast enough and that we only have a certain number of years left, probably no more than eight. And that’s before you consider the trade war and some of the policies of the Trump administration, which are greatly accelerating China’s fall.

So basically, if we still want manufactured goods stuff, we’re gonna have to make a lot more of it here locally. And that means a lot more factories. This statistic tracks exactly what we’ve been doing for the last several years. And if you start at the beginning in 2019, 2020, it’s Trump one. You’ll see that it was really low.

And honestly, that’s pretty historically normal. But that number makes it Trump look worse than he is by far. And part of it is simply Covid. We didn’t know what the rules of the game, where we didn’t know how long it was going to last. We didn’t know if was gonna be a lockdown. We didn’t know how many people were going to kill, because if you remember back to the early days, something like 3 to 4% of the people who were getting infected were dying.

And none of the treatments we had, especially in that early outbreak in New York, were working. It was it was awful. And nobody knew what to invest for. Then we have the Biden years where we had a lot of government spending to boost industrial production. And this makes Biden look better than he is, because while things like the Chips act and the IRA did put money into the system and did build industrial plants, only about 20% of that rise can be attributed to government spending.

Most of that was actually American corporations realizing that something was happening with globalization that was not just a one off. It was a trend, and they needed to build more capacity here. And so we saw a steady increase for those four years. More lately, you’ll notice that it has flatlined again. And this you can blame on Trump. This is the tariff policy.

At the time of this recording, we’re now at our 149th tariff policy since the 20th of January. And the rules of the game are changing every day, sometimes every hour. And so while everyone is completing the greenfield projects that they started, very, very few new projects have actually began. Any sort of construction and all of the deals that Trump likes to brag about.

None of them have moved at all. So this is the number that matters from my point of view. Here’s a QR code so that you can watch it yourself with live releases. Whenever the fed updates its data. This number goes up. You know we’re moving in the right direction. We’re getting ready for a future that is inevitable,

And if it goes down, then we are well and truly screwed.