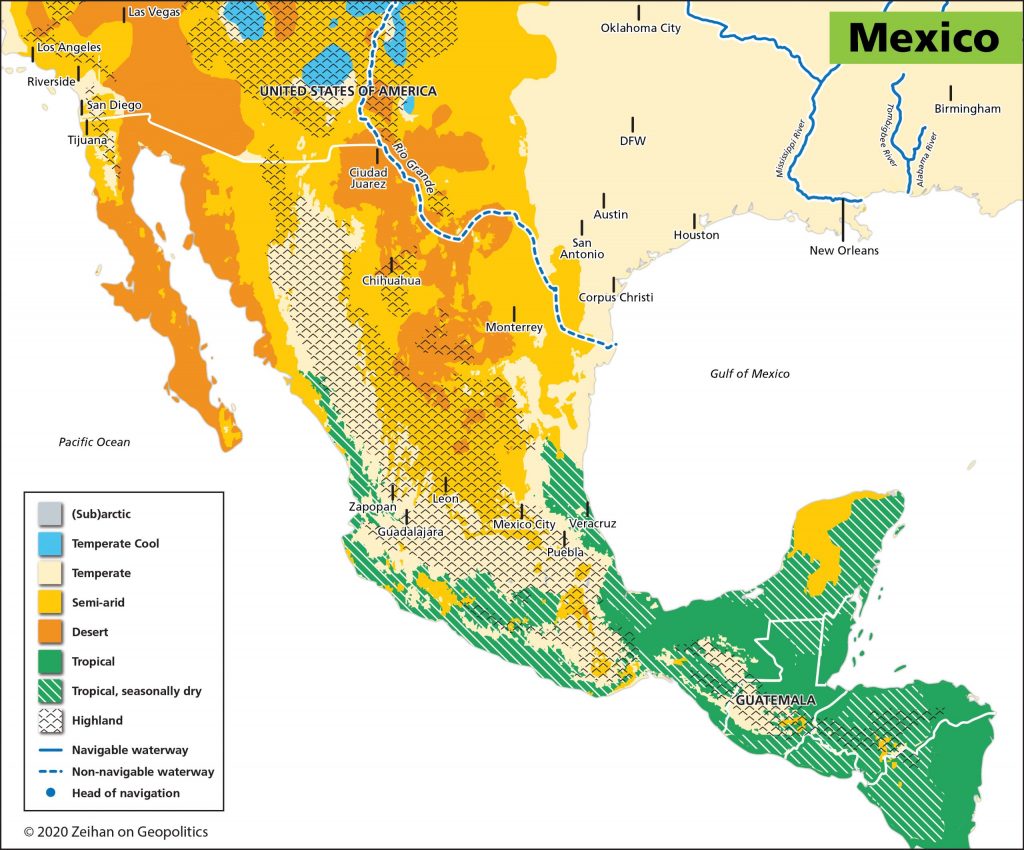

Let’s rile everyone up with an uncomfortable statement: Mexico should be a failed state. The issue isn’t cultural, political, or policy-driven, but rather, geographical. Most powers of significance share two geographic features:

First, they’re in the temperate climate zones, therefore boasting reliable rainfall, warm seasons for growing crops, cold seasons for deterring pests, recharging the soil, and avoiding extreme heat and cold that wrecks health and infrastructure.

Second, they’re pretty flat. Flatness simplifies the construction and maintenance of infrastructure. It means their cities can spread out, and keep land prices low. It means agriculture and industry alike can establish mass scaled economies, keeping food, power, and manufactured goods’ prices within reach. This not only boosts national power, but it also provides a backstop to help keep economic inequality-related issues under control.

Mexico has none of that.

Its north is a barren desert. That means agriculture is only possible by diverting the region’s few rivers. Its south is a rugged jungle, which reduces the general population to subsistence living. Plus, multiple mountain chains crisscross the country, with the two largest (the Sierra Madres Occidental and Oriental) prominently jutting up from the coast, complicating interior access to the one feature Mexico has going for it: its extensive coastline. All those mountains shatter Mexico’s people into multiple, often competing, zones.

Any of these features would be severely problematic, all sufficient enough to keep Mexico out of the ranks as one of the major powers. But all of them? Together? Across a territory as big as Spain, France, Germany, and Poland combined? With all these points, Mexico, arguably, has the world’s worst geography from an economic-development point of view. Mexico shouldn’t just be a failed state, it should exist in a degree of organizational chaos rivaling Afghanistan.

Yet not only is Mexico not a failed state, rather it’s the world’s 15th richest country, and among the most industrialized states of the developing world. Does this mean geographical lessons don’t apply to Mexico and its people? Hardly. But it indicates we need to add more layers of information.

First, Mexicans can read maps and thermometers. They know their country is in the tropics. Rather than staying in the tropics, the majority moved up their omnipresent mountains until they, literally, rose above the oppressive heat and humidity. Over half the Mexican population resides in a series of highland valleys and plateaus in the country’s midsection, with most living above 7000 feet. In doing so, Mexicans, at least in part, addressed some of their issues with agriculture and economies of scale and health. Other Latin American countries have followed similar paths, but none of them have proven as successful as Mexico.

Which brings us to the second layer of information: Mexico shares a 2000-mile-long border with the United States. There are plenty of historical chapters the two countries share that are, shall we say, less than cooperative. The United States defeated Mexico on the battlefield, and in the aftermath, drew the border to their own liking. As such, the United States owns the demographic and especially economic heft of the borderland. Still, the normal economic rules apply:

By imposing American security levels on the northern borderland’s bulk, northern Mexico has found itself somewhat freed of multiple “normal” stresses that plague borderlands in general (mountainous terrains specifically). And since Mexican labor is less expensive than American labor, the propensity for trade and economic integration among the two lobes of the borderland is amongst the strongest globally.

The American cities of San Diego, Los Angeles, Phoenix, Tucson, Albuquerque, El Paso, San Antonio, Austin, Corpus Christi, and Houston all sit less than 300 miles from the border – a border they are linked to by excellent infrastructure. The cities on the southern side of the borderland – the Mexican metro regions of Tijuana, Juarez, Hermosillo, Chihuahua, and Monterrey – might be culturally Mexican, but economically, they function as satellite cities of the United States.

And because Mexican-American relations have been stable and fruitful these past thirty years, those Mexican cities have painstakingly developed and increased their local educational standards to the American norm. This isn’t simply a relationship that simply works, it works well. Mexico figured out its geography, and northern Mexico in particular decided to get in-bed with its northern neighbor.

The third layer to Mexican success is more institutional: In the 1980s, Mexico was transitioning from single-party rule to democratic norms, a touchy, fraught process for any country – triply so for a country with as riven geography as Mexico has. Under George HW Bush and Bill Clinton’s leadership, both to expand the American economic footprints and provide Mexican democracy with a more stable footing, the United States negotiated a free trade deal with Mexico City (and invited the Canadians along for the ride). And so, NAFTA was born.

Access to American capital and consumer markets provided Mexico with the opportunity to shift away from a resource-export-driven system into something more value-added. The results are almost unprecedented. Most developing Latin American countries are relatively closed, with most export income coming from things like crude oil, coal, coffee, fish. In the early 1980s, Mexico was no different. But now, Mexico is the most trade intensive Latin American country by a factor of three, and over 80% of its exports are manufactured goods, with nearly all its products flowing north. Hiccups and exceptions abound, but Mexico has taken maximum advantage of the formation of North America’s trade space.

Fourth and finally, Mexico got lucky. This one takes a bit of exposition:

Normally, trucks are the dumbest way to move things from points A to B. Dragging stuff around via semi truck-towed container costs approximately twelve times more than floating them via container ship. Courtesy of the Mississippi, Missouri, Arkansas, Red, Tennessee, Ohio, Sacramento, Colombia, Alabama, Tombigbee, and Hudson Rivers (plus about five dozen of their smaller lesser-known brethren) the United States doesn’t just boast an internal, naturally navigable water-network larger than anyone else’s, but instead, a system larger than everyone else’s.

The United States’ rivers proved a key feature in empowering America’s breakneck growth to world power in the 19th century. Not to mention, the United States’ subsequent maritime acumen proved key to the Americans’ rapid and thorough defeat of the Mexicans in the Mexican-American War of 1846-1848. (Cliff-notes version: American forces baited the Mexican army into a multiweek march across Mexico’s northern deserts, while the Americans simply sailed the Marines to the Mexican port of Veracruz and marched directly onto Mexico City.)

Mexico lacks a single navigable river, and in moving the bulk of the Mexican population upmountain, most Mexican ports have become wildly underutilized relative to the size of the Mexican economy. In an industrialized and globalized world dominated by massed waterborne shipments, this is a kiss of death. All imports or exports must first deal with a mountain chain. Any goods part of an integrated multi-step manufacturing supply chain where goods come and go via Mexico’s ports would need to navigate such chains at least twice. One of the many reasons East Asia does so well in electronics manufacturing is because the bulk of East Asian cities are either on the Pacific Coast or, at worst, only separated from the coast by a relatively short stretch of (relatively) flat land. Mexico should not be able to play.

But it can, because the United States continues to do something monumentally stupid.

Back in 1920, the United States adopted the Jones Act (aka the Interstate Commerce Act) which among other things, forces any cargo being transported between any two American ports to use American built, owned, captained and crewed ships – a restriction the United States declined to place on any internal transport method. The result was a century of massive investment in rail and truck infrastructure that dramatically reduced the cost of internal overland shipments and an atrophying of the American waterway system.

The Americans deliberately muffled their sublime geography’s most glorious benefits.

Within a few years of Jones’ adoption, the Americans lost their coveted spot as having the world’s lowest internal transport costs. Today, instead of internal American shipments using waterways, Americans primarily use trucks to shuttle about over two-thirds of their internal commerce.

If the Americans utilized their waterways like other countries, Mexico simply couldn’t compete in the American market. But if the Americans insist on doing everything the hard way, and limiting themselves to trucks…well, on that field of competition, the Mexicans are in their element.

And it shows.

Mexico became America’s largest trade partner in 2019, a position they will not give up in our lifetimes. So to best understand what’s going on south of the border, as well as with American-Mexican economic and diplomatic relations, sign up for our videoconference on June 16 below.

Newsletters from Zeihan on Geopolitics have always been and always will be free of charge. However, if you enjoy them or find them useful, please consider showing your appreciation via a donation to Feeding America. One of the biggest problems the United States faces at present is food dislocation: pre-COVID, nearly 40% of all foods were not consumed at home. Instead they were destined for places like restaurants and college dorms. Shifting the supply chain to grocery stores takes time and money, but people need food now. Some 23 million students used to be on school lunches, for example. That servicing has evaporated. Feeding America helps bridge the gap between America’s food supply (which remains robust) and its demand (which coronavirus has shifted faster than the supply chains can keep up).

A little goes a very long way. For a single dollar, FA can feed one person for three days.