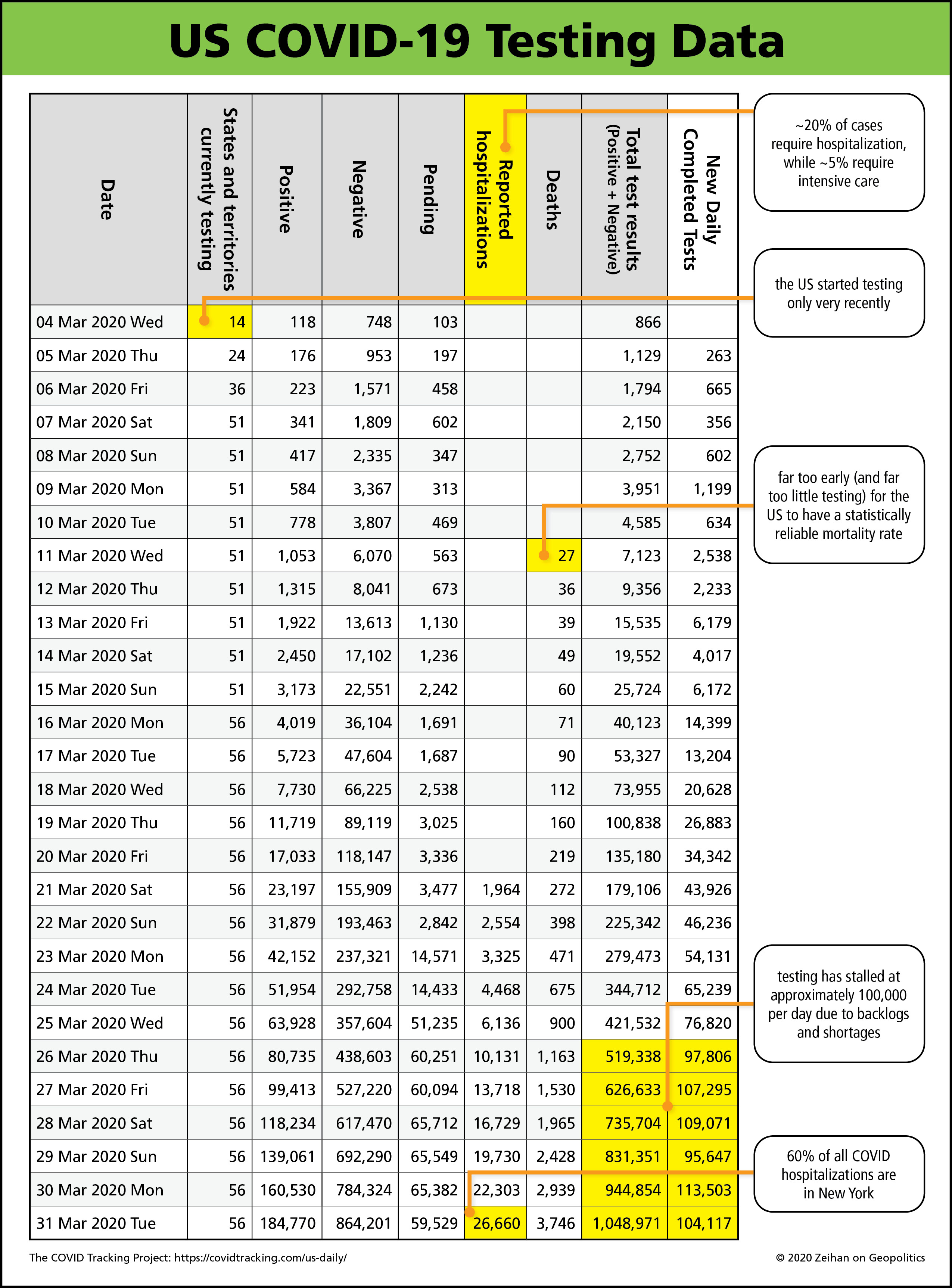

Coronavirus has launched the greatest energy upheaval since the dawn of the petroleum age. In the short run, this means rock-bottom – even negative – prices for oil and a much-needed price break for the world’s major energy consumers.

But nothing lasts forever.

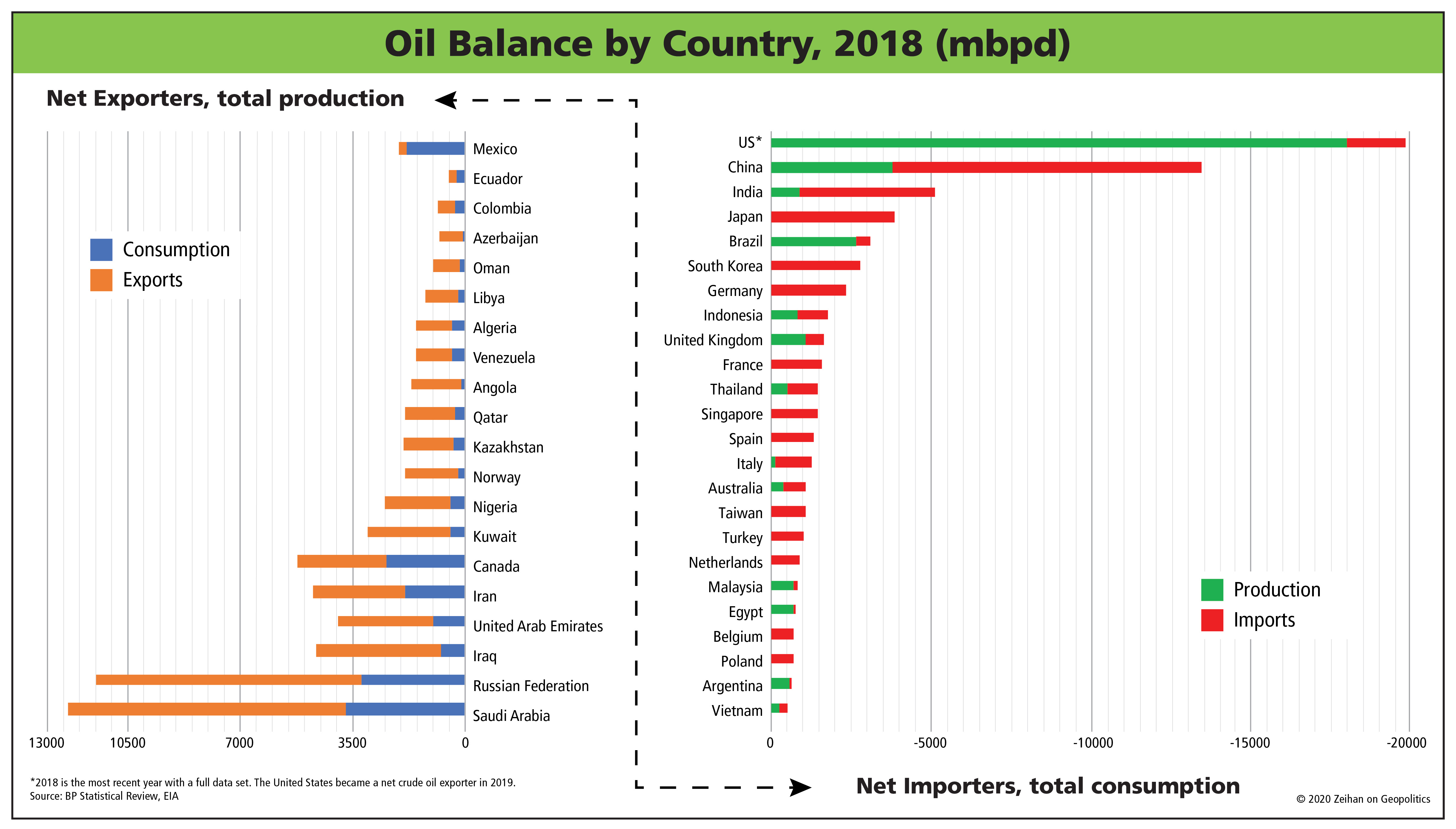

Extended periods of low prices will destroy the productive capacity of many oil exporters, removing them from the market for years. Once the coronavirus crisis passes, that changed map of oil production and export will radically remake global energy flows. By far the largest loser will be China.

China today, as the world’s largest oil importer, sources crude from quite literally everywhere it can. This map – from my new book, Disunited Nations – shows the diversity of sources and the risks to its oil supply chains posed by other countries.

Many of these producers will not be in the market a year from now. Their absence will add an energy security layer to China’s already irrecoverable debt, finance, demographic, consumption, security, political, supply chain and trade problems.

To get the full story, join Peter Zeihan for a video-conference April 10 to explore the end of the era of global energy markets and the rise of a more regionalized – and far less stable – system.

Future planned invents include:

- The Shattering of Global Oil (April 10)

- Agriculture

- Transport and Supply Chains

- Manufacturing

- Industrial Commodities