Disclaimer: The following newsletters were originally published in mid-2018. As the newsletter continues to grow, I will occasionally re-share some of my older releases for the newer members of the audience.

U.S. President Donald Trump made a… let’s call it a splash, at the G7 summit in Canada June 9, 2018. Normally, the G7 is a bit of a lovefest with leaders agreeing to push this bit of financial stability or that bit of poverty reduction. This time was different.

In this series we will go through the members of G7 and look at how this summit affected each of those countries.

To view all portions of this series, start here, or jump to other parts of this series: France, Germany, UK, Italy, Japan, and Canada. To view them all succinctly, keep reading.

Part 1: Intro

U.S. President Donald Trump made a… let’s call it a splash, at the G7 summit in Canada June 9. The G7 comprises the seven largest industrialized democracies – the United States, Canada, Japan, Germany, the United Kingdom, France and Italy – who also form the core of the entire American alliance network. Their leaders and finance ministers meet regularly to discuss challenges to the global order. Normally, the G7 is a bit of a lovefest with leaders agreeing to push this bit of financial stability or that bit of poverty reduction.

This time was different. The Trump administration is busy belittling and/or wrecking parts of the international order, and a mere week before the summit the United States levied steel and aluminum tariffs on nearly all the G7 members themselves. As such the summit was preceded and followed by quite aggressive statements out of most of the G7 members, most notably from Canada and France, about how American tariffs would not be allowed to stand in specific and a general dissatisfaction with the position of the White House on global affairs in general.

In essence, ahead of the summit the G7 leaders were showing concern that Trump’s rhetoric wasn’t simply rhetoric. And in the summit’s aftermath the emotion could best be summed up as defiant despair that Trump really, truly, means what he says.

I can see why they’re all pretty bummed.

The Americans created, supported, subsidized, and maintained the global order since the end of World War II. Under that order the industrialized world in general and the other G7 countries in specific have done very well for themselves, rebuilding after the war’s devastation in an environment of absolute physical security.

Maintaining a global order is far from “normal” when viewed from the long stretch of American history. In fact, it has only been the dominant strain since the end of World War II. Before that the United States had other foreign policy themes that competed for top billing.

- In the post-revolutionary era it was all about standing up to the established European empires, with former imperial master Britain in general triggering a near-dehabilitating mix of obsessive paranoia and narcissistic fear.

- The competing ideology back then was that the United States should be one of those imperial powers.

Theme1 nudged the Americans into the War of 1812, and led the Americans to encourage the independence of the European’s imperial colonies throughout the Western Hemisphere. Theme2 birthed the Monroe Doctrine and set the Americans on their own pseudo-colonial drives.

But as the world – and America – changed, American foreign policy changed with it. The American Civil War and Reconstruction removed all appetite and bandwidth for meaningful foreign policy, triggering a shift to hard isolationism. Once the Americans finally had their (second) coming out party with the Spanish-American War in the 1890s, isolation gave way to a mercantile-driven dollar diplomacy where the Americans would fence off swathes of the world in a corporate-driven foreign policy designed to maximize American economic penetration. The Depression and World War I convinced Americans the world was no fun at all; isolationism came back into vogue.

The great upheavals of the World Wars left the US the pre-eminent power in every respect that matters. Over the course of fifty years, the Americans had gone from almost no navy, stealing Britain’s IP, and being a major global debtor to having the only navy, the technological edge, and to being an economic power on an unprecedented scale. The US had a choice: seek isolation once again and watch its only real competitor – the Soviets – slowly eat away at the periphery until they could challenge the US or find a way to take a ragtag group with long lists of mutual historical grievances a mile long and get them to work together. A real life Magnificent Seven.

The new idea was as straightforward as it was revolutionary: use America’s newfound and historically unprecedented economic power to pay all the previous competing powers of eras gone by to be on the same side. Any country that had any meaningful imperial presence could only do so if it also had a significant naval force. These empires’ clashes — over resources, populations and trade routes — were the root causes of nearly every significant military conflict of the entire industrial period, and they culminated into the First and Second World Wars.

In response, the Americans launched a broad system of what was collectively known as Bretton Woods, named after the location where the deals were first hammered out.

Bretton Woods provided global security for all the maritime and industrial powers, enabling all of them to access any resource anywhere at anytime safely, and then export finished goods to the American market. Bretton Woods puts all the world’s competing naval / maritime / trading powers on the same side by providing them with everything they had ever fought to attain. In exchange the Americans only demanded one thing: alliance against the Soviets.

All those purchased allies are all still powers of significance today, and it should come as no surprise that the most powerful of them now comprise the G7. All were represented at the G7 summit in Canada this past weekend.

The Bretton Woods strategy is notable in American diplomatic history in that it had no counterpoint. No other policy oscillated with it. Bretton Woods was both bipartisan and served as the norm for seven decades. But longevity and broad support are not the same thing as sustainability or permanence. The world is changed since the Cold War’s end, and now – belatedly and until now piecemeal – the Americans are finally changing with it. Trump’s foreign-policy beliefs are not a bug in the American system, they are a feature. Under Trump the Americans are firmly – finally – abandoning Bretton Woods, and in doing so flirting with all four of their pre-Bretton Woods foreign policies.

- Trump’s hardball on NAFTA is most definitely neo-imperial. He is attempting nothing less than the forcible change of the economic structure of America’s neighbors to meet specific American structural needs. Also fitting the mold is Trump’s suggestion that Russia be re-admitted to the G7. In a post-Bretton Woods world Russia is less a foe to be contained as it is a potential partner to leverage against other competitors.

- Trump’s position on Syria is flat out isolationist. As are many of his inklings on U.S. basing and strategic stances in Western Europe and East Asia. It isn’t as crazy as it sounds. Something that no one has ever been able to explain to me about American involvement in Syria is what-does-the-winner-get? And the idea that the Americans should defend the Europeans from Russia so that they can use Russian energy en masse has always been an awkward sale.

- Trump’s pending trade war with China has overtones of the anti-British policies of America’s early decades. And there are more than mere echoes of the general anti-British paranoia in Trump’s overall feelings about foreigners whether they be Chinese, Mexican, Iranian or Arab.

- Trump’s willingness to flirt with North Korea most certainly has a dollar diplomacy feel to it, and Trump has directed Commerce Secretary Wilbur Ross on a never-ending road-show for American goods… and linking potential sales to ongoing trade negotiations with, well, everyone.

Viewed through the prism of Bretton Woods all these goals and methods are inane. But viewed through the lens of anything other than the strategic environment for which Bretton Woods was designed, Bretton Woods itself is ridiculous.

It isn’t that these goals – or even methods – are good or bad. It is that they are different. It is that they better reflect America’s current situation than the Bretton Woods situation does. The Americans are done paying for alliance.

Courtesy of the G7 show this past Saturday, I think they get it now. I think America’s closest allies realize the shift in the White House is, indeed, real. I think they understand Trump is not bluffing. I think they’ve internalized that Trump’s rhetoric is the American position. I think they finally believe Bretton Woods will not magically regenerate when Trump is gone.

And that means it is high time for the allies to figure out where they fit into the scared new world that is tumbling open right in front of them. In this series we will go through the other six members of the Group of Seven. These are the powers that the Americans co-opted to make the Bretton Woods system work. They are the countries with the greatest long-term potential to shape and re-shape their worlds. Many may be out of practice, but that is far from saying they are done with history.

Part 2: France

French President Emmanuel Macron is a bit aggravated these days. He went out of his way to court a personal relationship with U.S. President Donald Trump with the belief that chumminess would enable him to tilt American policy decisions. Between the Iran nuclear deal, steel and aluminum tariffs, the Paris Climate Accords and now the G7 debacle, Macron has learned otherwise. Social lubricant in international politics can be important, but it rarely trumps policy and national interests. The Americans have shifted from an alliance-based to a transactional foreign policy, and a parade followed by a firm handshake and a nice dinner just isn’t strong enough currency.

So, atmospherics aside, let’s talk about the French strategic position.

The French think of the European Union as theirs, and with good reason. They are, after all, the people who made it. With the end of World War II the Austrians, Germans and Italians were occupied, the Low Countries were rebuilding from rubble, the Swedes and Swiss were neutral, the Spanish were languishing under a local despot, and all Central Europe was locked away on the other side of the Iron Curtain. The strategic competition that had dominated the past millennia of European history was on hiatus, and the French found it almost too easy to force their political will on a shattered continent. And so Paris pulled together Italy, Germany, the Netherlands, Belgium and Luxembourg to create the European Coal and Steel Community, which a dozen treaties later evolved into what we now know as the European Union.

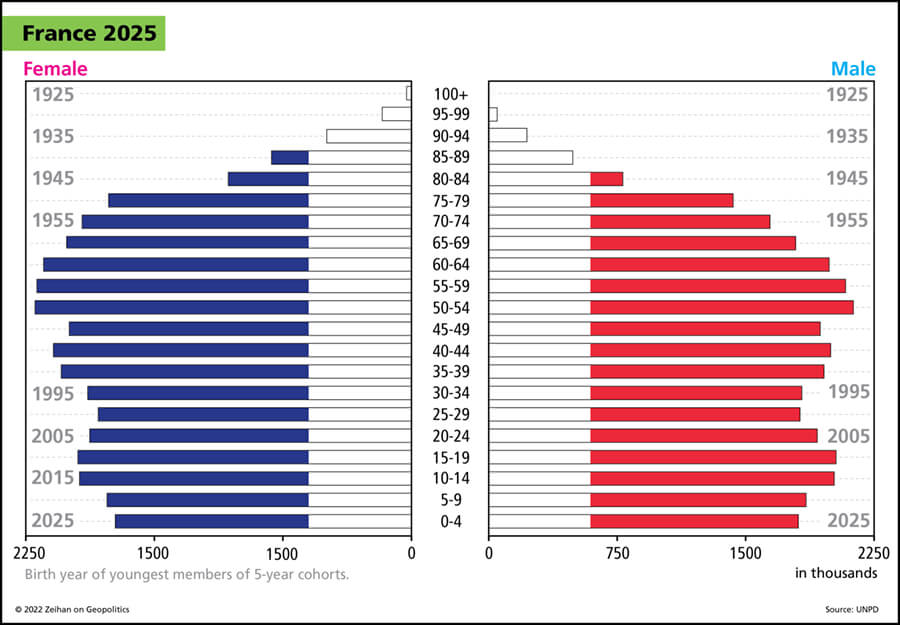

But for the French it was never about economics. The French metropolitan territories are rich. Phenomenally productive farmland. A wealth of inhabitable climate zones. Great rivers for industry and internal transport. A population far younger and aging far more slowly than the European norm. The French economy has always been held mostly in house, and the Cold War era was no exception.

France also boasts easy access to the North Sea, Atlantic Ocean and Mediterranean Sea, giving France – and France alone – fingers in every pot that matters to Europe. France’s position near the westernmost extreme of the European Peninsula even grants it good strategic depth, even if that “depth” belongs to other countries.

French strategic isolation freed up French defense planning to focus on the far horizon, as evidenced by France’s nuclear aircraft carrier and nuclear missile force. Nearly alone among the European states, the French do not need someone to defend them. It all means that the French didn’t really see a huge attraction to the Americans’ Bretton Woods plan.

The French know full well that should the Americans walk away from Bretton Woods, the global security that enables the European Union – which is at heart a union of exporters dependent upon global access – would no longer be possible. That obviously upsets Macron, but it doesn’t overly hurt France. Just as the Americans designed the world order for strategic reasons and so never lashed their economy to Bretton Woods, the French designed the EU for strategic reasons and so never lashed their economy to Europe.

Any global breakdown, even a European breakdown, is one that France can survive without the sort of catastrophic and transformative economic, political, cultural and strategic shocks that will so ravage almost everyone else.

France also faces no meaningful strategic challenges in the near- or mid-term. It is far enough away from Russia and Turkey to avoid complications from their expansions. Its position on refugees is so hostile that few try to go there. Its neighbors are militarily inept, demographically imploding, horrifically dependent upon America’s global trade and security strategy, or in most cases, all the above. In contrast, outside of the United States and the United Kingdom, it is the French who have the longest and most active history of engaging in military interventions. French forces are capable, experienced, professional, not at all in danger of rusting on the shelves, and when they go in, they go in hard – even in places such as Sub-Saharan Africa where the Yanks fear to tread.

That more or less dictates that in a world without the Americans running things, France is by far in the best position of any country on the planet (besides the United States itself) to chart an independent course. Macron isn’t hopscotching around the world (just) because he is a megalomaniac on an ego trip. He is doing it because he represents a waking superpower, because the world that is shaping up is a world in which France will shine, because he’s laying the foundation for France to once again be an imperial power.

No wonder Macron has been so combative with Donald Trump of late. Not only does his country have the most insulation from any meaningful trade conflict, his country is by far in the best position to do well should it all fall apart.

One of the beautiful things about having a strong national system with no international dependencies or exposures means that you can choose your battles rather than having them chosen for you. France will become a free actor at heart. That makes it somewhat difficult to suss out precisely what the French will go after, but there are three themes worth considering.

First, the French have to have a German strategy. The French have fought multiple wars with the Germans over the years and most of them… have not gone particularly well. The combination of Bretton Woods and the European Union enabled France to both defang the German military and harness the German economy to serve French strategic interests. It has been a happy time, but it is nearly over – which means Paris now needs to figure out a way to either re-harness Germany, point it firmly in another direction, or both. A rumbling Russia intent on re-securing its outer periphery before demographic collapse turns it into a brittle shell provides opportunities for both options simultaneously.

Second, the French need a Western Mediterranean strategy. As the only Northern European country with a Southern European foothold, the French have a unique capacity to leverage the capital, industrial and population densities of Northern Europe into a region that doesn’t have a whole lot of capital, industry or population. (France’s most important imperial territories were in the Mediterranean basin for good reason.)

There is a great deal more opportunity than danger for the French here. Italy and Spain and Portugal may be European, but projection-based powers they are not. With the EU on the ropes and likely soon to be gone from this world, France quickly becomes first among not-even-close-to equals and will be able to use its superior capacity to shoehorn the Southern European trio into any container it wishes. France already enjoys solid relations with Morocco and Tunisia, and while French-Algerian relations are reliably testy, in a post-American world Algiers will have no reliable partners aside from their former imperial overlords. Libya even presents an opportunity for a French state-building effort which, courtesy of Libyan oil, might even pay for itself.

Success in the first two strategies requires a third strategy: that of temporary alliance. There will be conflicts of interest constantly not only with Germany and Algeria, but with countries one step removed: the United Kingdom, Turkey, Egypt, Israel, the Netherlands, Sweden, Russia, even the United States. All will maintain capacity to get in France’s face, and yet all will prove to be tactical allies based on the issue of the moment. Securing such temporary alliances is a French national specialty, but a flair for dealmaking does not mean France will be able to leverage those positions into something greater.

Projecting power beyond your home region requires reach, access, insulation and strength. France has all of those, but only enough to dominate its front and back yard, and only then with a lot of back and forth. Moving into the Eastern Mediterranean or Sub-Saharan Africa or the Middle East, much less Asia or the Western Hemisphere requires a degree of spare capacity that France simply cannot generate unless it simplifies its neighborhood.

That could take many forms. Overcoming Algerian cantankerousness and successfully burying the hatchet would make the Western Med a French pond. An entente with merry ole London would lend itself naturally to co-dominion of the North Sea. A meaningful alliance with desperate Russia or neo-imperial Turkey would put Germany so firmly into a box that it would buy France a free hand in Western Europe. A (public) understanding with those neurotic Americans would go a very long way on everything.

But all these options require the French doing something they do not do well: act reliably and in good faith. That’s not how the French tend to function. France tilts the board. France switches sides. France abandons lost causes. France ditches allies. France extracts what it can when it can however it can because the French know they won’t be involved in any particular situation for long. France is a successful player because France is a player. As the French themselves say, “France has no enemies or allies, only interests.”

That switch-hitter mentality has served the French well for centuries, and continuing to follow the only-interests mantra will indeed enable France to reclaim its position as the first power of its region. But the constant back and forth prevents France from becoming more.

It is easy for a powerful, united nation to carve out a temporary sphere of influence in a time of global upheaval. But building something bigger, something that lasts, that requires a cleared board – and that is something that France cannot do unless it has a few allies who truly trust it.

Times of international chaos are wonderful opportunities to reset cultural norms. Emmanuel Macron’s rise to power shattered the traditional French political elite, making this an opportune time to change the French mindset on what the word “alliance” means. Let’s see what he does with it

Part 3: Germany

You may have noticed, but the Germans lost the world wars. Ever wonder why? The obvious answer is they started a two-front war, but the truth is more basic.

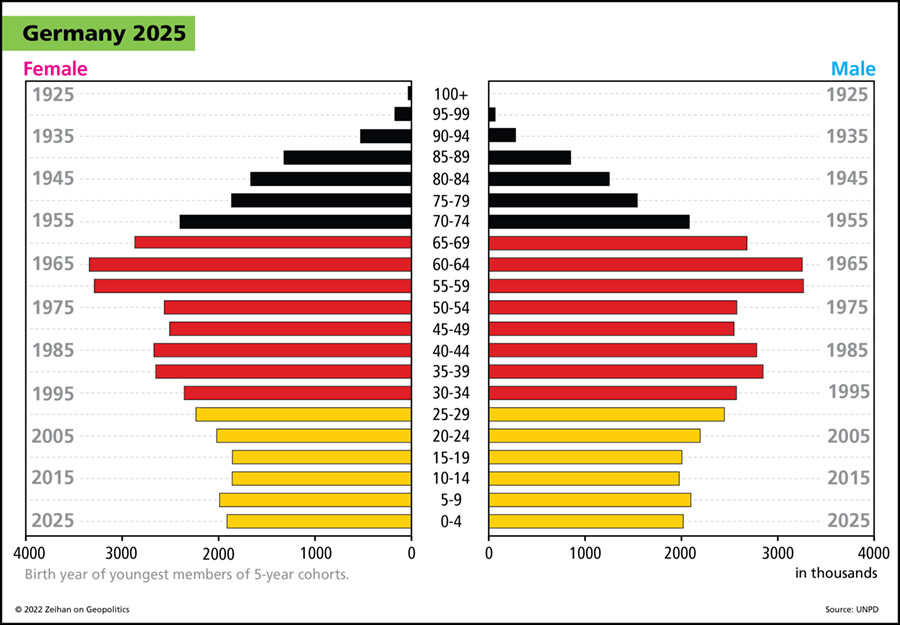

Germany sits in the middle of the Northern European Plain (NEP), a stretch of flat, arable, temperate, well-watered, densely-rivered territory that comprises most of the rich parts of Europe. It is a great place to craft a successful ethnicity, polity, economy and state. With one exception: Germany sits in the middle of a plain. Germany doesn’t have much in terms of defensible borders.

As big as Germany is, the Germans will never enjoy a quantitative advantage over their collective competitors so their only option is to be better at, well, everything: infrastructure, education, planning, financing, manufacturing, and so on.

But there are no secrets in Europe. The high productive capacity of European farmland means the whole region was the first in the world to urbanize. Combine a dense population footprint with an agriculturally rich zone like the NEP, and French cities and Dutch cities and Polish cities and Danish cities are so close to German cities that everyone’s noses are perennially in everyone else’s business. Germany cannot hide how good they are. Make anything as big as Germany as efficient as Germany and its mere existence is interpreted by everyone as an existential threat, prompting a pan-European alliance that tears it down.

Germany can deal with this in two ways. Option one is to hope against hope that no one will come for it in the night. Every time that do-nothing strategy has been chosen, Germany eventually suffers cataclysmic defeat and dismemberment. Option two is to attack first, trying to defeat its rivals in sequence before they can overwhelm Germany. Every time that strategy has been chosen, Germany eventually suffers cataclysmic defeat and dismemberment.

Unfortunately for the Germans, they live in a geography that actively discriminates against successful long-lived countries.

But the post-World War II world is different from what came before. In the bad ole days the imperial powers (Germany included) duked it out in a more or less continuous march of often-multisided wars. Trade among the empires was kept deliberately curtailed because trade with today’s friend could quickly devolve into dependency upon tomorrow’s enemy. Germany’s perennial quest for superior quality was harnessed for military purposes, and the Germans kicked some serious ass. From unification in 1871 on, the Germans inflicted triple or more the casualties on their foes than were inflicted upon them. The marrying of such a deliberately fractured international system to the rising industrial technologies to Germany’s penchant for perfection brought us to the inevitable horrors of World War II.

At war’s end the Americans bribed all the expeditionary powers – wartime allies like the United Kingdom and France and wartime foes such as Japan and Germany – to be part of its Bretton Woods alliance. The rivals who had caused the war were now clustered under American strategic leadership. The most successful of those powers were those able to refabricate their systems to fully take advantage of a world of open borders, of a world where the Americans provided free security for all, of a world where all the expeditionary powers were aligned, of a world where trade wasn’t something to fear, but something to embrace.

No one did it better than Germany.

Because Germany was defeated, the Germans had the advantage of a clean slate. The ancien régime wasn’t simply removed, it was executed. The allies imposed a new constitution (the Germans know it as the Basic Law) which established a number of legal roadblocks to keep extremist parties away from decision-making power.

But the real transformation was in German industry. After centuries of treating the German military as its first and most important customer, having the option of investing in, well, Germany, was a bit of a treat. Germany’s penchant for efficiency and organization was no longer directed to service the needs of the SS or the Wehrmacht but instead using the best technologies of the day to rebuild a country from scratch. Energy shortages became a thing of the past. The result was one of the fastest stretches of economic growth in world history. (Note: We are talking about West Germany here. Soviet-dominated East Germany was a hot mess.)

As West Germany-the-country was rebuilt, it was only one small step to West Germany-the-export-machine. Germany’s position in the middle of the Northern European Meat Grinder meant Germans had long been used to deferred gratification. Their savings tended to get funneled not into personal consumption, but instead into state-centric investment plans that typically had at least a heavy dusting of military purpose. But with the Nazi regime gone and the rebuilding largely completed, Germany’s (in)famous efficiencies were no longer applied to tanks or planes or rail lines or smokestacks, but instead to export goods such as automobiles and chemicals. West German exports were highly sought after the world over, largely because they were the highest quality goods humans had ever produced.

When the Cold War came to an end, the Germans advanced from what had been the greatest era of its existence to something even better. The two Germanies reunited. Germany gained access to a dozen new oil suppliers. The former Soviet satellites to Germany’s east and southeast all joined NATO and the EU. Instead of being a front-line state, Germany was now surrounded by allies and partners who were all members of the American-secured global structure. Defense spending plummeted with the savings poured into making Germany an industrial behemoth.

Simultaneously, the rise of the euro fused the European space together under German economic leadership. Even the weakness of some of the euro’s members – most notably Italy – helped Germany. With Germany in the same currency zone as moribund economies, the price of the Euro was weaker than a purely German currency would have been. German exports no longer merely competed on quality, but also cost. A second Golden Age dawned.

It was too good to last. Since 1992 the Americans have been pulling away from maintaining the global order that is so central to German peace, success, wealth and unity.

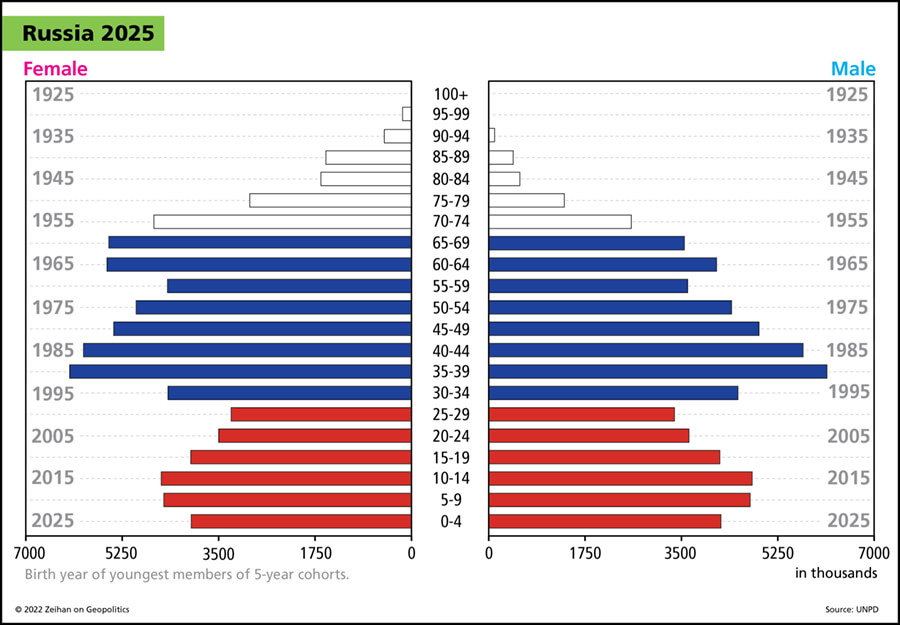

The first hot point for the Germans in this scared new world involves the Russians. The whole idea of Bretton Woods was to fence in the Russians. If the Americans walk away from Bretton Woods, Russia is not only no longer the bugaboo, it becomes a potential partner in a never-ending multi-sided balance of power game. And nearly anytime anyone has thought of the Russians as a partner, a bit of a scrap has eventually ensued between Moscow and Berlin.

The second point involves Europe. The European Union is able to exist because the United States keeps the European countries safe from both outside powers and one another. Germany is the EU’s economic heart and Germany is an export-oriented economy, which makes every other EU state integrated into German supply chains export-dependent systems as well. Remove American security overwatch and the whole thing comes crashing down (assuming other European issues such as the euro, sovereign debt, bad banks, terminal demographics, refugees, and so on don’t tear the Union down first).

It should come as no surprise that German Chancellor Angela Merkel’s dominant emotional state these days seems to be exasperated resignation, and why the key word from her post-G7 summit communications was “depressing.” There is absolutely no way forward here that works out well for Berlin.

But inaction is not an option, and so Germany once again faces the inevitable clash between strength and fear. The Germans under the Bretton Woods regime were able to have global economic reach without corresponding military reach. Strip away that feature, and the Germans either need to massively deindustrialize so that their economy matches their current military power, or they need to massively re-arm so that their military can sustain their current economic power. In times past the first option generated the 30 Years War, the Great Depression, and the near collapse of European civilization. In times past the second option generated the Nazis, the World Wars… and the near collapse of European civilization.

Which is a roundabout way of me saying that I think the Germans will end up trying something a bit different. They don’t currently have the military required to look after their own interests, and they don’t have an economy that is sustainable without someone powerful looking out for them. What they do have is a few neighbors who find themselves in hauntingly similar situations, many of which are also tied into pre-existing and most certainly non-military German manufacturing supply chains.

Courtesy of Bretton Woods, NATO, the Soviet collapse and the euro, there is an arc of countries that have broadly the same top-level concerns as Berlin: a crumbling European system, a supply chain model dependent upon extra-European end consumption, a concern about large-scale refugee movements, a shortage of local energy resources, and above all a resurgent Russia.

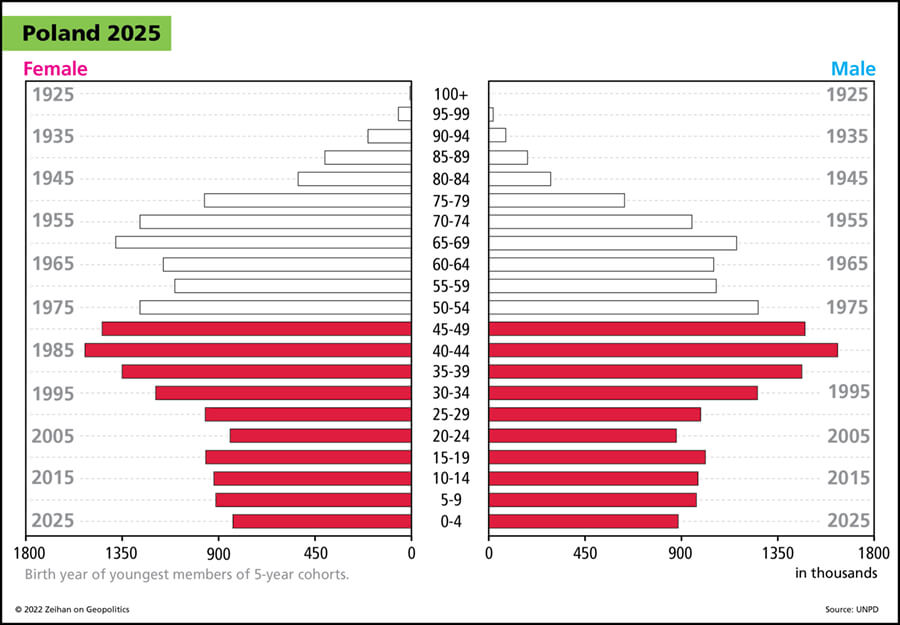

- Poland, the Czech Republic, Hungary, Slovakia check all the above.

- Estonia, Latvia, Lithuania, Sweden, Finland and Denmark check all but the supply chain issue.

- Belgium, the Netherlands, and Austria check all but the Russia issue.

The first two bullets suggest a Germanocentric NATO in miniature. The latter two bullets suggest a Germanocentric EU in miniature (perhaps selling military goods to the Germanocentric NATO?).

Neither is likely to last the test of time. Russia’s demographics are so horrid that it is unlikely to be a long-term problem and nothing kills an alliance like the lack of an enemy. Any revised supply chain system still needs a market, and once war-related demand fades, what then? And a Germanocentric system of any type is certain to attract the gentle crowbars of the French, British, Russian and Turkish diplomatic services within minutes of getting going. Compared to the long dark of Germany’s past, the possibility — however impermanent — of a third way between near-pacifism and a raging war machine is a surprisingly upbeat future. Merkel has presided over the best years in German history. What’s in front of her with a bit of luck just might be brighter than the German norm.

Part 4: The UK

The United Kingdom has been the United States’ firmest and most capable ally for over a half century. As such many often think of the British Prime Minster as a sort of Washington Whisperer. The Brits, so the thinking goes, are a civilized people who can bring the oftentimes erratic Americans around to a saner course of action.

As one of the United Kingdom’s great statesmen, Winston Churchill, famously put it: “You can always count upon the Americans to do the right thing… after trying everything else.” The quote is as much an homage to the immense power of the United States, as it is to the trademark patience, dry humor and stiff upper lip of the English.

And so it is with no surprise that many world leaders have called upon British Prime Minister Theresa May to intervene on humanity’s account with U.S. President Donald Trump. But it is no surprise to me that she has done nothing of the sort. Nor will she. It is all wrapped up in why the United Kingdom is a major power in the first place.

The United Kingdom matters not simply because Great Britain is an island, or because the Kingdom has the naval power to defend its island, but because the Kingdom has sufficient naval strength to project power well beyond its island. That enables the Brits to pick the time and place of the conflicts they choose to engage in. Even if they choose poorly, they can always pack up, sail away and try again later. Clashes that leave most in ruin at most force an early election in the Kingdom.

There are only two things that could undo this strength. First, the United Kingdom’s flexible strength could be overwhelmed by a more powerful navy. Since the only Atlantic Ocean navy that is more powerful is the American Navy, this is a low risk. Second, the United Kingdom could for whatever reason find its navy degraded to the point that it can no longer project power. And that is precisely the challenge facing the United Kingdom today.

Ironically, painfully, the UK’s current naval weakness comes directly from an attempt to generate strength.

It is difficult for any student of global strategy who is not willingly blind to ignore the role played by the American supercarriers. The Nimitz class carriers are not simply the largest combatants ever floated, as a rule they pack at least seven times the combat capabilities of any rival naval vessel – including the largest carriers floated by other countries. The Nimitz ships have enabled the Americans to project power not just anywhere on any ocean or coast, but in most cases several hundred miles inland as well. Without nuclear weapons they are the most powerful conventional weapons systems any country has ever fielded, and just one of them if nuclear-armed has more firepower than the entire military of France. (No, that is not a France slam. The supers are simply that cool.) The Americans have ten of them. The combined rest of the world? Zero.

So long as the Nimitz carriers (or their soon-to-be successors in the Ford class) are the top shelf of military capacity, anyone seeking to oppose the Americans has to find a way to push the Americans at least a thousand miles away from shore (ergo why the Chinese are so heavily invested into long range anti-ship missiles). And should any naval power seek to ally with the Americans, they will always be entirely in the shadow of the massive, raw American power that the Nimitz ships provide. So long as the Americans are the only people with fully-operational supercarriers, no one but the Americans gets a vote as to how the Americans and their allies perform global strategic policy – even if you are one of the allies.

There are a lot of non-blind students of global strategy in the United Kingdom, and about two decades ago they all came to the same conclusion: if the UK is to matter at all, we must have our own supercarrier. And since, like any other vessel, ongoing refits are part of the process, we must have at least two. The end result was the launching of the Queen Elizabeth carrier program. Weighing in at 65,000 tons displacement they will be the largest combat ships ever floated with the notable exceptions of their inspirations: America’s Nimitz and Ford classes. Fully operational, they will give the Brits exactly what they are after: a seat at a table for two, the only table that matters. When the first ship of the new class started sea trials in December 2017, a veritable army of bubbly erupted at Whitehall.

Just one problem. The Brits screwed it up a little bit.

Maintaining weapons development systems over multiple decades and multiple administrations is difficult. In the time since the plans for the Queen Elizabeth class were first floated, the Brits have had a dozen elections and five prime ministers (and unless my political tea-leaf reading has gone completely off the rails, they’ll have a sixth before long). With each change of leadership there is a change in priorities, and oftentimes life rudely intervenes. Financial crises of the Asian, European and global kind have competed with the British Navy for resources. The Iraq War, the Afghan War and the Libyan intervention ruthlessly pulled British defense prerogatives away from the sea and towards land. The Joint Strike Fighter development program has gone egregiously, criminally, hilariously over budget.

At each step the Queen Elizabeth carrier program had to re-justify itself and fight for funding anew. In the process the Brits found themselves forced to mothball their existing jump carrier fleet in total in order to funnel resources to the new supercarriers’ construction effort. The Brits had to transfer their navy aircraft, pilots and flight crews to the U.S. Navy in order to maintain any hint of naval aviation capacity. And now, with Brexit looming, they’re having to slim the rest of the naval force to keep their supercarrier program on track.

Which means the Brits no longer have sufficient ships to protect their new supers once they are fully operational.

Carriers are not just massive and massively capable combatants, they also represent years if not decades of investment into equipment and personnel, and while they cannot be sunk easily, sunk they most certainly can be. As such every carrier is but the nucleus of a battle group, with all the other vessels’ primary purpose to ensure the carrier does not sink. The British Navy has atrophied so much for so long that it can no longer assemble two credible battlegroups and still defend Great Britain itself.

For the Queen Elizabeths’ deployments, this is nothing short of a Charlie Foxtrot. The new British supercarriers dare not venture further away from shore than the reach of British air power, whether that air power be launched from the United Kingdom itself or from the territory of a trusted ally. Support ships can certainly be built up more quickly (and cheaply) than the supercarriers themselves, but ships don’t grow on trees. This will be the state of the British Navy for at least a decade. Probably two.

This presents London – the naval power par excellence of earlier eras – with a galling choice:

- Abandon all hope of ever projecting power, and treat its shiny new supercarriers as the same sort of idiotic chest-beating paperweights the old Soviet “carrier” was,

- Fold its supercarriers into the Americans’ battle groups and de facto merge with the United States on all strategic policy… and hope against experience, culture and hope itself that the Americans will listen to your strategic opinions because you contributed a couple big boats.

The decision has already been made. The Brits know better than to fly solo, and they certainly know better than to fly solo against the Americans. The key memory is the 1956 Suez Crisis.

At that time the Brits were certain when the Americans said under the Bretton Woods system all the empires would be disbanded, that it didn’t apply to the British Empire. The British assault on Egypt inadvertently forced the Americans to choose between maintaining the British Empire and their own new global order. It wasn’t a hard choice. The result was strategic castration – with the Americans using all their ample political, financial and military strength to force the United Kingdom into a permanent, subservient position within the alliance that has lasted ever since.

To underline how annoyed the Americans were, they also forced the Brits to stick to the letter of the deals signed to support the United Kingdom against Nazi Germany in the early days of World War II before the Americans themselves were involved. The terms of such loans were so onerous that the Brits didn’t finish paying them off until the 2000s.

And so the Brits have no choice but to stiffen that lip and march forward into the very much known.

- They will seek a direct bilateral trade deal with the Americans in order to replace the European Union at the core of their economic strategy. It may have fewer regulations, but it won’t enable the United Kingdom to be as wealthy as they have been, and the Americans will offer few concessions because the Brits are economically and strategically without options.

- They will surrender the financial centrality of London to New York City either as part of the trade negotiations in the hopes they can glean a few concessions on other topics, or because without a firm Brexit deal the financial sector will up and leave London anyway.

- Should the Trump administration manage to extract a final NAFTA deal from the chaos of the current negotiations, the Brits will grudgingly sign on knowing full well that direct competition from Mexico will do to the United Kingdom what Team Trump says Mexico has done to the United States. The alternative is to be a forgotten side deal only tenuously linked to the American market.

- And no matter what military adventure the Americans go on, the Brits will be there. They know better than anyone it is far better to be in the Americans’ shadow than in the Americans’ way.

Put simply: what Trump wants, Trump gets. It’s that simple, because if the goal is security and stability for the British people, there is no other option. This might sound humbling, horrible even. But it really is not. So the Brits don’t matter strategically on their own. They are still safe. They are still wealthy. With the world crumbling down there are worse sides of history to be on than being an adjunct to the Americans. And isn’t it the fate – if perhaps not the goal – of most parents to eventually move in with the kids?

Part 5: Italy

In any discussion of foreign affairs the same list of powerful countries have been bubbling up for decades, if not centuries. The order often shifts, but the countries themselves tend to hold on: the United States, Russia (aka the USSR), Japan, the United Kingdom (aka the British Empire), France, Germany (aka Prussia). There’s also a secondary list of largely regional powers: Iran, Turkey, India, Mexico, Brazil, Argentina and Sweden. Israel, Korea and Pakistan are relative newcomers to the second list while China has graduated from the latter list to the former.

One country that most don’t spare thoughts for, however, has been one of the world’s top ten economies ever since humanity developed sufficient command of statistics to come up with the list in the first place. That country is Italy, and it is about to crash back into the world as a significant player.

But first, it has to…crash. Hard.

Contemporary Italy is beyond dysfunctional.

- The country is flat out broke — only Japan and Greece have national debts that are higher in relative terms.

- Its banking sector is arguably the most overextended in the world, with a relative weight of bad loans that is eighty times that of the United States at the height of the subprime crisis.

- Unemployment is at a level that would spawn riots in the United States.

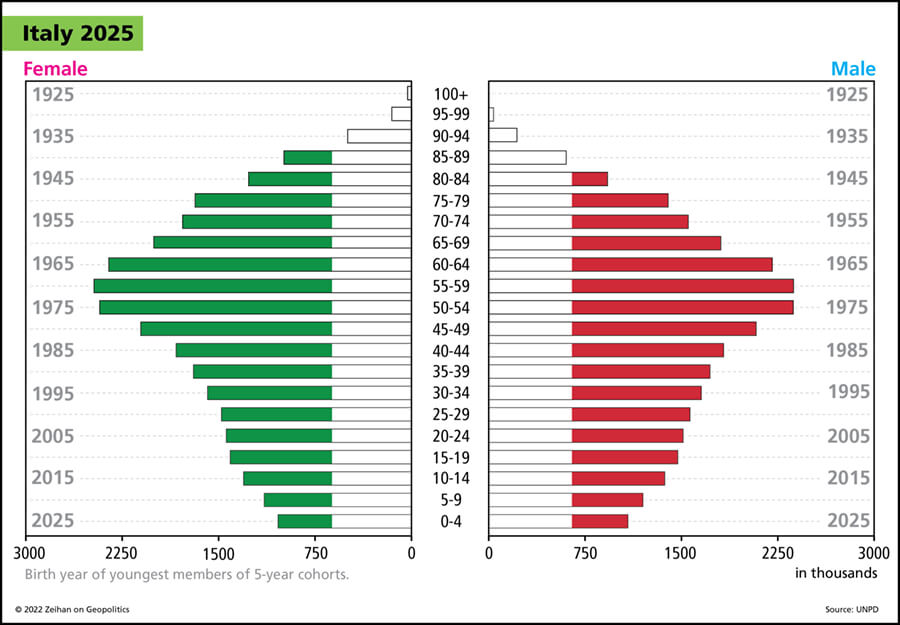

- The birthrate collapsed thirty years ago and never recovered. Its population is one of the ten most rapidly aging on the planet, and already well past the point of meaningful recovery.

- The country’s current pension overhang is already among the worst in the world, and that before the Italian Baby Boomer generation even begins to retire.

- Italy suffered greatly during the European financial crisis and its economy hasn’t seen appreciable growth since 1998.

- Citizen trust in government is so low as to barely register in opinion polls.

And the political situation is an utter circus, complete with actual clowns or, more accurately, a populist comedian but you get the idea. The Italian equivalent of the Republicans and the Democrats have been gutted to the point of extinction, being displaced by an alliance that could only happen in Italy: a pair of parties that most closely resemble Texan secessionists (the Northern League) and Bernie Sanders…if Bernie Sanders was a career comedian who used a lot of racist jokes and opened rallies with the song “America-F*** Yeah” (the Five Star Movement).

What’s the way forward here? There isn’t one, except national collapse. Italy as a modern political economy is already over. The only reason it has not passed into history already is that it is lashed into the European Union. There are many structural issues embedded within the European system that could bring the entire edifice down. The United States withdrawing from the global order is one. The death of Italy is another. Weighing in at over $2 trillion dollars, the Italian system isn’t too big to fail — it is too big to save.

But from the rot of the current system, from the end of a Europe that is united and free, something new is about to arrive. Or perhaps it is more accurate to say that something old is about to return.

The Italian core territory is unlike anything else in the world. The Po Valley is a rich land with a perfect climate nearly encapsulated by some of the world’s most rugged mountains. The Po’s entire northern horizon are the European Alps. Even with today’s technology and centuries of infrastructure building in what was until very recently the world’s richest continent, the Alps still remain a massive barrier to communication, much less armored columns. To the south the Apennine Mountains of the Apennine Peninsula are certainly less imposing, but the utter lack of large chunks of flat land (and the fact that southern Italy is a peninsula of peninsulas) make it both a non-challenge to the economic and political supremacy of the Po as well as an at best imperfect invasion route.

In the Po’s near neighborhood there are no meaningful threats. To the north — across the Alps — are Switzerland and Austria, a Germanic pair of countries far more concerned with issues on the Northern European Plain than in the Po. To the east are the minor and often failed states of the Western and Southern Balkans: Slovenia, Croatia, Bosnia, Serbia, Montenegro, Macedonia, Kosovo and Greece. None of which — individually or in concert — can hold a candle to Italy’s economic heft, and none of which — individually or in concert — pose even a modicum of a security threat. (If anything, their bickering chaos provides Italians with a massive strategic buffer.) To the south across the Mediterranean is Northern Africa, a region that has not posed a meaningful danger to Southern Europe since Christopher Columbus was a teenager.

That just leaves its western neighbor, France. The Italians may have some differences of opinions with the French, but since the Franco-Italian border is a chunk of the Alps and the Po’s window on the world lies far to France’s east via the Adriatic, it is rare for the pair to butt heads. Add in a moderate sized navy of moderate skill — which the Italians have — and the Po is if anything more secure than the United Kingdom.

And that’s how we must think of the Po — as an island. Separate from Europe, separate even from the rest of Italy. Within that distinction lies the Italians’ future.

In the world before World War II the Po Valley was one of, and at many times the, economic powerhouse of the both Europe and the Greater Mediterranean. Its physical separation and inviolability made it the logical location to broker deals, to install infrastructure central to the economic health of the broader region, and to serve as trade middlemen for everything that mattered.

Part of the attraction of the Americans’ installation of a global security order was that geography mattered less, so countries with often-compromised geographies could shine — in many cases for the first time. For the Po Italians whose geography was their ticket to centrality and wealth, this sort of sucked. Had they not been on the wrong side during the war and not already been issued an opinion on the matter, they may well have sat out membership.

As the Bretton Woods order expanded, as the European Continent unified under the aegis of the European Union, as stability spread, what made the Po special became less so. Italy as a whole saw its position slide. With the end of the Cold War the Po is little more than a rich backwater. Italy as a whole hasn’t seen meaningful economic growth in nearly two decades, and its end is nigh.

But Trump’s actions at the G7 indicate that the system that has so enriched the rest of the world and so stabilized Europe — in part at Italy’s expense — is at its end. Remove global stability, remove the European Union and NATO, break the supply chains that supply the global system with everything from cars to crude, and all of a sudden the Po’s island-but-not-an-island geography combined with its relative centrality makes it the place to be.

So what kind of place will the Po become? What does it have to offer?

First, a step back to frame the discussion:

Just as the Po Valley and “Italy” are not the same thing, the Po Valley itself isn’t one place. The cities of Northern Italy in many cases have identities and histories just as distinct from one another as full-blown European countries. Verona, Trento, Parma, Bologna, Milan, Venice, Turin, and Genoa were all independent players from the fall of the Roman Empire right up until Italian Unification in the 1870s. That means they only rarely act as a unit, and the emphasis of all things Italian has always been on diversification and differentiation.

In the world of energy it means the Italians maintain one of the most varied set of refineries in the world, able to take in any crude stream and process it into any end product. Today Italy boasts roughly double the refining capacity they need. Toss in the sort of economic adjustment that comes from state collapse and dollar to donuts the Italians’ surplus capacity will soon make them the largest source of available refined product within three thousand miles in a world where energy security for most is a long-faded dream.

In the world of manufacturing it means the Italians make things a bit differently. For Italians wares are not about assembly lines or efficiency — that requires economies of scale and integration. The Italian cities compete with one another instead. They don’t share. They keep all the steps in house, so it is all about expression and perfection. The sort of long, gangly, multinational supply chains that can only survive in a world of stability and global market access are not the sort of things Italians do well. Think Fiat. So instead of mass producing serviceable items, the Italians hand-craft products that could easily be mistaken as art. Think Lamborghini and Versace. That sort of “manufacturing” does just fine when the world falls apart.

The problem with this machinery-as-art model is labor. It literally takes a lifetime to train a Ferrari craftsman. It is something the new manufacturing techniques that are sweeping the American industrial space cannot integrate into. The Italians don’t hate immigrants for simply the standard religious, ethnic and economic reasons, but also because immigrants simply cannot help with the problem the Po faces.

Nor is this new. Nor is it constrained to outsiders.

The Po Valley versus Italy’s south is a study of polar opposites; the Po’s sophistication and productivity contrasts sharply with the statist rot, civil breakdown, organized crime, and poverty of the South. Between unification and 1940, southern Italians moved en masse to work in northern factories. This was at a time when Northern Italian sentiments toward many in Southern Italy was racist in a generous sense. Even Mussolini’s son-in-law is said to have privately mused that perhaps it would have been better to be born a Jew than a Sicilian in Fascist Italy (against the backdrop of the Holocaust, no less). Today, the south’s population is smaller, older and sicker relative to the north than ever before. It is already on the ragged edge of failed statedom, and northerners fear southern in-migration nearly as much as they resist boatloads of migrants from Africa.

Northern Italy doesn’t need Southern Italy for anything in the traditional sense: labor, market, capital, technology, food, even strategic depth. What the Po does need is free access to the Mediterranean for oil inflows and trade outflows (and perhaps the refineries that dot the southern coastlines). It needs Southern Italy to be in a box that also contains the Southern Italians and blocks would-be migrants from the world beyond. It needs to be able to treat the south as an occupied territory.

There’s really only one governing system that can fit that bill: Fascist. Again, this isn’t new. Fascism was well established in Italy a decade before Adolf Hitler’s rise to power in Germany for much of the same reasons.

Assuming the Italians of the Po can constrain and contain the Italians of the south, there is little need to venture further out. The Po will again become the lynchpin between the Middle East and Africa on one side, and Europe on the other. The Italians’ very lack of strategic ambition makes them the perfect middleman. About the only weakness in such a system is ensuring sufficient inflows of crude so that Italy can be a large refining center. There’s nothing new here either: The Northern Italian cities have been brokering deals with whoever controls the Eastern Mediterranean for the commodities of the day for over a millennium.

To paraphrase an old European saying: Italy is dead. Long live Italy.

Part 6: Japan

Japan was a latecomer to the modern world.

The Home Islands are rugged territory with few chunks of flat land that can play home to the sort of agricultural infrastructure from which most cultures rise. Geography made transport between these little pockets of land treacherous and rare. Combined with a dearth of local resources much of Japanese history right up until the industrial age was flat out feudal. Local leaders would rise and fall based upon local politics and dynastic struggles. Family was everything. The odd imperial impulse towards unification did occur, but typically the emperor’s powers were of the limited sort. Most competitions had a distinctively local feel. Hell, most names had a distinctively local feel. Most Japanese commoners didn’t have last names until after 1868.

The islands’ distance from the Asian mainland combined with China and Korea’s brand of insular chaos layered on more locality; aside from pirate raids, Japanese interaction with the mainland was at most episodic. Foreign ideas, culture, technology and norms were a world away. Life was slow. While the Germans and Americans and Brits and French and others were using (early) industrial volumes of steel in railroads and stoves and weapons in the first half of the nineteenth century, pre-industrial Japan’s steel use was pretty much constrained to a handful of implements and those famous samurai swords.

But then the Americans arrived.

Admiral Matthew Perry’s flotilla of hybrid sailing-steam ships likely comprised more steel than had been produced by all Japanese in the previous decade. The world realized Japan wasn’t some mystical kingdom, but instead a hugely, hilariously, outdated backwater. The tsunami of American trade – and the new technologies that came with it – surged across Japan, wiping away and transforming the country’s entire political, social, cultural and economic system in what is arguably the most holistic transformation in modern history. It wasn’t an entirely pleasant experience, including as it did the greatest industrial buildup in history, regional civil wars, a class-based genocide, a massive imperial expansion, and a fascist rise to power,

It happened so quickly that Japanese cultural mores couldn’t possibly keep up.

The Japanese thought of their enclavic geography as granting them infinite variety, but when exposed to the kaleidoscope of the wider world they realized just how uniform Japanese culture was. The Home Islands’ isolation sharply limited contact with the wider world; the Japanese are nearly homogenized racially, not just compared to multi-ethnic America but even to rather monochromatic places like Vietnam or Korea.

The sudden exposure encouraged some significant rank-closing, further deepening Japan’s cultural monolith. And since the consolidation occurred during a time of rapid economic development and technological advancement, cultural unity became synonymous with the ideals of Japanese superiority and invincibility.

Cross that cultural tweak with Japan’s geography and East Asia got something new… and dangerous. For Japan wasn’t simply a unified nation, it was a unified island nation – and islands have navies. Industrial prowess, an industrialized navy, a culture bordering on the wrong side of haughty with a burning desire to show its neighborhood just how invincible and superior it really is… you can see where this is going.

Japan’s participation in the Second World War resulted in the imposition of a regional brutality that while not as industrialized as Germany’s Holocaust, was more pervasive through the Japanese armed forces. More casual in its application.

The combination of cultural arrogance and the reach of an industrial navy inevitably brought the Japanese into sharp conflict with the Americans, who eventually rolled the Japanese all the way back to the Home Islands. The post-WWII settlements were crushing – Japan lost absolutely everything from over a generation of imperial expansion. That made sense to the Japanese. They had lost the war so they lost territory.

But the post-WWII order the Americans imposed was downright bizarre from the Japanese point of view. Through the Bretton Woods system, the Americans offered the Japanese everything they had fought for for decades: access to global resources and global markets. In addition, the Americans offered to protect the Japanese from all threats. In exchange all the Americans asked for was that the Japanese join an alliance expressly designed to combat a country that the Japanese had crossed swords with three times in the past half century. Confusion reigned, but the Japanese know a good deal when they see it. They signed up for Bretton Woods eagerly.

The American occupation continued with the now-familiar Japanese tradition of root-and-branch overhaul. The emperor was stripped of everything except his clothes. Democracy was imposed. Bombed out cities – three of which were little more than cinders – were rebuilt from the ground up. The Americans used Japan as a launching pad for their military operations, first in Korea and later in Vietnam. By the early 1960s, Japan had recovered and was humming along nicely.

And then the changes… stopped.

Sure, the newest technologies were still layered into the Japanese system as soon as they were developed, sure booms and recessions came and went, but there were no wars. No political revolutions. No jarring cultural upheavals. No coups. No invasions – either by Japan or of Japan. No shocks – internal or external.

For the next fifty years.

After a century of shock and reinvention and revolution and war and pain, Japan simply was allowed to… be. In a way, time stopped. In a way, Japan walled itself off from the world again. In a way, the average Japanese citizen’s interactions with the world ended.

In a way Japan’s cloistered narcissism returned.

Now the Americans are backing away from it all. All at once the Japanese are discovering the global structures which enabled them to be wealthy while also being isolated are evaporating. That there isn’t a thing Japan can do to preserve the world order. That very soon they will have to choose between wealth and isolation. Considering that one involves high living standards, electricity and full bellies, I’m pretty sure I know which they’ll go for.

But East Asia isn’t as simple a place for the Japanese in 2018 as it was in 1928, because the Japanese were not the only Asian peoples the Americans brought into Bretton Woods.

Taiwan too came in early, and became nearly as technologically sophisticated as Japan. Access to global markets combined with American military protection transformed backwards, poor, wrecked Korea into an industrial powerhouse. Richard Nixon and Jimmy Carter brought mainland China into the fold, starting Beijing on the path to the colossus it would become.

With the Americans leaving, Japan finds itself in a struggle to be Asia’s first power. Unlike in 1928 when Japan was industrial and the rest of Asia undeveloped, the whole East Asian rim is overflowing with industrial might. No longer is Japan towering above the rest.

But that hardly means Japan is going to lose. All Japan’s perceived vulnerabilities are real, but in all cases those same vulnerabilities apply to all its East Asian neighbors – where they are all far more serious.

- All the East Asian powers face a dependency upon foreign markets, but Japan has long since offloaded its production capacity to be on the safe side of currency and political risk. Its trade exposure is less than a third relative to its economic size of any of its neighbors.

- All the East Asian powers have horrid demographics, but Japan mastered automation over a decade ago and has been steadily modifying its industrial base to operate in a world of constrained supply chains ever since. As a percent of GDP, Japan’s vulnerability to disruption is a shadow of everyone else’s.

- All the East Asians face cultural difficulties in dealing with other countries, and Japan has utterly failed to collaborate with its neighbors as equals. Yet far from weakening Japan this exclusionary attitude has forced the Japanese to find economic and technological means around immigration. For example, a refusal to admit foreign health workers has lead to the rapid rise of automation and AI in geriatric care. This not only generates positive knock-on effects throughout the Japanese economy, it keeps a large chunk of the Japanese economic system in-house and utterly immune to the ebbs and flows of the international environment.

- All the East Asian powers are hugely dependent upon oil imports, but Japan sits on the outside of the island chain that constrains Asian mainland access to the world. Japan also has a long-reach navy that can go almost anywhere in the world without encumbrance.

- All the East Asian powers are poor in any sort of electrical input fuel whether it be high-quality coal, natural gas, or uranium. Not only does Japan’s geographic position enable easy access to diversified sourcing, but Japan’s overbuilt power system enables it to fuel switch with a few days’ notice to whatever imported inputs Tokyo can scrounge up. (For those Greens out there, East Asia has pathetically low wind and solar potential too.)

Will Japan have to fight? Certainly. But it is a fight Japan is well suited for.

My concerns are twofold.

First, part of what made the Asian theaters of the Second World War so nasty was the norms of cultural and racial superiority that emerged from Japan in the pre-war decades. While democratic Japan today is a far cry from the imperial fascism of the 1930s, the Bretton Woods system has certainly enabled pieces of the old cultural milieu to re-entrench. The sort of culturally isolated Japan that exists today, combined with a technologically advanced navy, and a need to use that navy to achieve national prerogatives feels uncomfortably familiar.

Break the global system and it is devilishly easy to imagine an East Asia where the Japanese are not simply on the warpath (again), but one where the Japanese are less than gentle with countries who disagree with them. Most focus on the likelihood of Chinese aggression throughout the region. I think that’s a bad reading of East Asia’s geographic, industrial, trade, and historical characteristics – both past and present.

Second, is the issue of “what then?” I typically try to limit my forecasts to the next couple of decades. Past that range, changes in demography and politics and culture and technology tend to layer in a lot of future fog that limits data-and-geography-fueled forecasting to little more than armchair prognosticating. But if the Japanese have the deck so stacked in their favor, I believe it is useful to push a bit further forward and guess at what’s just over the horizon. What happens after the Japanese have re-established some version of a mercantilist colonial relationship with their region, an Asian Co-Prosperity Sphere, if you will?

More than any of the other major players, Japan needs to be cognizant of American goals, interests and whims. The United Kingdom is in tight and won’t break with Washington. Canada is family. Family fights, but family also makes up. The Germans and Italians swim in different ponds. The French will be the French, but there’s no real likelihood of meaningful French structural competition with North America.

But Japan is likely to emerge from the coming Disorder as the dominant regional power. Its relations with everything from Vladivostok to Yangon will be a diverse mix of neo-imperial management systems ranging from alliance to partnership to suzerainty to occupation. That sort of dynamism and variety is certain to suck in external powers. And this phase in American isolationism is just that: a phase. It will end.

Of all the soon-to-be-rising powers, it is Japan which must tread most carefully to ensure it doesn’t step on Washington’s toes. Tokyo remembers full well what miscalculation in that department leads to.

Part 7: Canada

Writing about Canada is a guilty pleasure for me. I find endless intellectual stimulation in delving into the particulars of a country that is so close – and yet somehow so far – in political and cultural norms to my own. I also find it highly entertaining at how offended my Canadian friends and colleagues are when I don’t talk about Canada… and how horrified they are when I do. (It’s one thing when this dumb Yank proves aware of Canada’s inner workings, and quite another when he highlights cracks in the façade of liberal Canadian perfection.)

Recent events have put the typically sleepy world of Canadian-American relations front and center. Canadian Prime Minister Justin Trudeau played host the G7 summit (which triggered this series). His team crafted an agenda for the summit, most of which American President Donald Trump found so superfluous that he came late and left early. Trudeau’s post-summit firm rejection of American trade tariffs (firm by Canadian standards, that is) so enraged Trump that Trudeau found himself the target of a presidential tweetstorm.

Terms like “dishonest” and “mistake” and “Canada will pay” peppered the airwaves. Trump’s trade advisor, Peter Navarro, went so far as to assert there was a “special place in hell” for Trudeau for his alleged baiting and switching of Canadian policy positions. (Navarro later recanted on his hell quote, although it was pretty clear his heart wasn’t in the apology).

Despite my glee that writing about Canada is fully topical, I get no joy from what I see coming down the pipe. The end of the global system is putting the existence of Canada into mortal danger. It all has to do with how the Canadians are attempting to manage the Trump administration.

First, let’s put Canada into the Bretton Woods context:

The United States set up the Bretton Woods system in order to fight the Cold War. The Americans traded global market access for security cooperation. It was a straightforward butter-for-guns swap.

As the Americans withdraw from maintaining the Bretton Woods system, all the structures they established – the WTO, NATO, free trade, freedom of the seas – are disintegrating. All the things that thrived in a world of open borders and wealth – the EU, the Chinese Communist Party, OPEC, globalized manufacturing supply chains – will crash and burn. Very few of these collapses will be clean. There will be chaos. There will be wars. Some will stay local. Some will span continents. A lot of B- and C-list countries will cease to be. Even a couple of the A-list face dissolution. Canada was a founding member of the Bretton Woods agreements, and Bretton Woods’ fall will impact Canada as well.

But Canada is different.

Global chaos has zero impact on domestic Canadian security. With the Cold War over, the Americans are freeing themselves of the responsibility of defending Europe from Russia on one side and from defending Japan, South Korea and Taiwan from China and North Korea on the other. (A particularly cold reading of the Eurasian situation suggests renewed conflicts on both of Eurasia’s ends might be good for the United States’ overall strategic position, but let’s leave that debate for another day.) Yet the Americans can never stop defending North America. Canada has the option of getting a free ride even if relations with Washington tank.

What about economics? Consider the rest of the world. When China or the EU beat the trade war drum, I find it kind of sad. Economic success in China and Europe has proven possible largely because of the economic concessions allowed and security environment imposed by the Americans. The Americans subsidize the global trade and security order in order to purchase the cooperation of the Bretton Woods allies, but the war the Americans needed the allies for ended three decades ago. The Americans no longer get much utility from the Order that makes everyone else’s systems possible. The Order’s end won’t cost the Americans much. Anti-American chest-beating may make good local political fodder, but anything that pisses off the Americans in general – or America’s thin-skinned leader in particular – just seems suicidal to me.

But Canada is different.

Canada has something other Bretton Woods members do not: leverage. Canada is directly adjacent to the United States. That means the Americans traded with the Canadians not only before Bretton Woods, but before the industrial revolution hit the North American continent. NAFTA is the only active trade deal the Americans have that was not a strategic swap of the Bretton Woods model.

That provides Canada a unique opening. Broadscale chaos in the global system will not overly harm the domestic American experience, but mild chaos in North America would. Unlike Japan or France or Italy or Germany or the United Kingdom, the Canadians have their claws into the American economy’s guts, giving Canada the option of hitting America where it hurts. When the Canadians talk reciprocal tariffs, it matters.

And the Canadians know what to do with that leverage, because Canada has something else the other Bretton Woods allies lack: insight.

Because Canada is different.

The bulk of the Canadian population lives within a couple hour drive of the U.S. border, massed on road and water infrastructure that admits Canadian citizens and commerce to the most densely populated American territories. Integration – economic, cultural, political – is guaranteed. Canadians and Americans are family. It’s a family where the Americans outnumber the Canadians nearly ten-to-one, but isn’t the younger, smaller sibling always the thoughtful, scrappy one?

Canadians might not always like what they see, but issue number one for any Canadian government is managing relations with their primary security, economic, trade, cultural, and political partner. America’s power and insulation from the wider world combined with the imbalance between Canada and America means the Americans can take a rather lazy approach to all things foreign. Canada’s lack of power and lack of insulation from the United States means the Canadians can never take bilateral Canadian-American relations for granted. And so Canada studies the United States more than the Americans study Russian, Chinese, Iranian, North Korean, Mexican, energy, trade, disarmament, military, and immigration issues combined. Canada knows the United States intimately, while the United States barely registers what’s going on north of its border. (The only country that even comes close to studying the United States as intently is Israel.)

In a time of global breakdown, all this security, leverage and insight has encouraged the Canadians to play hardball.

Canada’s foreign policy of late hasn’t seemed to be about protecting the global order, but is instead about wrecking it:

• Canada is pursuing cases against the United States at the WTO that – should Canada win – actually hurt Canadian producers and exporters… but a win would prompt the Americans to abandon the WTO altogether.

• Canada is one of only a scant handful of NATO countries that has made any effort to increase its military spending… but rather than spending on NATO programs, the assets it is building are for independent power projection.

• Canada’s intransigence in NAFTA talks are likely to wreck the negotiations altogether… assuming the Trump administration in the United States and likely incoming López Obrador administration in Mexico don’t wreck them first.

The logic is as simple as it is dark:

If the global order does not collapse, Canada will have made itself the leader of the anti-Trump league of nations, reaping beaucoup gravitas for the country in general and for the Trudeau administration in particular. If the global order does collapse, the Canadians have a separate trade deal with the United States outside of NAFTA and the WTO, so Canada would be the only country of consequence to retain access to the world’s largest and most stable market as the world falls apart.

Such a scorched earth policy has almost a Trumpian feel to it, but delivered as it has been with panache, politeness and perfectly poised hair, the world in general and Americans in specific have interpreted Canada’s burn-it-all-down campaign as a hug offensive. (Say what you will about the Trudeau team, they know how to manage public relations!)

Canada’s hardball strategy is clever, but clever is not the same thing as smart. There is a very real risk that the Trudeau government’s America strategy puts the very existence of Canada in doubt.

In most places a single ethnic group forms in a specific location and forms a government to look after the interests of that people in that place. The people and their government then expand outwards until they control a large, rich and securable enough geography that they can become what we now call a nation-state. The English of England dominate Great Britain, the French of the Beauce dominate metropolitan France, the Japanese of the Seto Inland Sea dominate the Home Islands, and so on.

But Canada is different.

Canada is by far the least centralized of all the world’s operational countries. Canada is a settler state, colonized by a mix of different ethnicities in different places. The governments of settler states are far less centralized than those of the traditional nation-states, with a great deal of decision-making power reserved for regional and local governments.

It is a direct reflection of Canada’s geography. The northern four-fifths of Canada is tundra, taiga and the broken poor-soil, heavily-forested lakelands of the Canadian Shield. Its entire population exists like a sort of thin frosting on the southern border. But even this is broken up into disparate pieces.

Populated British Colombia, which is to say the city of Vancouver, is blocked by a 12-hour winding drive through the Canadian Rockies from the Prairie provinces. The Prairies are blocked by a 24-hour winding drive through the Canadian Shield from Ontario and Quebec, Quebec is blocked by a 10-hour winding drive through deep forest from Halifax, the largest city in the Maritimes (whose name gives away that you cannot drive to most of it). Each province has its own legislature which enjoys broad decision-making power almost over everything but foreign and defense affairs. Topics that are national policies in most countries as a matter of course tend to be devolved to the provincial level.

Much has been made – rightly – of how the cultural split between Anglophone Ontario and Francophone Quebec threatens Canada’s national coherence. The two provinces may have the bulk of Canada’s population, but starkly different economic management styles have generated starkly different economic structures – and it doesn’t help that Ontario’s window on the world is the St Lawrence Seaway… a waterway Quebec controls. Quebecois independence referendums have, repeatedly, threatened Canada with national dissolution.

But Quebec separatism is hardly the biggest threat to Canada these days. Ontario ultimately bought Quebecois loyalty to Canada by paying Quebec off. Fat financial transfers – largely funded by taxes on Ontarians – have kept the Quebecois fat and happy. But times are changing. Canada has the world’s second most distorted and fourth fastest-aging demographics. The Quebecois are on the cusp of mass retirement which means the state will need a lot more money to support a population that will no longer be working. But the Ontarians are but three years behind, meaning that Ontarians can no longer afford to pay the Quebecois to be part of Canada.

The two provinces have decided the solution is to jack up taxes on the remaining provinces to make up the difference. But citizens of the Maritimes and British Colombia are as old or older than the Quebecois and Ontarians. That leaves the tax burden on the Prairies, most notably on Alberta and Saskatchewan. In The Accidental Superpower I included a chapter titled “The Alberta Question” in which I detailed at length how the disconnects between Alberta and the rest of Canada threatened the country’s national coherence. I stand by that assessment, but now I see something more ominous.

The United States is a global power. As such it has a lot of brands in a lot of fires at any particular time. Canada may be America’s largest trading power, but the Americans haven’t viewed Canada as a security threat in nearly two centuries. Washington tends to allow American-Canadian disputes to slide down the to-do list. That, in part, is what has enabled the current Canadian government to take such a firm stance on trade issues. There’s a perfectly reasonable expectation that the Americans will get distracted by something shiny out there in the great wide world, and give in to Ottawa just to simplify things.

But something most Canadians miss is that while their proximity to and close relationship with the United States does indeed grant them security and leverage and insight, that’s only an advantage if the Americans are distracted.

End America’s position as the global leader. Take most of those irons out of the fire. Contract America’s already small international economic footprint. Washington’s to-do list shrinks immeasurably. Purely by circumstance, Canada moves up. Way up.

Canada faces very real danger of national fracture without American attention. But if the American population or presidency perceives – rightly or wrongly – that Canada is part of the problem rather than part of the solution, then the full power of the American system can be brought to bear on its politically, economically and strategically fragile neighbor.

Many Canadians think of Trump as a child, but there are soooo many weak points in the Canadian confederation it would be child’s play to pry it apart. Even without going for the jugulars of Albertan or Quebecois separatism, there are a host of options. Here’s a few:

- Canada’s riven geography means every Canadian province trades more with the United States than with the rest of Canada. Canada only implemented their first comprehensive internal free trade agreement among the provinces last year. Granting preferential access to this or that province’s politically sensitive sector in exchange for monkeywrenching Ottawa would be painfully simple.