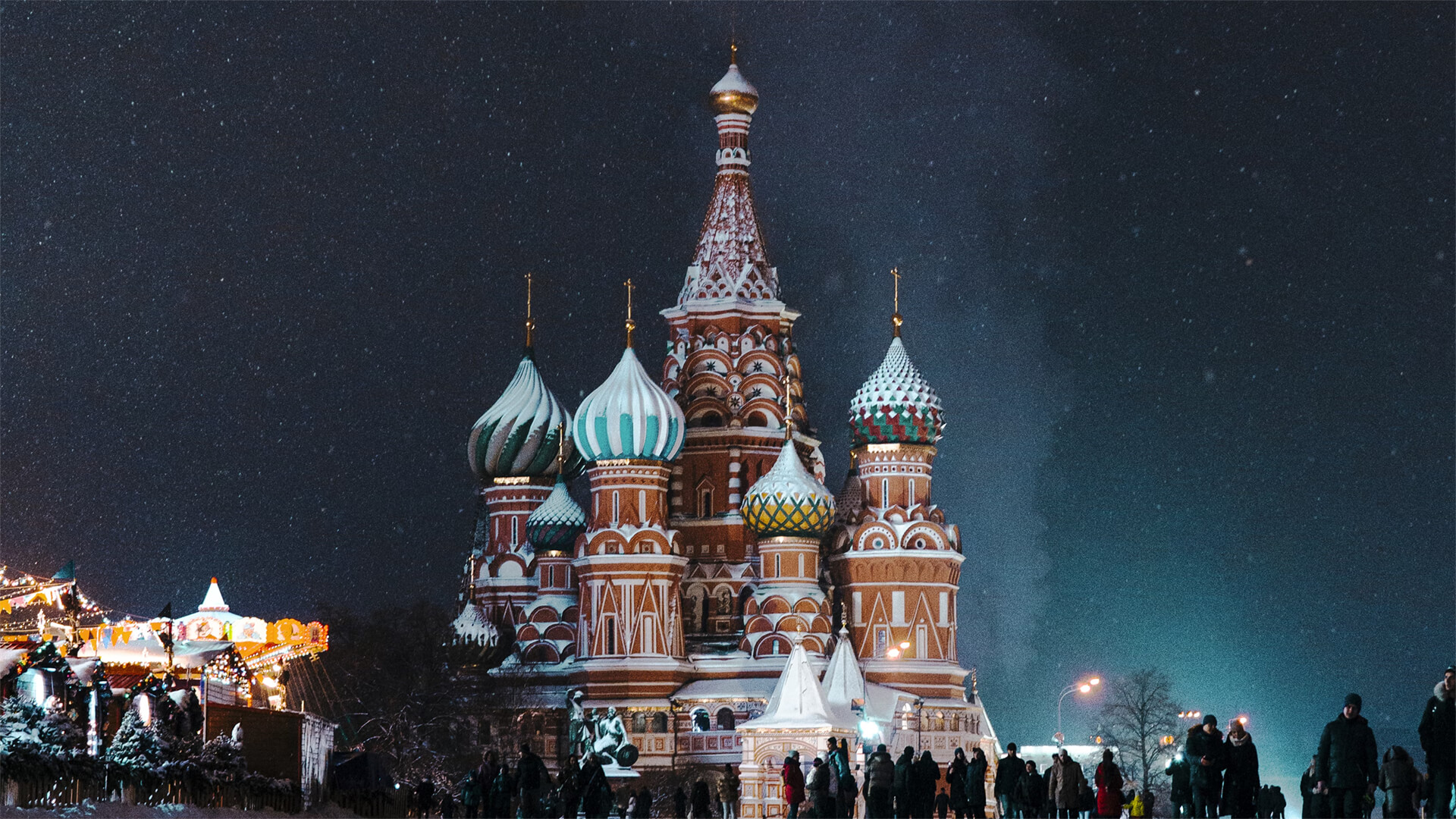

It should come as no surprise that the Russians love meddling around, so let’s see what they’ve been up to lately. We’ll be looking at tech transfers with Iran, North Korea, and China and Russian propaganda in the US.

Russia has promised satellite launches to the Iranians and North Koreans in exchange for Iranian Shahed drones and North Korean artillery rounds. In fact, the Iranian satellite was launched about a week ago. The Chinese are getting in on the action too, with naval technology and weapons systems changing hands.

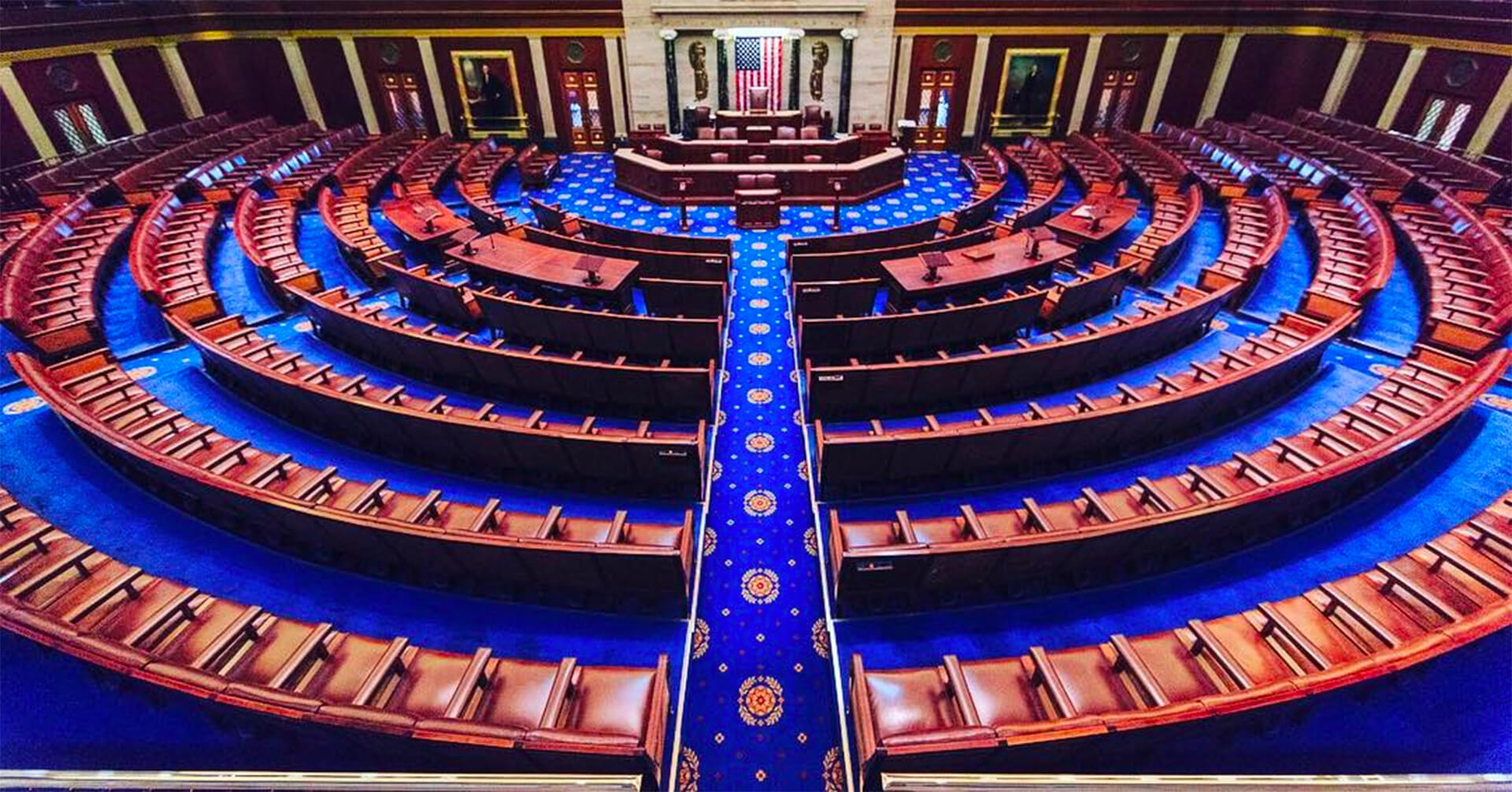

Now with all that going on, you would think America could agree that the Russians are NOT our friends…sadly that’s not the case. The MAGA movement has fallen victim to Russian propaganda, which reaffirms Russia’s ability to disrupt American politics and sow discord (especially during election season).

Here at Zeihan On Geopolitics we select a single charity to sponsor. We have two criteria:

First, we look across the world and use our skill sets to identify where the needs are most acute. Second, we look for an institution with preexisting networks for both materials gathering and aid distribution. That way we know every cent of our donation is not simply going directly to where help is needed most, but our donations serve as a force multiplier for a system already in existence. Then we give what we can.

Today, our chosen charity is a group called Medshare, which provides emergency medical services to communities in need, with a very heavy emphasis on locations facing acute crises. Medshare operates right in the thick of it. Until future notice, every cent we earn from every book we sell in every format through every retailer is going to Medshare’s Ukraine fund.

And then there’s you.

Our newsletters and videologues are not only free, they will always be free. We also will never share your contact information with anyone. All we ask is that if you find one of our releases in any way useful, that you make a donation to Medshare. Over one third of Ukraine’s pre-war population has either been forced from their homes, kidnapped and shipped to Russia, or is trying to survive in occupied lands. This is our way to help who we can. Please, join us.

TranscripT

Hey everyone. Peter Zeihan here coming to you from Colorado, where we are recovering from Snowmageddon 2024. We’ve gotten about 40 inches of snow in the last 36 hours. pretty though. Anyway, the news today is that the Russians are making some adjustments to things. Number one, they’re starting to pay back countries that have helped them in the war with Ukraine.

So, for example, they’ve promised a satellite launch to both North Koreans and the Iranians. And the Iranian one launched in the last few days. So if you think of all of the operations where Iran has activities in Iraq and Syria and Lebanon, in Jordan, in Gaza, they now have the ability, at least in a limited way, to have a bird’s eye view of what’s going on, which is going to cause significantly more problems for anyone who happens to be on the other side of the ledger.

The Russians are doing this in exchange for the Shaheed drones that the Iranians have been providing. Those are the ones that are basically flying mopeds. They have a £10 warhead. The Russians have been using those targets in power centers. The North Koreans will be getting one soon as well. Of course, North Korea has been providing the Russians with about a million artillery rounds.

And for those of you who have forgotten, North Korea has intercontinental ballistic missiles. So getting satellite recon for any reason is something that vastly increases that threat. And then, of course, there are weapons systems being traded to the Chinese, things like naval technology, where the Chinese could use them to hurt the United States and any number of ways.

That’s kind of half of what’s going on. The other half is the Russians are in a celebratory mood because they’re discovering that they can widen, that the sort of propaganda that they spread in the United States and certain factions of the American political system, specifically the MAGA. Right. Because, I mean, here we’ve got the Russians providing aid and comfort to three countries, North Korea, Iran and China that even Mogga agrees are all bad.

But that doesn’t seem to be registering. They’re still thinking of Russia as a friend. Let’s see. The background of this, of course, happened during COVID, when the Russians were the most active peddler of anti-vaccine disinformation in the world, which resulted in the death of over a million American. You know, the kind of death toll that the Russians could have never achieved during the Cold War without some sort of horrible response.

But now they have enablers across this branch of the Republican Party. And so the Russians have started to diversify what they’ve been saying just to see how far they can push it. And last week, they were able to actually get Donald Trump to stop campaigning against the ban of Tik Tok, which is something that is broadly popular even among the American right.

So it’s going to be interesting to see how Donald Trump’s shift on this is going to now translate into Moscow’s opposition to Chinese issues. I don’t know how far this is going to go. The general breakdown in civics education in the United States is definitely having a very deep impact on our political system at home, but it’s providing a lot of opportunities for the Russians to drive wedges between the various aspects of American society.

So far, with minimal blowback. So this is something that is definitely on my worry list and not something that I have a very clear idea of how it’s going to go. There’s just too many pieces in play. I can tell you that because it’s an election season and because Donald Trump is defending himself from 90, I think, indictments, that there’s going to be ample fodder for the Russians to work with over the next several months.

This is definitely one of those things that’s going to get far worse before it even begins. Do you get a hint of better?