Apologies to all for having not written much in the past three weeks. The Ukraine War has been unfolding with such unforgiving speed and complexity that I’ve just not had time. While the pace hasn’t exactly slowed, the conflict is setting into a couple readily identifiable patterns. That enables me to peer forward a bit.

First, the patterns.

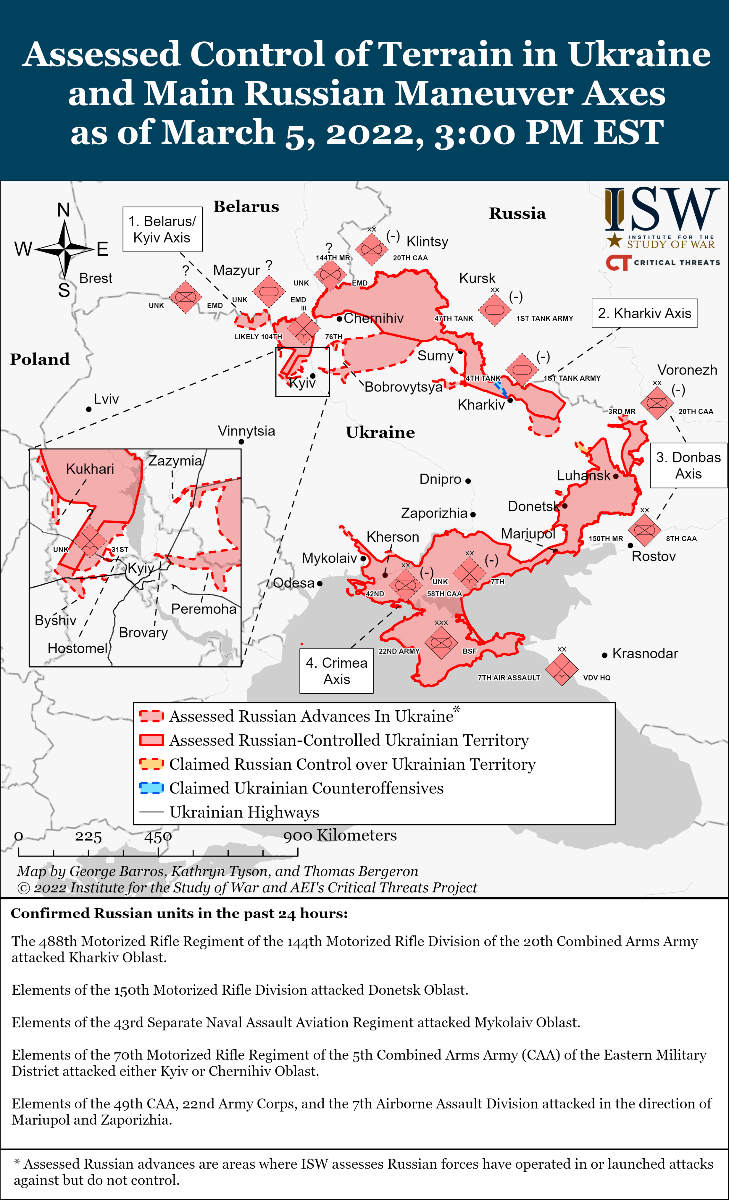

- The Russian military has massively underperformed while the Ukrainians have massively overperformed, and that before all the West’s massive weapons transfers could make it to the front lines. Of particular note I’d like to point out the Ukrainians began the war with but a handful of Stinger anti-aircraft missiles supplied by the Baltic states of Estonia, Latvia and Lithuania. Stingers are the magical equipment the Afghan mujahedeen used against the Soviets to such great effect. Soon Stingers direct from US stores will arrive in the hundreds. Expect Russian aircraft loses to increase massively.

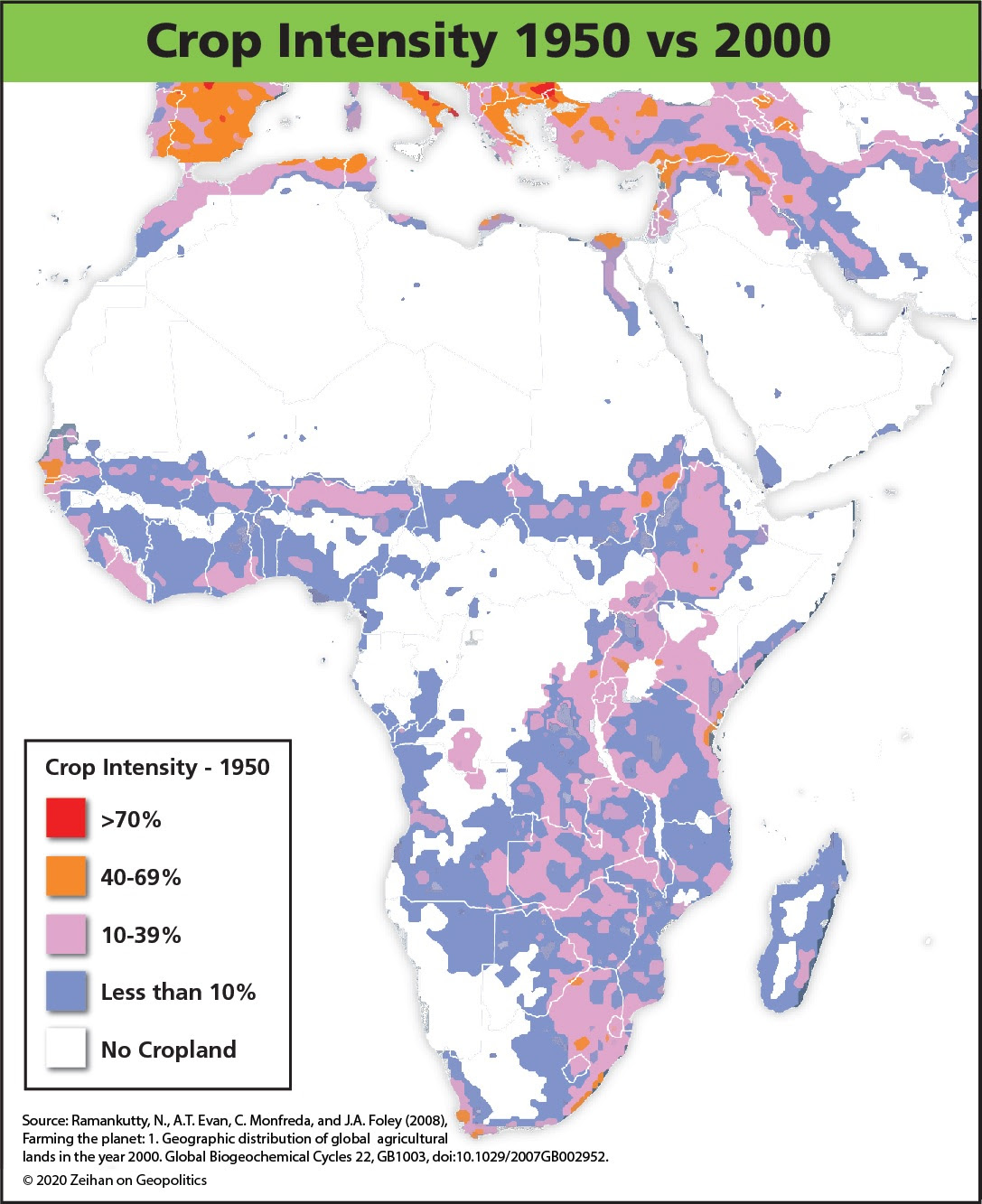

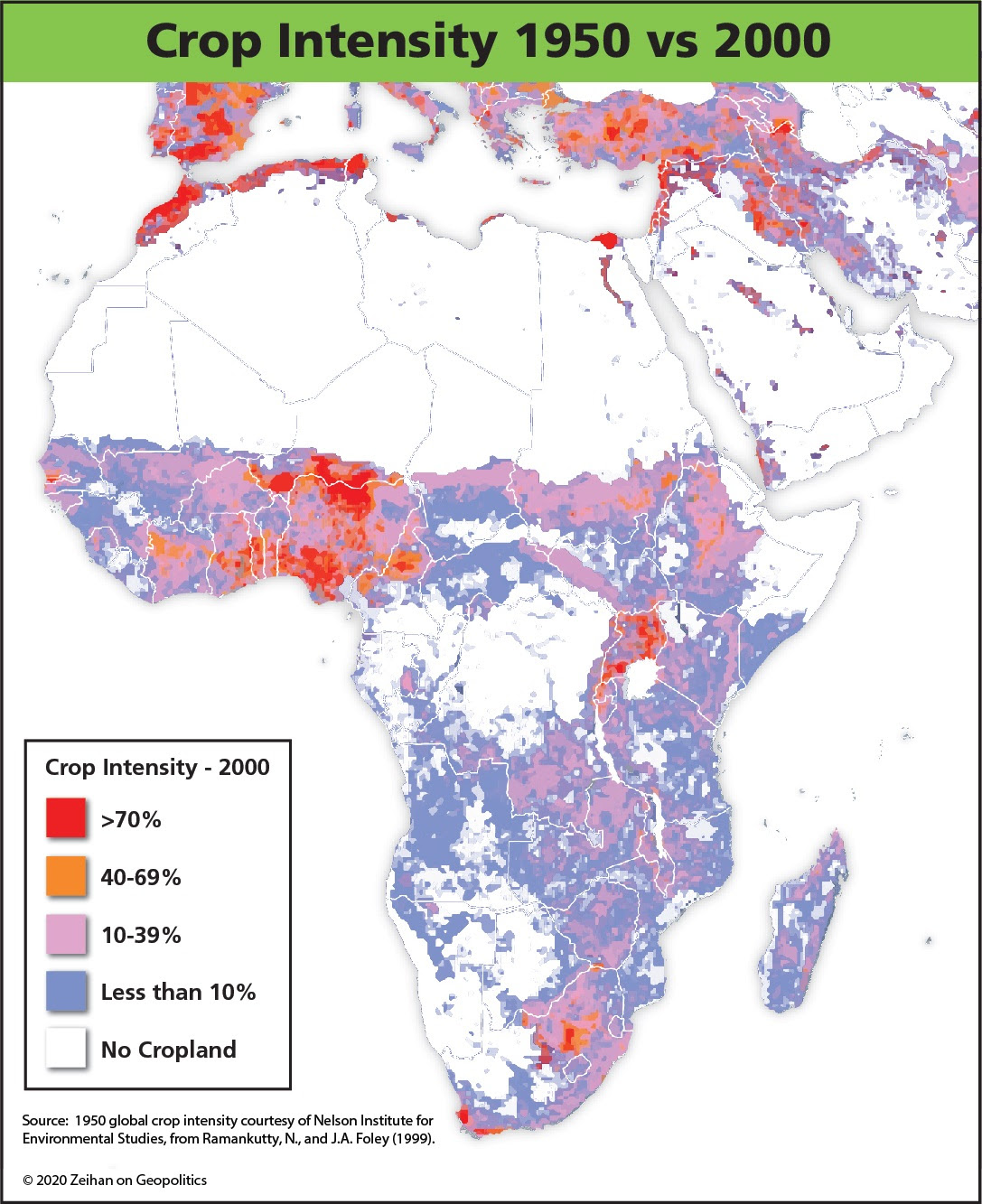

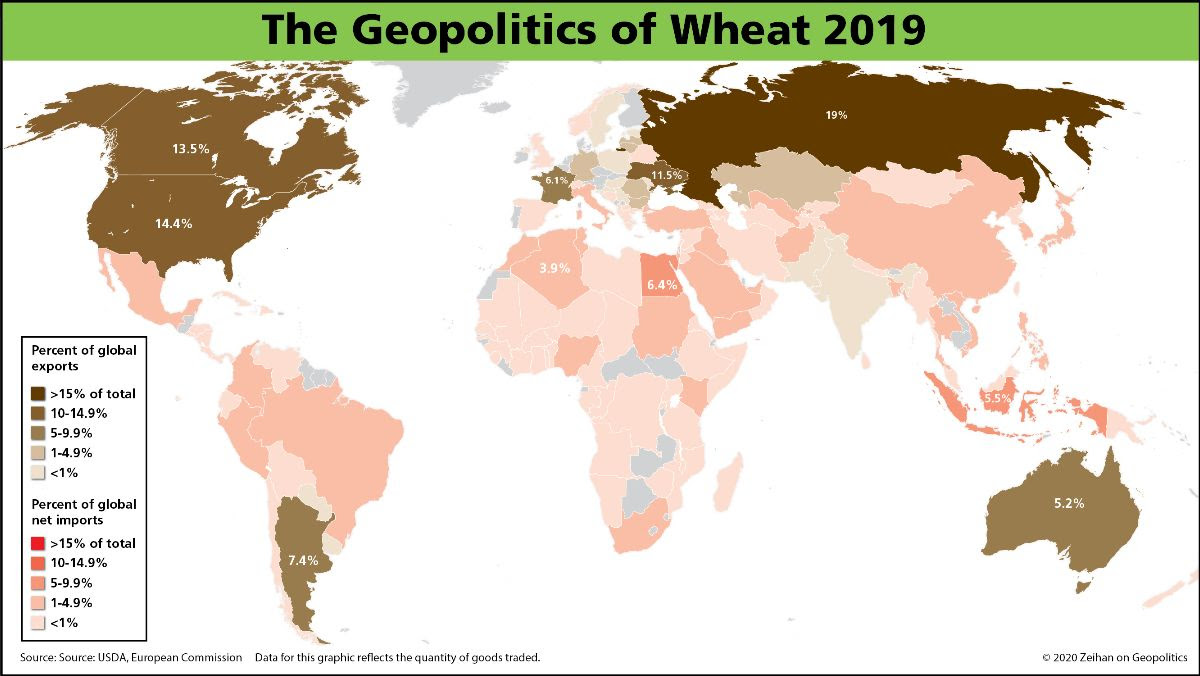

- Russia has begun applying its civilian obliteration tactics: ring a city, fire artillery at everything and anything until there is nothing left but rubble, advance with ground troops and eliminate anything that moves. It’s a tactic the Russians developed in the Second Chechen War and perfected in the razing of Aleppo in the Syrian Civil War. It’s nasty. It’s bloody. I’d argue it’s a war crime. And it’s what the Russians are doing to Kyiv, Kharkiv, Mariupol, Mykolaiv, and soon Odessa. Once Odessa falls or is destroyed, that’s the utter end of Ukraine’s participation in global agriculture. And that will bring the war home to everyone, everywhere.

More on both of those topics in good time. Today I want to kick around something else.

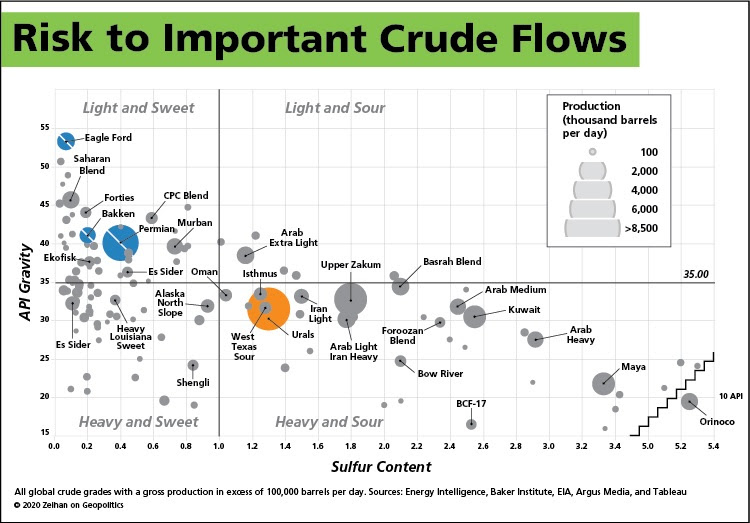

Spearheaded by the West, there are now more sanctions on Russia than all other countries combined…ever, and that without significant energy sanctions having yet been applied. (They are coming, btw.) Imports, exports, SWIFT, it’s a really hefty list of really hefty sanctions, but all of them combined pale in comparison to the fact that the sanctions include the Russian Central Bank itself.

Central banks do more than steward a national economy, they also serve as a clearinghouse for all international transactions. By sanctioning Russian banks and the RCB, Russia is functionally cut off from moving money in and out of the country, even if the money the RCB would like to move is Russia’s. This includes anything done in US dollars, euros, yen, Korean won, Canadian dollars, and Australian dollars. It also includes Russia’s $640 billion in currency reserves.

The evening of February 27, Russian President Vladimir Putin went to bed with literally $640 billion in the bank. Enough to cover Russia’s bills for months. Probably even years. On February 28 he woke up to discover two-thirds of it fenced off permanently. Of what remains, $135 billion is within Russia in gold – which is beyond useless for stabilizing the domestic market (gold bugs take note). The rest is $60 billion equivalent in yuan (which nobody wants – not even the Chinese).

Overnight one of the world’s largest monetary authorities and its attached Finance Ministry just…stopped…functioning.

While we are certainly in some uncharted territory, the full default on all Russian government debt has now shifted from the inevitable to the imminent. The only reason we might not see it in March is because the Russian Central Bank chief – Ms Elvira Nabiullina – is arguably the smartest person alive on the planet.

(By the way, Western governments? If you’re looking to poach top-notch Russian talent, Ms Nabiullina is absolutely someone you should try to recruit. She’s been one of those people sitting in the cluster of officials 1.7 lightyears downtable from Putin of late, and she does not look…pleased.)

Beyond implementing capital controls – which Ms Nabiullina has already done – the task of avoiding a full default on every Russian bond is simply beyond her. Operating in a vacuum is operating in a vacuum. Either Russia’s finances crash due to sanctions which deny Russia the hard currency in which nearly all of its debts are denominated, or the Russians choose not to pay on their government debt to stick it to their (primarily Western) creditors. Either way, total default lies before us. Probably in April, as April 15 is the end of the 30-day payment grace period on the first big batch of government debt. After that Russia can look forward to the familiar menu of carnage that accompanies a full-scale default: economic breakdown, hyperinflation, food shortages.

It’s time to talk next steps. A bit of history is in order. Way back in 1997, a series of Thai equity investors realized their sector had a fishy stench, and so they cut and ran. Within a few weeks, the Thai baht was in the toilet and its falling managed to pull most of their Southeast Asian neighborhood along for the flush. In under a year, the contagion had spread to encompass South Korea, Brazil and Russia as well. Four countries that had nothing to do with one another.

The original Thai trigger was both tiny and local. The Russian federal government has about $60 billion in outstanding bonds. Plus Russia’s regional and city bonds. Plus the bonds of state energy majors Gazprom and Rosneft. Plus those of the fifty-odd other major firms in Russia’s resource and industrial space. They are all going to zero. Again. (For students of Russian history – military or financial – there’s little about this past month’s events that has the ring of originality.) Every investor who holds nearly any sort of “developing nation” bonds or indexes or funds is exposed, as are most who hold some flavor of commodities funds that target producers rather than product streams.

What’s next? Not really sure. Personally, I still get confused when I try to trace how some cut-and-running Thais managed to inadvertently tear down economies several times larger and a half a world away. I do know two things. First, Russian flushing sounds will not be alone in the night. Until the financial world changes how it assembles funds so that Russia is no longer in the same bucket as Vietnam and Brazil, you should expect some insane and insanely-unpredictable volatility.

Second, I know that for reasons demographic and geopolitical the world was edging to the end of our current financial models even before the Ukraine War kicked over the table. In my upcoming book, The End of the World is Just the Beginning: Mapping the Collapse of Globalization, I delve into why our concepts of currency and economic management – honed over literally centuries of experiences – are no longer appropriate for the world we are devolving into.

Here at Zeihan On Geopolitics we select a single charity to sponsor. We have two criteria:

First, we look across the world and use our skill sets to identify where the needs are most acute. Second, we look for an institution with preexisting networks for both materials gathering and aid distribution. That way we know every cent of our donation is not simply going directly to where help is needed most, but our donations serve as a force multiplier for a system already in existence. Then we give what we can.

Today, our chosen charity is a group called Medshare, which provides emergency medical services to communities in need, with a very heavy emphasis on locations facing acute crises. Medshare operates right in the thick of it. Until future notice, every cent we earn from every book we sell in every format through every retailer is going to Medshare’s Ukraine fund.

And then there’s you.

Our newsletters and videologues are not only free, they will always be free. We also will never share your contact information with anyone. All we ask is that if you find one of our releases in any way useful, that you make a donation to Medshare. Over one third of Ukraine’s pre-war population has either been forced from their homes, kidnapped and shipped to Russia, or is trying to survive in occupied lands. This is our way to help who we can. Please, join us.