Both in the US and globally, the green energy transition has been all the rage for the past few years. With President Trump’s second term kicking off, how will it impact the green transition domestically and beyond?

For the green folks outside of the US, the impact should be minimal. Since the US doesn’t manufacture most Greentech components or provide much financial support, Trump’s influence is (mostly) contained to the US. But the story isn’t so pretty for those in the US.

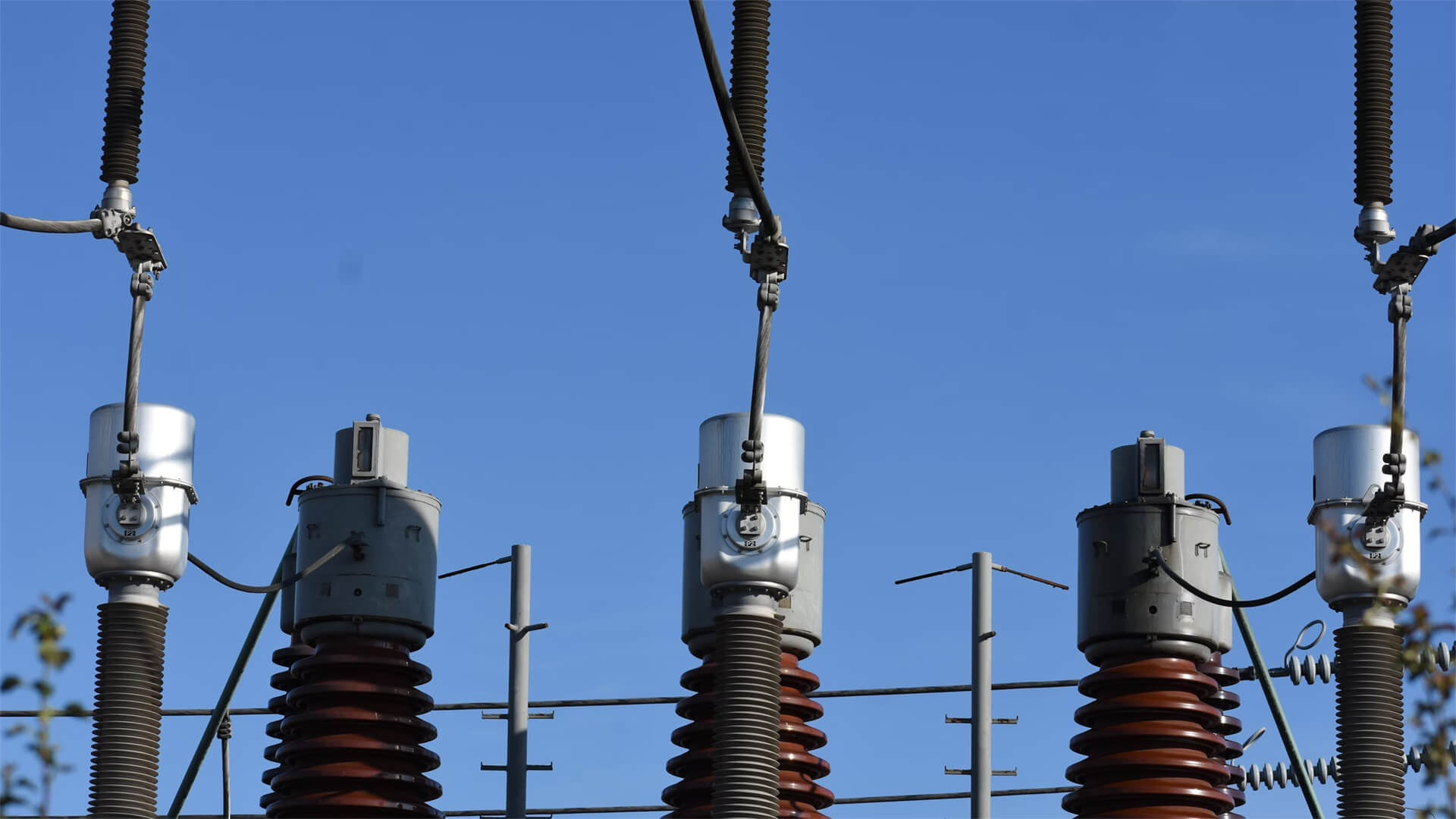

The main challenges for the green transition in the US are transmission infrastructure and financing. Federal support is crucial for developing the infrastructure to get the energy from where it is generated to where it will be used. Trump could make this development and coordination process much harder. Wind and solar projects require more robust financing than a traditional fossil fuel plant, so cuts to federal incentives or subsidies could make these projects unviable.

Without federal backing, many of these green projects would stall. Private investors might try to step in, but they can’t match federal funding levels. Trump has the ability to significantly slow down the green transition, but at least that doesn’t extend beyond the US.

Here at Zeihan on Geopolitics, our chosen charity partner is MedShare. They provide emergency medical services to communities in need, with a very heavy emphasis on locations facing acute crises. Medshare operates right in the thick of it, so we can be sure that every cent of our donation is not simply going directly to where help is needed most, but our donations serve as a force multiplier for a system already in existence.

For those who would like to donate directly to MedShare or to learn more about their efforts, you can click this link.

Transcript

Hey, all Peter Zeihan here coming to you from Colorado today. We’re taking a question from the Patreon page. And that’s specifically what sort of impact can Donald Trump have on the green transition, both in the United States and wider abroad? Abroad, very, very little. The solar panels aren’t made here. The wind turbines are not made here. And U.S. financial support for anyone else’s transition is well below $1 billion a year.

So, you know, you know, whatever. It’s all about what would happen here and here. The the federal government has a lot of, means for changing the way the green transition works. A couple things to keep in mind. Number one, green technologies, as a rule, require a great deal more transmission infrastructure because where most people live is where it rains.

And so you can grow your own food. We don’t have a lot of desert cities. So in most cases we generate power with coal, nuclear, and natural gas relatively close to where we live. And so transmission for most power plants is well under 50 miles. But most of the places that are very sunny or very windy are not within 50 miles of where we live.

It’s in the Great Plains, it’s in the desert southwest. And so you have to build these pieces of infrastructure to generate power well away from where people are. And then you have to wire that power to somewhere else. And that often means crossing jurisdictions. And if you cross a economic or political jurisdiction, the regulatory burden becomes more robust.

And it’s up to the federal government to try to smooth that out. So if all Donald Trump does is not smooth things out, becomes a little bit more onerous to build green tech anywhere because you can’t hook it up to a source of demand, then that’s problem one. Problem two is much bigger. You see, if you’re doing a conventional, facility, whether it’s coal, natural gas or a nuke, only about one quarter of the cost of the facility is in the upfront construction.

And then linking that up to the grid, most of the rest is fuel, especially for coal and natural gas. So as a rule, it varies based on where you are and how close you are to the fuel source. As a rule, about 80% of the cost of the lifetime cost of a coal or natural gas facility is the fuel. You basically buy it and burn it as you go. And so with that sort of model, you only have to finance the initial 20% that it’s required for the construction of the facility and looking it up to the grid and everything else.

You have an income stream to defray and ultimately overpower the cost of the fuel moving forward. It’s not how green tech works. The whole point of solar and wind is that you don’t have fuel. The fuel is free. Well, that means that most of the costs, almost all the costs are upfront. Over two thirds go to the construction and linking it up to the grid.

So the degree of financing you need megawatt for megawatt is more than triple what you need for a more conventional fuel system. Now, one of the things to keep in mind in the United States is that capital costs have roughly increased by a factor of four since 2019, as the baby boomers have retired, and the money that they used to have in stocks and bonds, that fueled the sort of capital environment that we had ten years ago just no longer exists.

They’ve all been liquidated and they’ve gone into T-bills in cash, which is driven up the cost of financing for almost everything, including power plant expansion. Well, if you’ve seen the cost of capital increase by a factor of 4 or 5, and you have to finance three times as much for wind and solar as you do for core natural gas, you can see where the problem is.

This is normally where the government would step in with concessionary deals on whether it’s on taxes or directly on financing in order to help bridge that gap. And so all Donald Trump has to do is say, I’m not going to finance this stuff anymore, and a lot of it is going to go away, even if, as isn’t the case in the desert southwest or in the Great Plains, solar or wind are already cheaper on an all in cost basis over the entire life of the project.

But that’s not the number that matters. Part of the problem that I’ve always had with the green communities, they keep using this thing called levelized cost of power, which shows how over the life of a project, the cost of solar and wind has gone down and gone down and gone down. And it has. But they assume that there’s no problem with intermittency.

So like when the sun sets, solar doesn’t work anymore. If you pair a more realistic cost structure because you know you want electricity after the sun goes down. Hello. With financing the issue, then the federal presence in the financing world really is critical. And even in projects that make a huge amount of sense, not just environmentally but economically.

If you can’t get that financing right, you can’t have the project. Private industry can step in, but it’s going to be a hard sell to do financing for something on concessionary terms, for something that it’s going to take longer to pay out as compared to a colder natural gas plant. And you might get local and state governments kicking in some for political and environmental reasons.

But there’s no way that they can compete with the sheer volume that the federal government can come up with. So we should expect a lot of these projects to slow down quite a bit. Even if Donald Trump doesn’t call them out by name is something that he doesn’t like. You interrupt the financing and you simply don’t get much new construction.