In early 2020, reports of a virus sweeping across the globe hit the headlines. But where did it come from? How did it start? This week’s news is that the Department of Energy released a low-confidence statement that COVID originated from a lab leak within the Chinese System.

Was there a breakthrough in the evidence? Did they find the smoking gun everyone has been looking for? No. And much of the scientific community still believes this was a Mother Nature special and just jumped from a different species to humans.

So without any concrete evidence, why has a chest-thumping-contest broken out in the American political system over who hates China the most? Regardless of the origins of COVID, the Chinese knew there was a breakout in Wuhan. They shut down all domestic flights in and out of the region, but you know what they didn’t stop…International flights. They intentionally let the virus spread across the globe.

Prefer to read the transcript of the video? Click here

Here at Zeihan On Geopolitics we select a single charity to sponsor. We have two criteria:

First, we look across the world and use our skill sets to identify where the needs are most acute. Second, we look for an institution with preexisting networks for both materials gathering and aid distribution. That way we know every cent of our donation is not simply going directly to where help is needed most, but our donations serve as a force multiplier for a system already in existence. Then we give what we can.

Today, our chosen charity is a group called Medshare, which provides emergency medical services to communities in need, with a very heavy emphasis on locations facing acute crises. Medshare operates right in the thick of it. Until future notice, every cent we earn from every book we sell in every format through every retailer is going to Medshare’s Ukraine fund.

And then there’s you.

Our newsletters and videologues are not only free, they will always be free. We also will never share your contact information with anyone. All we ask is that if you find one of our releases in any way useful, that you make a donation to Medshare. Over one third of Ukraine’s pre-war population has either been forced from their homes, kidnapped and shipped to Russia, or is trying to survive in occupied lands. This is our way to help who we can. Please, join us.

CLICK HERE TO SUPPORT MEDSHARE’S UKRAINE FUND

CLICK HERE TO SUPPORT MEDSHARE’S EFFORTS GLOBALLY

TRANSCIPT

Hey everybody. Hello from California. I just want to take a couple of minutes real quick to talk about the news this week. We’ve got a number of folks in the United States government who are taking a firmer stance on China, on COVID related history. Specifically, the Department of Energy is now saying with low confidence that it believes that COVID originated in a lab leak out of the Chinese system. And the director of the FBI concurred with the general statement that this is the bureau’s standing position.

Couple of things real quick. First, don’t blow it out of proportion. Low confidence means that there’s actually no smoking gun or firm evidence of any kind. It just means that this is the opinion of the agency and there’s a lot of circumstantial evidence that points in that general direction. There’s no new breakthrough. There’s been no information brought to light that indicates that the lab leak is indeed where COVID came from. And as a rule, about two thirds of the American intelligence community officially is on the position that this is a 100% Mother Nature special, that jumped from one species to humans, somewhere in the Wuhan area. So there’s really no movement in terms of policy here or in terms of information.

I will outline two things. Number one, the Department of Energy in the FBI are as a rule, not known for medical expertise. So when they come out and say things like this, you should take it. Not so much with a grain of salt. Just put it in the context. Second, no one has any information or smoking gun or evidence pointing to it not being a lab leak. So while the general position of the scientific community is, it would probably jump from animal to human, that doesn’t mean that we know that that is what happened. It could be either way.

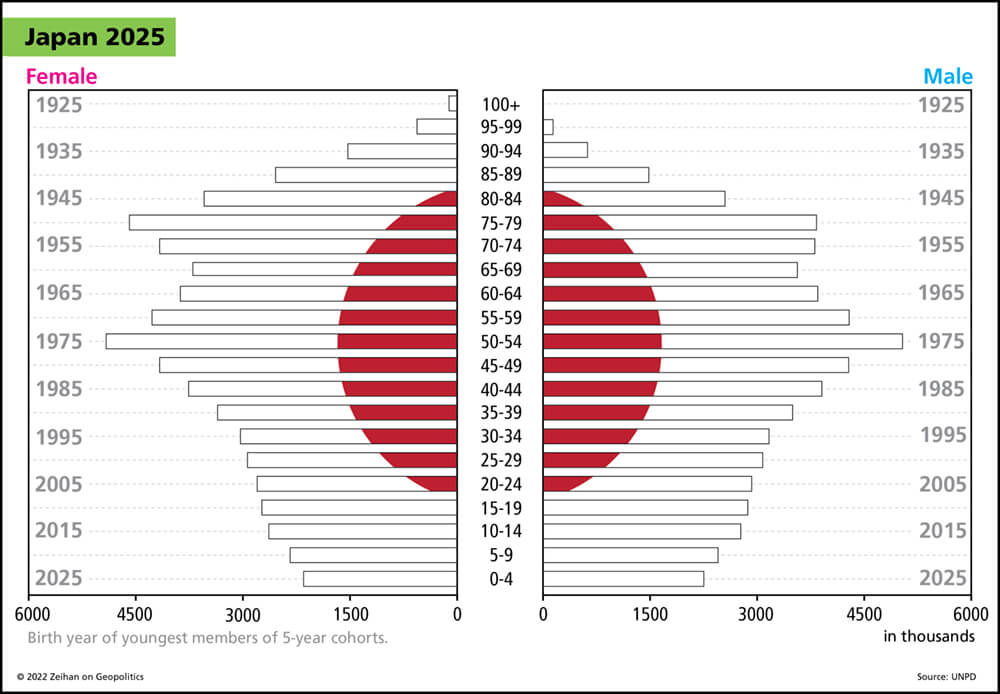

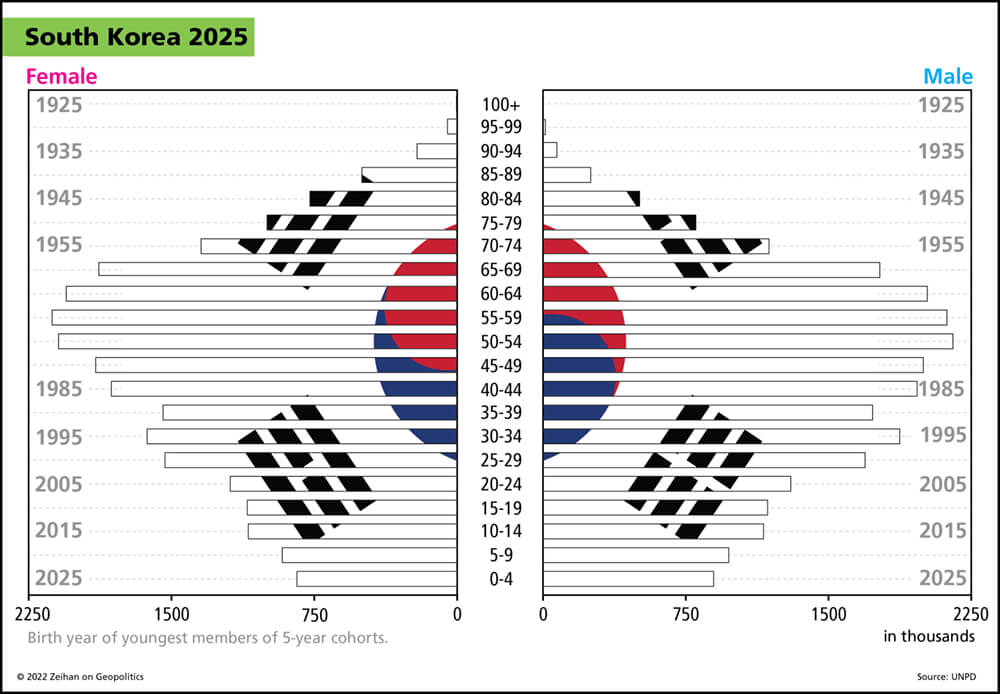

Now, a couple of things here. First of all, politics. There is now a competition across the American political spectrum as to who is going to be more anti-Chinese. And so there are resolution after law after amendment across Congress to prove that the Republicans or the Democrats happened to be the ones that hate China the most. Gone are the days that the business community was even part of this conversation, and now it’s all political and everyone is competing to see who can beat their chest the most. That should be your first big take away that relations with the Chinese. On the American side of the equation are breaking down because they no longer have a defender, they only have attackers. So whether you like Trump or Biden or hate Trump or Biden, everyone has decided that they don’t like the Chinese very much. That’s number one. What’s number two?

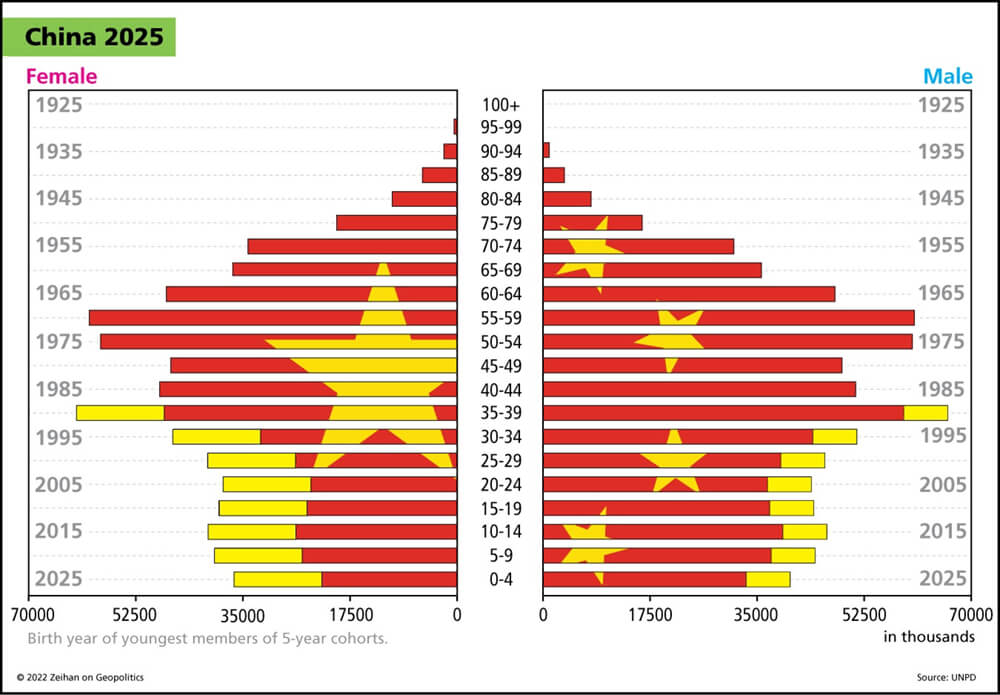

Oh, yeah. There’s plenty of reasons why we should still be mad about the Chinese, even if it’s not a lab leak. So the lab leak theory is based on the idea that either through carelessness, negligence or accident, it leaked out. So accidental being the key word there. And obviously, if the Chinese did allow it to escape from a lab and hushed up, that is bad. But that is ultimately accidental. What we know for sure, what there is no dispute of what have been the Chinese admit publicly is that for the two weeks after the Chinese realized they were dealing with a respiratory pathogen in Wuhan, they banned domestic flights to and from Wuhan, but they allowed international flights to continue to and spread the virus worldwide.

The lab leak would be embarrassing, but what we know for certain was that the Chinese intentionally allowed the virus to spread globally. And from my point of view, that means it’s perfectly reasonable for the Democrats and Republicans to compete as to who is more anti-Chinese these days. Alright. That’s it for me. Until next time.