Not all epidemics are created equal, even when everyone is battling the same pathogen. Let’s start with timing and intensity. The imminent coronavirus wave of cases about to hit the United States is going to hurt, but it will hurt less than what’s about to occur in Europe.

Despite all their similarities, there are sufficient differences between America and Europe demographically, geographically, economically and institutionally to generate significantly different epidemic experiences.

Let’s start with connectivity. Despite being all under a single political authority, the US has considerably less connectivity than either China or Europe.

First, because of its failure of national infrastructure. The US has no meaningful passenger rail system aside from creaking Amtrak in the Northeast corridor, and it has no highspeed rail at all. If Americans want to travel long distance, their choices are limited.

Passenger aircraft: While it hasn’t officially been shut down (yet) American carriers have already reduced their flight schedule by over two-thirds, and most of America’s smaller airports are already closed. Expect several of the larger ones to follow suit.

Automobiles: Car travel is slower and outside of summer vacation season (which is likely suspended for 2020) is largely limited to short-haul travel. It is also incapable of serving as robust of a disease vector as passenger aircraft.

Second, it’s a simple issue of size. China is physically larger than the United States, but some 95% of its population lives on less than one-third the land area. Europe’s usable land is one-third less the size of America’s while its population is one-third larger. That makes America’s functional population density roughly half that of Europe and one-fifth that of China. Social distancing is simply easier when there is already some distance baked in to living conditions. Those hell commutes many Americans factor into their lives at least have one silver lining.

Third, the “normal” function of the American economy is a bit more resistant to viral spread than the European or Chinese equivalent. America’s economy is primarily service based, and roughly one-third of its workers can work remotely. Yes, that’s a low number, but it is significantly better than the figure in more industrial China or more manufacturing-based Europe.

Even within manufacturing, arguably the economic sector most impacted by the virus because staff must come to the facility to work, the Americans have a bit of insulation.

In part it is because the outsourcing of manufacturing jobs to China means the US manufacturing base is smaller in the first place and so less likely to serve as a disease vector. American manufacturing largely limits itself to North American needs. It isn’t nearly as export-driven as Europe or China and as such simply has fewer personnel to expose.

In part it is because the America’s manufacturing is integrated with Mexico, a country with which the US has a hard border that limits personnel exchange. For their part, China’s system is largely self-contained within its borders, while the German manufacturing system enjoys passport-free access to all its manufacturing partners throughout Europe.

None of which means the Americans are incapable of having an epidemic, obviously, but it does mean that epidemiologically segregating America’s cities from one another is a far simpler task than doing so in China or Europe.

The road forward will look something like this:

Europe is next up. Best guess is Europe had more – perhaps several times more – coronavirus cases than the United States. What is occurring now in Italy with high numbers of deaths and higher numbers of cases, will repeat in northern Europe on a much grander scale. Americans will get a good hard look at what the virus can do to a place of similar socioeconomic development before the virus crashes into the United States. From the point of large-scale movement restrictions, the peak in cases and deaths is typically two weeks out with notable declines in three weeks. Europe didn’t begin their restrictions until the week of March 16, so expect the epidemic to likely peak in the first or second week of April. In the meantime, Spain is following closely in Italy’s footsteps. Madrid is at the heart of the outbreak with a rapid increase in hospitalizations and a rising mortality count now well above what the US experienced on September 11, 2001.

One to two weeks later comes the United States. For the reasons noted above, the virus’ penetration into the United States will likely be somewhat less intense in terms of number of cases with several metro regions unlikely to experience severe outbreaks, but that doesn’t mean the Americans are in for a softer ride. There will be plenty of population centers that will feel the pain: Seattle, San Francisco, New York and New Orleans are particularly high on our watch list.

American deaths will fall into two general buckets.

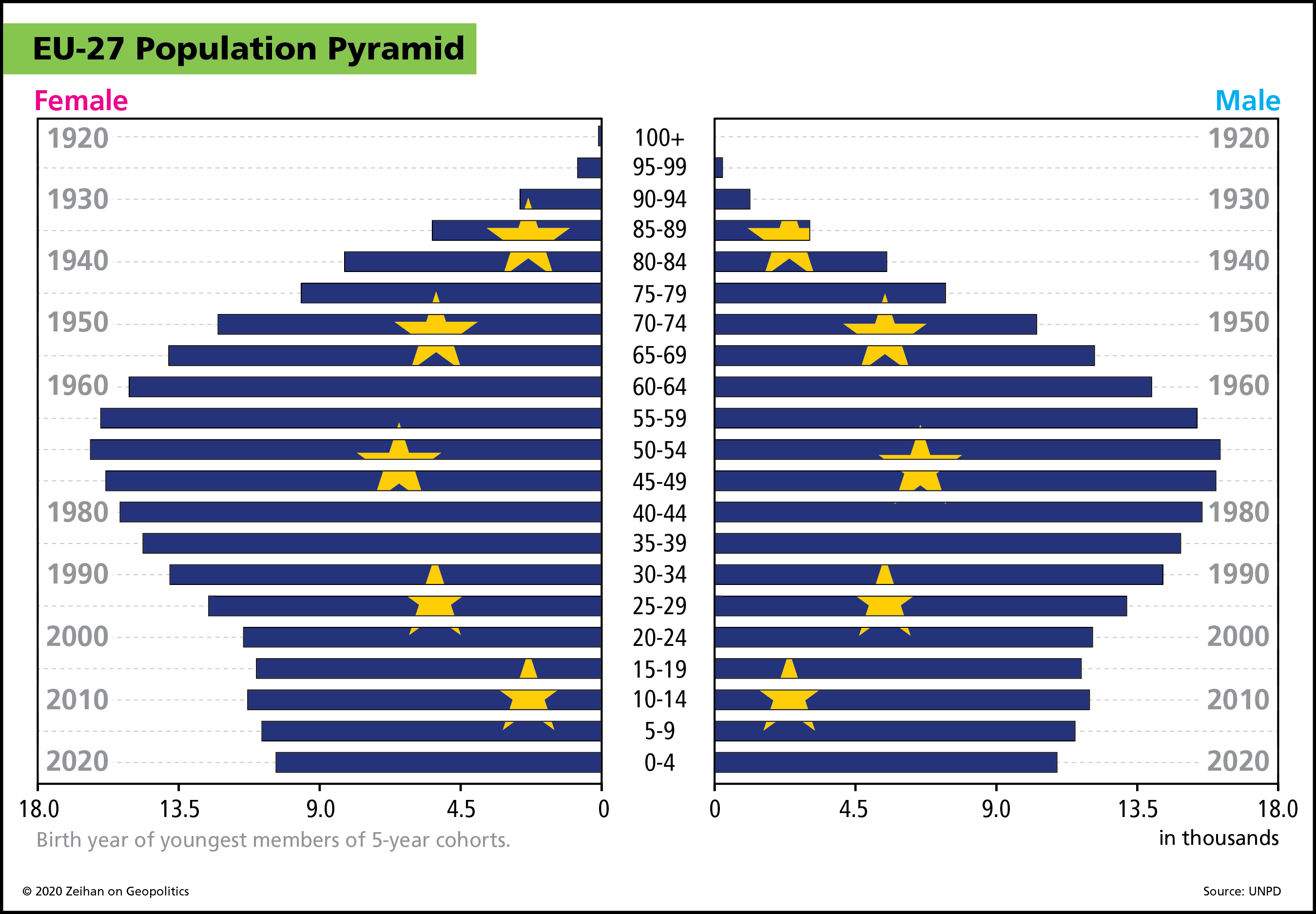

First, the elderly. This group will feel disturbingly similar to cases elsewhere. Best data out of Italy suggests the average age of mortality from coronavirus is 80. On the somewhat bright side, however, is the simple fact that the Americans have fewer elderly. Birth rates in most of Europe cratered over 30 years ago, meaning that the average American is about a decade younger than the average European.

The second category for mortality are those with impaired respiratory health. Mild (and easily survivable) cases involve “only” the upper respiratory system and often involve “only” a dry cough and fever. Severe and critical cases (which require hospitalization) see the virus migrate into the lower respiratory system, inducing pneumonia and lung failure. Americans may be younger than Europeans on average, but they are also in poorer health. America teems with “lifestyle” diseases such as obesity and diabetes. Over half the American population has restricted respiratory health, making much of the population more vulnerable to the virus’ effects.

Once the initial peak passes, we’ll start peeking out from under our rocks and start venturing back into the sun. We’ll loosen our quarantines on both sides of the Atlantic, but the virus won’t be done with us. Europe’s higher connectivity means the virus is likely more entrenched more deeply within the population than the United States. Europe’s quarantine will need to last longer, and Europeans’ close proximity to one another means a local flare-up can easily go national or transnational. Distance and the de facto suspension of air travel means the United States can – will – have local flare ups and they will jump cities. But the combination of the virus’ relatively long incubation period combined with the fact that most US cities are at considerable remove will make the post-quarantine period feel like a giant game of whack-a-mole instead of a nationwide secondary (and tertiary, and quaternary…) epidemic.

There’s one additional difference worth noting. Leadership at the national level in the United States and the supernational level in Europe is sorely lacking.

Ideologically, the Trump administration is fairly opposed to government, and as such has refused to fill – three years into its term – many top spots throughout the federal system. Mr. Trump is also pretty hard on what staff he has; Even within his cabinet Trump has a bit of a revolving-door policy for top personnel. For example, the president is already on his fourth chief of staff. Don’t-shoot-the-messenger is a concept largely lost on the American president and he is allergenically opposed to information that doesn’t match his worldview or whim.

That makes epidemic mitigation – something that to be done right requires seeking bad news – damnably difficult. Trump’s decision to stop air traffic first to China and later to Europe was probably the right decision, that bought the United States a month of time to prepare. But then the Trump administration returned to business as usual and, a month later, here we are. Functional action on the epidemic, therefore, falls to the states and cities who are now competing for resources to combat the virus.

Europe isn’t any better, but it is less because of ideology or personality and instead because of constitutional law. The European Union has no indigenous disaster response capabilities, and what little it has are held within the NATO alliance. Since NATO’s backbone is US troops and since not all EU members are NATO members, it is highly unlikely we’ll see NATO forces enforcing quarantines across Europe.

Making decisions about novel situations at the EU level typically requires multiple all-night summits of all EU heads of government to hash out ad hoc legal and financial compromises. Under quarantine, that’s simply impossible. With the exception of Italy, the Europeans didn’t even begin travel restrictions until a week ago. Legally and functionally, the EU’s member states are entirely on their own, and most lack even scant bits of the supply chains required to ramp up medical services.

These differences in health, age, governing and health care systems abound and are giving us a real-life compare-and-contrast case study between two similar-yet-different systems that is simultaneously large-scale, amazing and disturbing. These differences will also generate radically different consequences in finance, manufacturing, currency and governance – all of which will be the subject of subsequent installments in our Coronavirus Guides series.

And now the pitch: the Coronavirus Guides are our primer documents, intended not to finish the discussions of this or that topic, but to launch them. Contact us at Zeihan.com/consulting to inquire about rates and scheduling options for teleconferences, videoconferences and in-depth consulting calls.