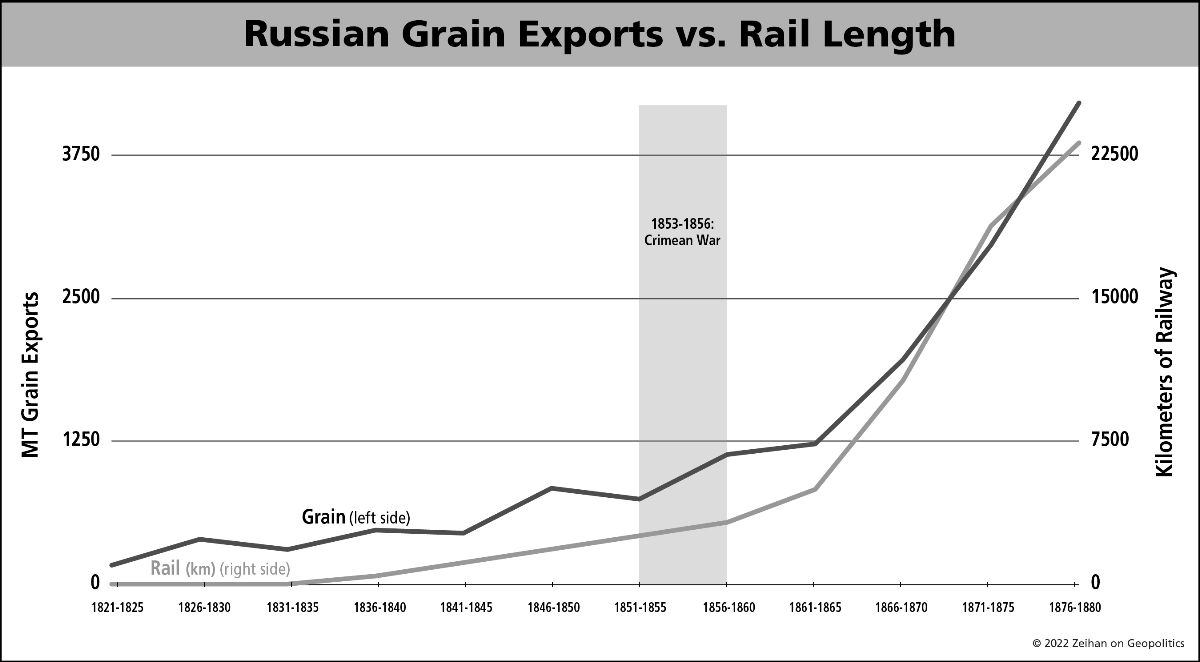

Russia’s abundance of flat, cool-temperate land doesn’t provide much in terms of defensible geography. But it is good for growing grain, particularly wheat. Russia’s place in global grain markets is also a great example of technology helping a country overcome geographic limitations. Moscow was not blessed with a country boasting an American or German level of navigable riverways, nor are its prime grain producing regions particularly close to any of its ports.

Enter rail.

The below graphic is an excerpt from my upcoming fourth book, The End of the World is Just the Beginning: Mapping the Collapse of Civilization. We can see that as Russia was able to install more railways, grain production and exports exploded by the mid-to-late 19th century. And the Russians have never really looked back. (Russian agricultural technology has not really advanced much since the introduction of rail cars and mechanical tractors and harvesters, but I digress…)

Now we are gearing up for the release of our newest project – The End of the World is Just the Beginning: Mapping the Collapse of Globalization. The new book breaks down the future shape of various economic sectors in a post-globalized world: finance, manufacturing, agriculture.

Consider the above map. Every country that is not green or blue is a food importer. Keeping the global population alive requires global peace and global sRussia is often derided as a gas station masquerading as a country. As I have noted before, this is an oversimplification that belies the significant role Moscow plays in global agricultural markets. Russia and its wheat belt neighbors, particularly Ukraine, are significant agricultural exporters of grains and seed oils. But Russia is also leading global exporter of fertilizers and fertilizer components. Not only do Russian fertilizer exports help support agricultural production in Brazil, China, India and Europe, but they help provide necessary supply in a globalized market that is increasingly seeing farmers’ input costs rise.

The breaking of trade relationships, spasms in energy pricing, and most certainly the Ukraine War will limit sharply what is possible in the world of agriculture, and do so more quickly than I have ever feared. Join us March 11 for a seminar on the impact of the Ukraine War on global agriculture. We’ll dive deep into the product and input disruptions that will shape our world this year, and deep into the future.

REGISTER FOR THE UKRAINE WAR: AGRICULTURE EDITION

Can’t make it to the live webinar? No problem! All paid registrants will be sent a link to access the recording of the webinar and Q&A session, as well as a copy of presentation materials, after the live webinar concludes.