I’m going to attempt the impossible with this one: making economics not necessarily fun, but painfully relevant to someone who cannot work an Excel document.

Here goes:

The United States is experiencing the fastest increase in prices since at least the peak of the subprime boom back in 2008 – in April inflation was already up 4.2% from a year earlier – generating waves of criticism for the Biden administration, whose spending plans are credited with artificially spiking demand. (Normally, the government aims to keep annual increases below 2.0%). At first blush, I really don’t see the April data as a big deal. Everyone remember what was going on a year ago? Coronavirus-induced lockdowns cratered demand, which meant that prices were falling quite a bit. This 4.2% increase from a year earlier is really just a reversion to the mean.

But that said, yeah, it is going to get much, much worse over the next year or so.

Arguably the single biggest reason for the price increases is that Americans are getting out. The country is now majority vaccinated and since COVID is a respiratory pathogen, it has more difficulty spreading when people are outdoors. Aside from the most introverted of agoraphobes who have loved COVID lockdowns, everyone is jonesing to get out of their home this summer and to some version of “normal”.

Market tightness will become particularly noticeable in food. Traditionally, half the food consumed (by value) is eaten outside of the home. A year ago when the lockdowns began, there was simply too much steak and cheese and bacon and not enough flour and chicken and milk. Agricultural production and processing systems contorted to make the adjustment. Now everything is going the opposite direction. There isn’t enough steak and cheese and bacon to support rapidly-shifting demand patterns.

Energy is rapidly evolving to match, for reasons typical, atypical, and downright weird. There’s a normal seasonal increase in demand as farmers start planting in March, and as spring breakers hit their “hold my beer” parties. That increase doesn’t typically stop until autumn. So cyclically, we’re on the “normal” early part of the demand ramp up. And it is happening as Americans are starting to get back to their lives and so are driving more. And we have summer car vacation season just around the corner that pretty much everyone is looking forward to. Hell, I am planning a road trip. I hate road trips and yet I. Cannot. Wait!

On top of that we’ve had a few hiccups across the energy sphere. A container ship clogged the Suez Canal for a week, blocking about 10% of global energy flows. Texas had a freak freeze that took some 3 million barrels of crude production – over 20% of US output – offline for a couple weeks, along with all the downstream refining and petrochemical work that actually brings us usable products like plastics and diapers and tires and cosmetics and…face masks. Russian hacker group DarkSide took down the Colonial Pipeline for nearly as long, interrupting gasoline flows to half the Eastern Seaboard. A new, horrific COVID wave in India is threatening port operations, potentially impacting half the country’s oil supply. Individually, each is an event of global significance. Together? Damn.

Nor are Americans staying put. The Boomers, America’s largest-ever generation, are moving to warmer locales as they retire en masse. The Millennials, America’s second-largest-ever generation, are moving away from the major coastal cities to places where they can afford single-family homes so they can raise their new families. No one wants to be in a bus or subway everyday where they might be exposed to COVID. Collectively, mass relocations are adding huge demand pressures to any and all suburban locations, particularly those in the South, Southwest, and Mountain West.

In the world of manufacturing, the pressure is even greater. On the demand side we’ve seen a lot of sloshing around this past year as people in waves decide they all need new computers or phones or home additions or furniture. We’ve not seen this level of erratic consumer behavior in the modern era. The world of global manufactures simply cannot keep up, and retooling to meet demand in one area almost by definition means insufficient supply for another. The issue of the current quarter is surging demand for electronics has meant there are not enough semiconductors available for automobile manufacture.

The broader supply side is a more national issue. American firms, rightly spooked by disruptions physical, political and medical are relocating many of their supply systems to North America to insulate themselves from global disruptions. The shale revolution has made energy costs locally lower than they are globally, while the U.S. workforce’s high productivity has made most manufacturing processes cheaper to operate in North America than East Asia. Of course, the industrial plant first needs to be built, and that absorbs just as many material inputs as expanding the housing stock.

There’s also a big risk on the near horizon. If the Biden administration’s signaling bears out, the United States will be boycotting the 2022 Winter Olympics in Beijing. That will turn what is an ongoing trade cold war into a full collapse of economic relations. Every American firm operating in China will need to decamp, either because the Chinese confiscate everything as punishment or because their competitors start slapping them with the label of “sponsors of the Genocide Olympics”. We probably are only seeing the tip of the proverbial iceberg in terms of relocation-driven manufacturing price pressures.

So far, Americans don’t care about the price increases, and they aren’t likely to soon. If you fear the subway, you will pay a premium to not have to use it. If you do not want to shovel snow, you will pay a premium to not have to do it. If your home improvement project is already three-quarters finished, you will pay a premium to complete it. If your new home office has demonstrated to you that you need a better set of headphones and a newer computer, you will pay a premium to get them. If you have not eaten out in a year, that first time out – the first twenty times out – you are going to have yourself a damn steak. Personally, I find myself in four of these five categories. Add in my shiny new snow blower and I’m in four and a half.

In the remainder of 2021 and throughout 2022 the United States will experience the highest levels of inflation since at least the 1970s. And if relations with the Chinese really do tank, the United States will be looking at World War II levels of price increases.

American citizens can afford it. Multiple federal bailout programs by two presidents have put cash in pockets; Americans now have record cash on hand. One often-missed aspect of the most recent COVID mitigation plan is to nearly double the child tax credit, and make half of it pre-paid in monthly installments. Those checks start reaching Americans July 15.

American companies can afford it. Those bailout programs benefit American firms just as much as they benefit the American people. Arguably more in some cases. Without them the airlines would have had to ground over half their fleets, and we wouldn’t be nearly half as far along on retooling our industrial plant. Even small firms like ours have benefited. State support not only helped us maintain the staff we’ve spent 15 years building, but even expand a bit. (Incidentally, we hope to have our disaster assistance loan paid back this calendar year. But regardless, everyone say hi to our new researcher!)

Collectively, this government spending expansion is the largest since World War II, and it is not the story’s end. The Federal Reserve has expanded the money supply to purchase government debt to pay for all the new spending as well as to purchase bonds on private markets to backstop everything from city spending to corporate spending to the mortgage market to student debt to credit cards.

(For those of you who obsess about Fed actions as harbingers of the American Apocalypse or vanguards of the imminent dominance of Bitcoin, curb your enthusiasm. Yes, the Fed has expanded M2 by roughly one-fifth since COVID began to just shy of $20 trillion, and yes that is clearly inflationary. BUT… First, over half that increase was in the first month of COVID. That was over a year ago now, and…no Apocalypse. Second, the U.S. economy is bigger than $20 trillion and the USD is the world’s primary method of exchange and primary store of value, so a moderate monetary expansion just doesn’t get my motor running. Third and most importantly, the Chinese have expanded their money supply to $35 trillion despite their economy being smaller than America’s and very little of the yuan supply being traded internationally. Please obsess about the right thing and adjust your forecasts and plans accordingly.)

Between the breaking of a year-long claustrophobic containment and government actions, Americans are gobbling up a whole lot of everything. Rising prices reflect all this.

This does not mean the price increases don’t matter, and I’m not limiting the things-that-matter to the normal bugaboos of inflation as regards spending capacity, wealth generation, debt levels, income stress, and mid-term economic growth trajectories. The country – the world – is changing, and inflation is hitting us all a bit differently than before.

First, a lot of jobs that existed pre-COVID are simply gone. COVID gave many firms no option but to automate away as many manhours as possible. McDonalds and Pizza Hut have practically turned into Sonic. Now that the recovery is underway, but income support has not stopped, folks who used to earn less than $16 an hour are either waiting for benefits to run out or looking for jobs with better compensation. That’s nudging employers with lower-pay positions to automate more. Most of what few of those jobs might have survived COVID will not survive the recovery.

COVID also encouraged online shopping to a degree and for a duration which suggests most retail locations will simply not recover. The jobs lost in the retail sector are among people on the low-end of the income spectrum, disproportionately impacting women, Blacks and Hispanics. The most impacted individuals are those who have the lowest education levels and the most difficulty adapting to changed circumstances. They are also the people least able to function in a higher-inflation environment. America’s inequality issues are on the cusp of becoming far, far worse. We can look forward to that being reflected in American politics throughout this next political cycle. More Trumps. More Sanders.

Second, the inequality issue isn’t simply within the United States, but between the United States and the rest of the world. The United States will largely be finished with its vaccination program in about a month, enabling it to experience the fastest economic growth of its history. We’re talking in excess of 10% annually. That’s China-doping-statistics sort of growth. The United Kingdom and Israel are finishing their vaccinations on a similar timeframe. Vaccine diplomacyfrom Washington will soon flood Canada and Mexico with more than enough doses to enable them to join the party by the end of August. Europe is unlikely to join in until at least the fourth quarter. More likely year’s end.

And…that’s about it for now. The vaccine formulas that work and that the U.S. will soon have an excess of – Pfizer and Moderna – require two shots and primarily freezer storage, making both broadly unsuitable for the developing world. For most of the world’s population, mass vaccination cannot begin until 2022 and it will be at a much slower rate than what we have seen in America.

The timing of all this is beyond unfortunate. Most of the world’s investment capital comes from people who are on the cusp of retirement. They’re shoving every spare dollar, euro, pound or yen they have into their retirement savings. Once they flip into retirement, they never add to their nest egg again. Collectively the Boomer generation of the world is the largest generation our species has ever generated, and they, on average, retire next year. Capital has never been as easy to access or on cheaper terms as it will be in this calendar year.

America, and a few other lucky countries, are experiencing this capital surge and record growth at the same time. Such a happy confluence of events is the sort of thing that enables firms and governments to lay down development efforts that will last for decades. I may have a boatload of reservations about all the new spending the Biden administration wants to launch, but I have to admit, if it is going to happen, the time is absolutely now.

For the rest of the world, they are missing the last global capital boom of our lives. Most of the global Boomer cadre did not have kids. Which means that as they age they will instead absorb capital from their respective systems in the form of higher health care and pensions costs, while never again paying into those systems. Those costs of capital won’t simply increase by end-2022, they’ll skyrocket. For those of you who don’t understand what “skyrocket” means, increasing the interest rate on your mortgage loan by just 1% means increasing your monthly payment by 20%. Now apply that to everything. Car loans. Credit card debt. Municipal bonds. The federal debt. Everything. By the time the rest of the world emerges from under the pall of coronavirus, it’ll be too late.

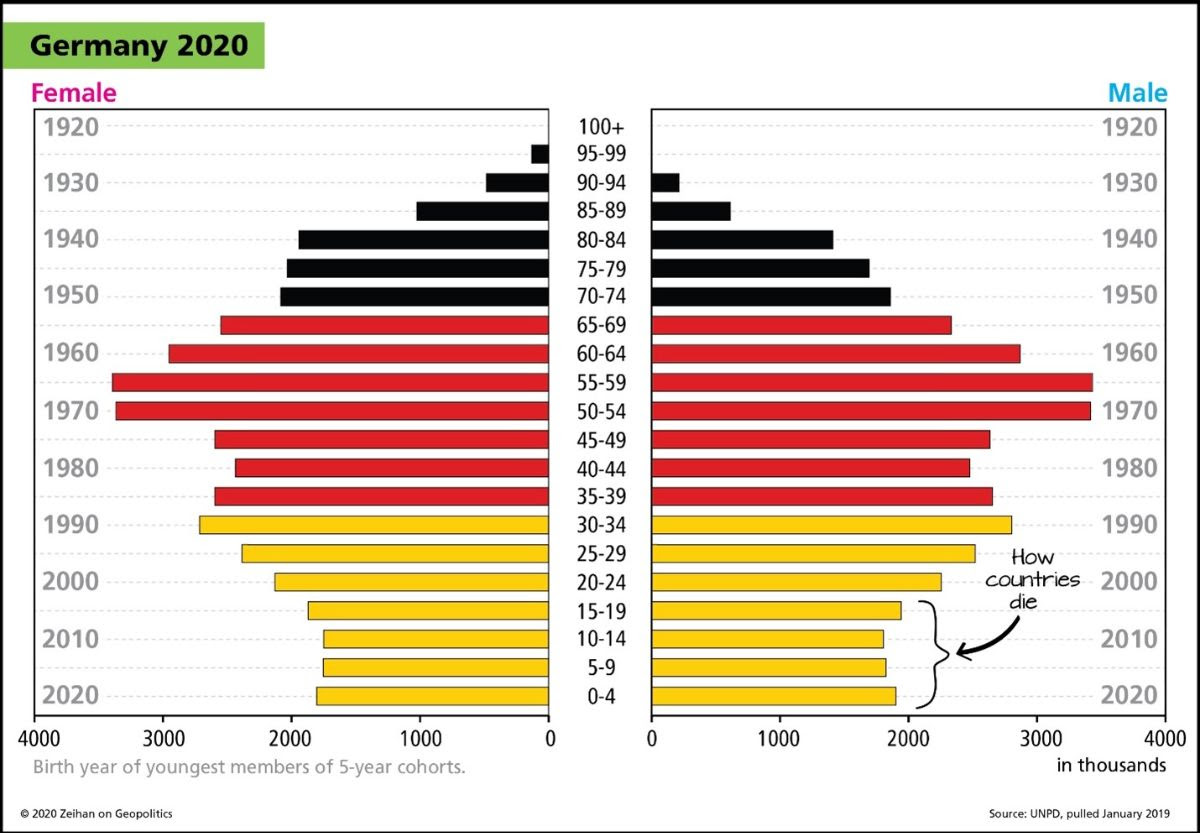

The United States, France and New Zealand are the only exceptions to these patterns in the advanced world. The Boomers in those three countries had kids. They’re the people that we know as the Millennials, the oldest of which are now 42. Their consumption is keeping these three systems ticking on, and in about a decade American, French and Kiwi Millennials will become major savers and investors and they will bit by bit regenerate the capital stock in their respective countries. But there are not appreciable numbers of Millennials in any other advanced nation. Add in that the vast bulk of the developing world has experienced baby busts more traumatic than anything that’s happened in the developing world these past five decades and this is pretty much it for capital supplies globally.

Folks, this is it. Globalization is over. Even if the Americans decided that they wanted to continue to patrol the world, even if the Americans could keep making the world safe for international trade, global demographics and global capital tell us the page has already turned. Global aging meant that global consumption and investment was always going to collapse this decade, and then coronavirus moved the end forward. Most countries will never recover economically to where they were at the beginning of 2020 when the health crisis struck. And now countries must deal with the intertwined nightmares of a collapse in global consumption, rising economic nationalism in the small handful of countries that retain decent demographic structures, and a high inflation environment triggered by the American recovery.

For me, at least, this simplifies the math. My next book project, scheduled to publish in 2022, was originally going to thread the needle of how various economic sectors will function in the transition from a globalized world to a deglobalized world. History, apparently, has other ideas. It has now sped up. We’ve retooled to focus on ‘life after the end of the world’. Which, now that I’m reading it aloud, might make a pretty good title.

If you enjoy our free newsletters, the team at Zeihan on Geopolitics asks you to consider donating to Feeding America.

The economic lockdowns in the wake of COVID-19 left many without jobs and additional tens of millions of people, including children, without reliable food. Feeding America works with food manufacturers and suppliers to provide meals for those in need and provides direct support to America’s food banks.

Food pantries are facing declining donations from grocery stores with stretched supply chains. At the same time, they are doing what they can to quickly scale their operations to meet demand. But they need donations – they need cash – to do so now.

Feeding America is a great way to help in difficult times.

The team at Zeihan on Geopolitics thanks you and hopes you continue to enjoy our work.